The Most Active Investors Were Extra Busy In Q1 In our q4 report, a list of the 17 most active north american investors showed they collectively backed 307 rounds. the top 17 in q1 had 373 rounds between them — a roughly 21 percent gain, quarter over quarter. The sums of financing of sequentially weakened seeds were reported and yr on year in q1. however, the most active seeds of seeds remained quite busy, as evidenced by the chart below, in the rating of the most attempts of traders in this quarter.

The Most Active Investors Were Extra Busy In Q1 The most active investors during the quarter — venture debt firms stride ventures and alteria capital backed 27 and 26 startups in the quarter respectively. prominent investors blume. 🥇 our interactive global league tables are now available for q1, covering the full spectrum of private market activity. we rank everything from the busiest pe investors by region to the most active law firms in the venture universe. In this camp is andreessen horowitz (a16z), which is making a run for the title of most active venture investor of the post peak era. per crunchbase data, a16z participated in 27 post seed rounds in the first quarter of 2024 — more than any other venture investor. The busiest venture backers upped their game in the recently ended first quarter. among the 14 most active post seed investors, a majority backed more deals in q1 2025 than they did a year ago.

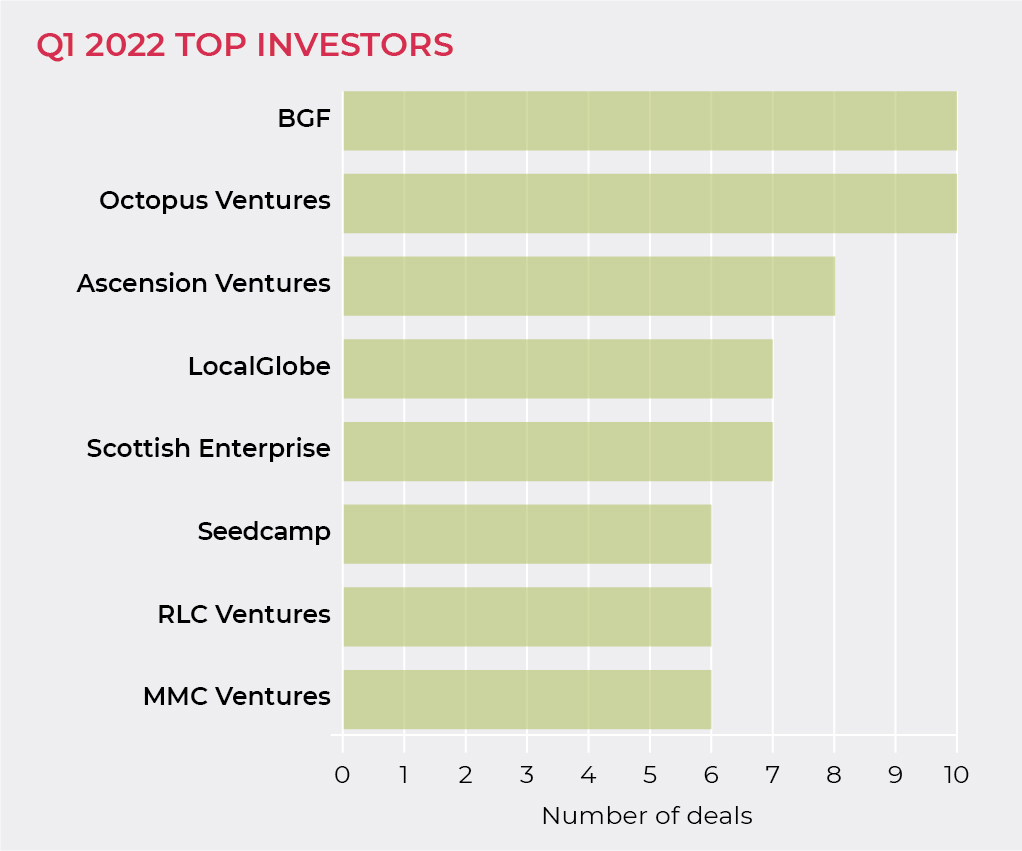

Uk Growth Capital Market Still Running Hot Q1 2022 Growth Capital In this camp is andreessen horowitz (a16z), which is making a run for the title of most active venture investor of the post peak era. per crunchbase data, a16z participated in 27 post seed rounds in the first quarter of 2024 — more than any other venture investor. The busiest venture backers upped their game in the recently ended first quarter. among the 14 most active post seed investors, a majority backed more deals in q1 2025 than they did a year ago. Lead investors also got serious about spending in q1. this is evidenced by our list of investors who led or co led rounds valued at at more than $500 million, charted below. Recently, many investors have expressed similar feelings to us: market confidence is recovering, and trading activity has significantly increased. on the one hand, the pace of project financing. Investor activity hit a weekly q1 record high, spiking by 21.7% in early march. founder pitch deck supply surged by over 20% compared to q1 2021, signaling fertile ground for vcs looking to. Vc activity surged in q1, with global startup investment reaching its highest level in years, fueled by ai momentum. 🚀 from y combinator doubling down post seed to softbank group corp.’s.

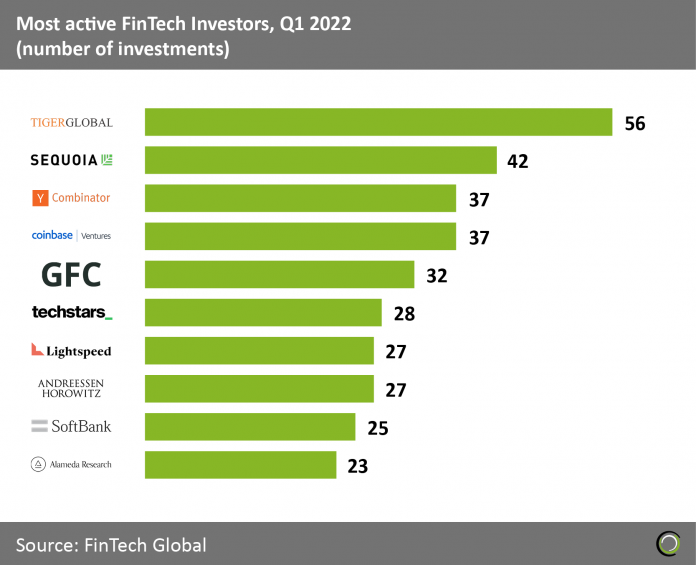

Us Investors Were The Most Active Fintech Dealmakers In Q1 2022 Lead investors also got serious about spending in q1. this is evidenced by our list of investors who led or co led rounds valued at at more than $500 million, charted below. Recently, many investors have expressed similar feelings to us: market confidence is recovering, and trading activity has significantly increased. on the one hand, the pace of project financing. Investor activity hit a weekly q1 record high, spiking by 21.7% in early march. founder pitch deck supply surged by over 20% compared to q1 2021, signaling fertile ground for vcs looking to. Vc activity surged in q1, with global startup investment reaching its highest level in years, fueled by ai momentum. 🚀 from y combinator doubling down post seed to softbank group corp.’s.