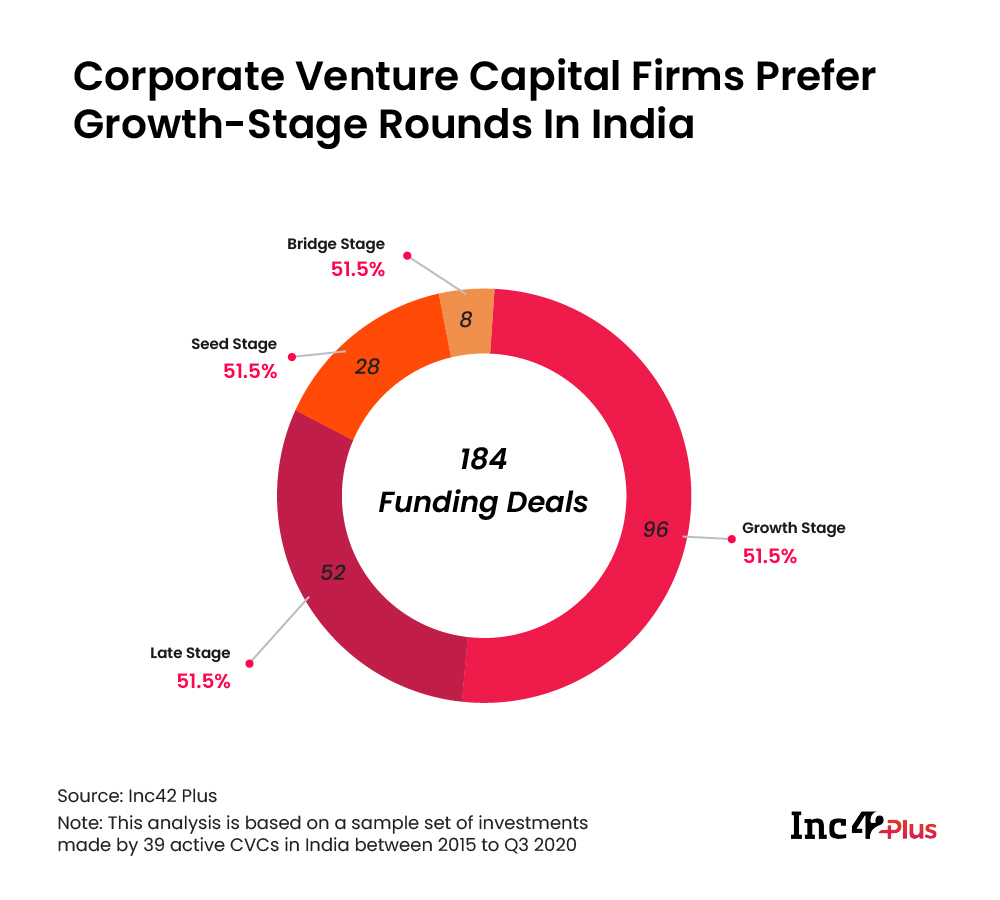

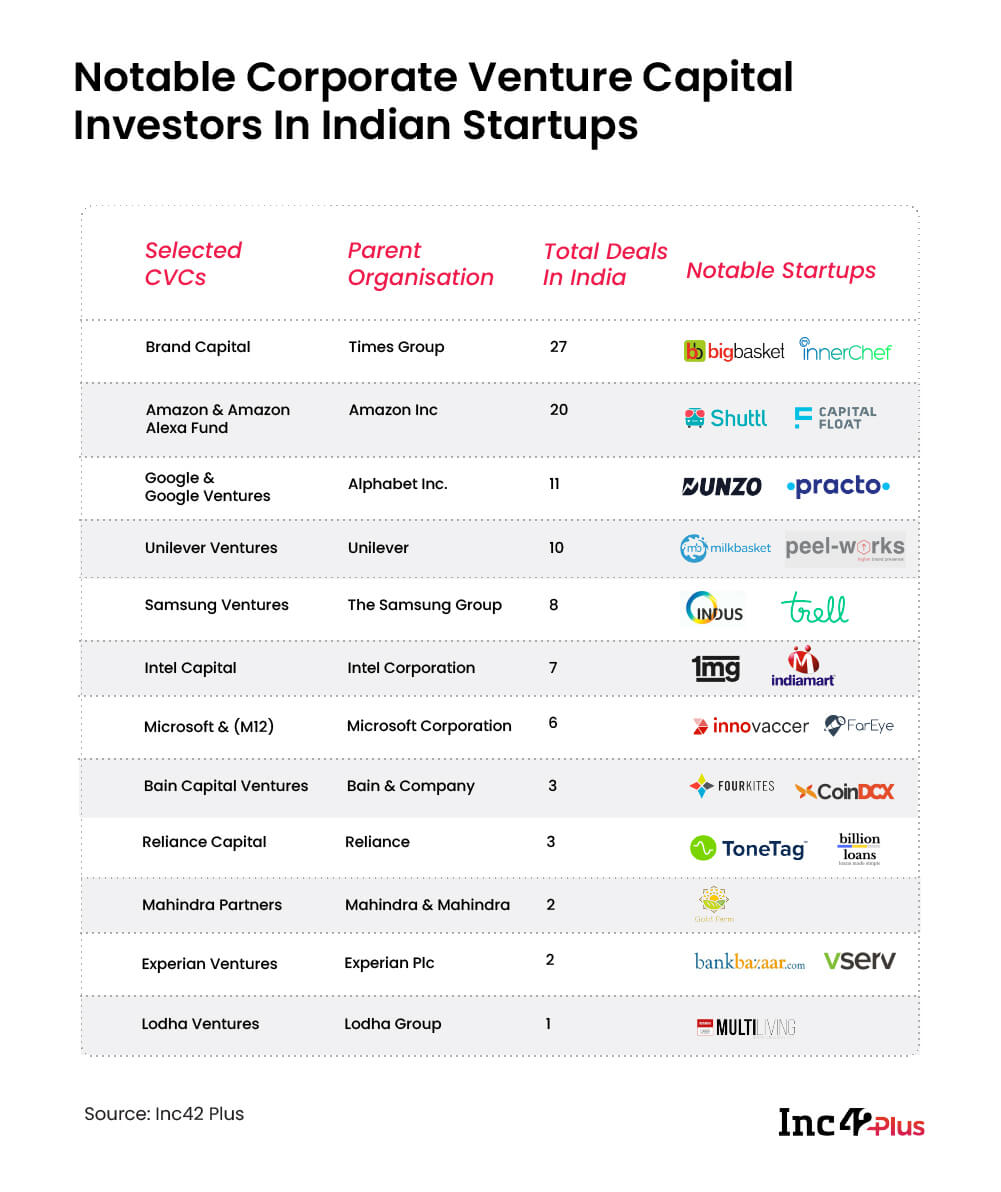

India S Burgeoning Corporate Venture Capital Cvc Ecosystem From 2015 to q3 2020, 39 cvcs in india have invested in 144 indian startups, with brand capital being the most active cvc. one of the hurdles in the indian startup ecosystem is the lack. India, with its thriving start up ecosystem and evolving regulatory landscape, has witnessed a growing interest in cvc investments.

India S Burgeoning Corporate Venture Capital Cvc Ecosystem In the longer term, india’s vc ecosystem is poised for sustained growth. strong consumption tailwinds, regulatory advancements, and a rapidly expanding digital backbone will drive this development. The promise of open innovation is driving the growth of corporate venture capital (cvc) units in india. here is our take on why cvc is a compelling proposition that can help companies remain resilient to external shocks. Corporate venture capital (cvc) units — investment vehicles created by large companies to back start ups with strategic alignment — remain a relatively small part of india’s start up funding landscape, with data compiled by pwc indicating that cvc investments stood at $8.2 billion in 2024. Corporate venture capital (cvc) firms have a disproportionate advantage over traditional vc firms, especially in areas such as deeptech, in terms of long term mapping, said adarsh sekhar,.

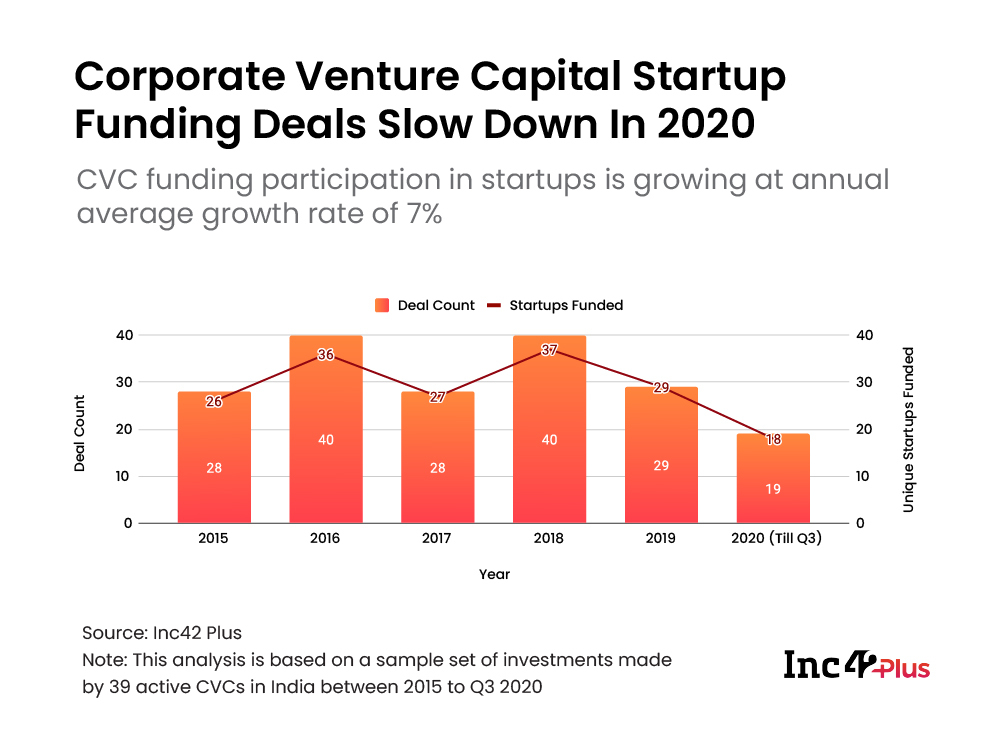

India S Burgeoning Corporate Venture Capital Cvc Ecosystem Corporate venture capital (cvc) units — investment vehicles created by large companies to back start ups with strategic alignment — remain a relatively small part of india’s start up funding landscape, with data compiled by pwc indicating that cvc investments stood at $8.2 billion in 2024. Corporate venture capital (cvc) firms have a disproportionate advantage over traditional vc firms, especially in areas such as deeptech, in terms of long term mapping, said adarsh sekhar,. Complemented with a booming financial system and growing per capita revenue within the nation, india can also be one of the vital profitable startup ecosystems on the planet for enterprise capital investments, particularly after the high profile acquisition of flipkart by walmart in 2018. India's startup ecosystem—the world's third largest—is experiencing an increase in cvc activity, with corporate finance participation expanding at 7% annually, pwc said in a report. experts feel this trend would accelerate innovation and strengthen india's status as a global entrepreneurship hotspot. The next five years will likely see a fundamental shift in india’s venture ecosystem. beyond the current wave of saas and deep tech innovation, we anticipate the emergence of category defining companies that combine india’s technical depth with sophisticated understanding of global enterprise needs. Looking to get your startup funded? here's your list of 95 active vcs in india. most founders know sequoia, accel, and maybe matrix partners. but what about india? there's a massive, thriving venture capital scene here that often goes unnoticed.