First Class Tips About How To Find Out My Tax Bracket Backtask Discover the indonesia tax tables for 2020, including tax rates and income thresholds. stay informed about tax regulations and calculations in indonesia in 2020. Any individual taxpayer has an obligation to calculate their tax payable by the end of the year to find out whether they have outstanding tax or need to ask for a tax refund.

2020 Tax Tables Britishmokasin This parallel tax income system requires high income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the amt. Use this calculator to estimate your self employment taxes. normally these taxes are withheld by your employer. however, if you are self employed, operate a farm or are a church employee you may owe self employment taxes. For the 2020 tax year, the self employment tax rate is 15.3%. social security represents 12.4% of this tax and medicare represents 2.9% of it. how do i calculate my self employment tax? generally, the amount subject to self employment tax is 92.35% of your net earnings from self employment. 3.8% tax on the lesser of: (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households, $250,000 for married couples filing jointly, and $125,000 for married couples filing separately.

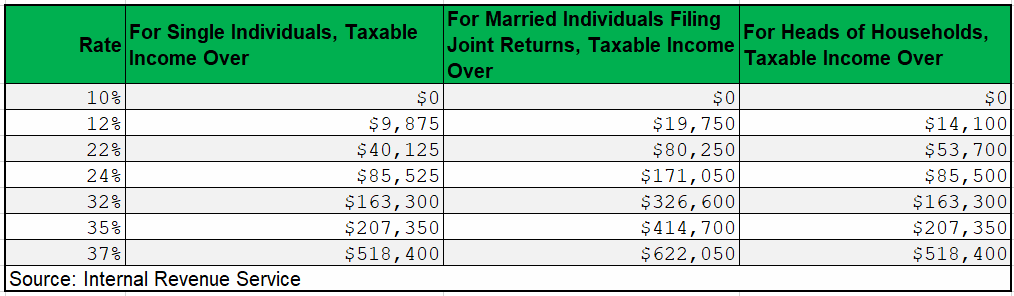

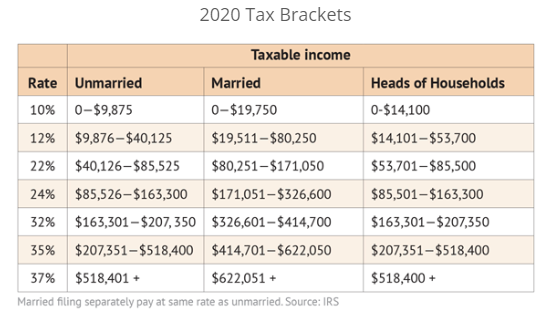

2020 Tax Brackets Nri Path For the 2020 tax year, the self employment tax rate is 15.3%. social security represents 12.4% of this tax and medicare represents 2.9% of it. how do i calculate my self employment tax? generally, the amount subject to self employment tax is 92.35% of your net earnings from self employment. 3.8% tax on the lesser of: (1) net investment income, or (2) magi in excess of $200,000 for single filers, or head of households, $250,000 for married couples filing jointly, and $125,000 for married couples filing separately. Here are the new brackets for 2020, depending on your income and filing status. the irs also released information on the 2020 standard deduction. these are the rates and income brackets for. This rate consists of 12.4% for social security and 2.9% for medicare taxes. the maximum amount of net earnings subject to the 12.4% social security portion of the self employment (se) tax for 2020 is $132,900. Discover the workings of self employment tax brackets, including rates, how they differ from income tax, and how to minimize your tax liability. get professional advice on small business owners' and freelancers' self employment taxes. Class 2 national insurance is £158.60 per year. there are many other thresholds for other circumstances not mentioned here. you can read more about them on the hmrc website: it’s always best to check with your accountant to make sure that you are paying the right amount of tax.

2020 Tax Brackets Chart Allgen Financial Advisors Inc Here are the new brackets for 2020, depending on your income and filing status. the irs also released information on the 2020 standard deduction. these are the rates and income brackets for. This rate consists of 12.4% for social security and 2.9% for medicare taxes. the maximum amount of net earnings subject to the 12.4% social security portion of the self employment (se) tax for 2020 is $132,900. Discover the workings of self employment tax brackets, including rates, how they differ from income tax, and how to minimize your tax liability. get professional advice on small business owners' and freelancers' self employment taxes. Class 2 national insurance is £158.60 per year. there are many other thresholds for other circumstances not mentioned here. you can read more about them on the hmrc website: it’s always best to check with your accountant to make sure that you are paying the right amount of tax.

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes Discover the workings of self employment tax brackets, including rates, how they differ from income tax, and how to minimize your tax liability. get professional advice on small business owners' and freelancers' self employment taxes. Class 2 national insurance is £158.60 per year. there are many other thresholds for other circumstances not mentioned here. you can read more about them on the hmrc website: it’s always best to check with your accountant to make sure that you are paying the right amount of tax.

2020 Tax Brackets