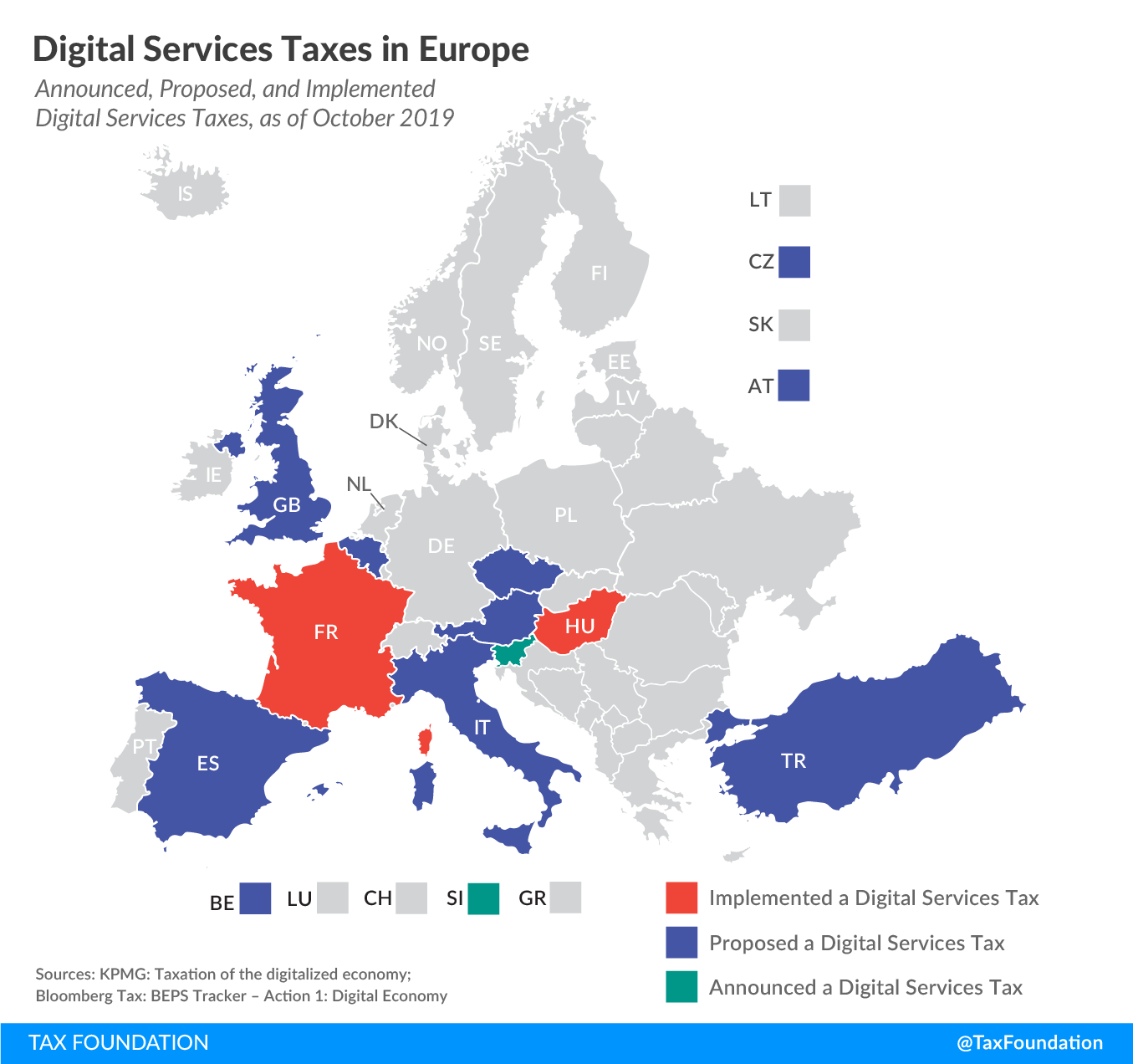

Digital Tax Map Digital Taxes In Europe Tax Foundation President trump signed a memorandum directing the united states trade representative (ustr) to review and consider renewing investigations into digital services taxes levied by us trading partners, specifically targeting france, the united kingdom, italy, spain, austria, turkiye and canada. The us has said that digital taxes in spain, austria and the uk are discriminating against american tech companies, paving the way for tariffs and setting the scene for transatlantic.

Digital Tax Update 2024 Digital Services Taxes In Europe Because dsts tax revenues, not profits, a company with a 10 percent profit margin would face a 60 percent effective tax rate on digital services provided in france. the proposal also raises the global revenue threshold for companies subject to the tax, making the dst even more discriminatory. The uk increasingly stands out, operating one of the most onerous remaining digital services taxes–taking in an estimated £808 million last year, and surpassing france’s €800 million, according to the latest estimates for dst revenue in key markets. On 21 february 2025, us president trump signed an order to investigate potential tariff retaliations against countries which have implemented . the memo targets 6 countries’ dst’s: france; the uk; italy; canada, spain, and turkey. And republicans in congress have also criticized existing dsts as discriminatory. that stance leaves countries like italy, the uk, france, spain, austria, canada, and india with a decision: eliminate or tweak their digital services taxes on companies such as meta and.

What European Oecd Countries Are Doing About Digital Services Taxes Wita On 21 february 2025, us president trump signed an order to investigate potential tariff retaliations against countries which have implemented . the memo targets 6 countries’ dst’s: france; the uk; italy; canada, spain, and turkey. And republicans in congress have also criticized existing dsts as discriminatory. that stance leaves countries like italy, the uk, france, spain, austria, canada, and india with a decision: eliminate or tweak their digital services taxes on companies such as meta and. All of these negotiations stem from us objections to dsts and 2019 and 2020 “section 301” investigations by ustr that concluded the taxes proposed by austria, france, india, italy, spain, turkey, and the uk were discriminatory and aimed largely at us tech giants. U.s. treasury secretary steven mnuchin says washington is looking for a “broad solution” to digital taxes that will be supported by the organization for economic co operation and development. Given that dsts are economically harmful and discriminatory, it’s worth asking why european policymakers adopted them. the introduction of dsts had three main goals. one was to change tax rules to make digital companies owe and pay taxes where users are located. Trump has long argued that digital services taxes are discriminatory against the likes of amazon inc. and meta platforms inc. he’s warned he would impose “ substantial ” tariffs on.

Digital Tax Update Digital Services Taxes In Europe All of these negotiations stem from us objections to dsts and 2019 and 2020 “section 301” investigations by ustr that concluded the taxes proposed by austria, france, india, italy, spain, turkey, and the uk were discriminatory and aimed largely at us tech giants. U.s. treasury secretary steven mnuchin says washington is looking for a “broad solution” to digital taxes that will be supported by the organization for economic co operation and development. Given that dsts are economically harmful and discriminatory, it’s worth asking why european policymakers adopted them. the introduction of dsts had three main goals. one was to change tax rules to make digital companies owe and pay taxes where users are located. Trump has long argued that digital services taxes are discriminatory against the likes of amazon inc. and meta platforms inc. he’s warned he would impose “ substantial ” tariffs on.