What Are The Common Methods For Calculating Historical Volatility Stock And Options Playbook

Options Volatility Implied Volatility In Options The Options Playbook We will guide you through the process of gathering historical price data, calculating daily returns, and determining the average return. additionally, we’ll cover how to compute variance and. Historical volatility calculation – what historical volatility is mathematically, how to calculate it step by step using the most common method – the standard deviation of logarithmic returns, and how to annualize volatility.

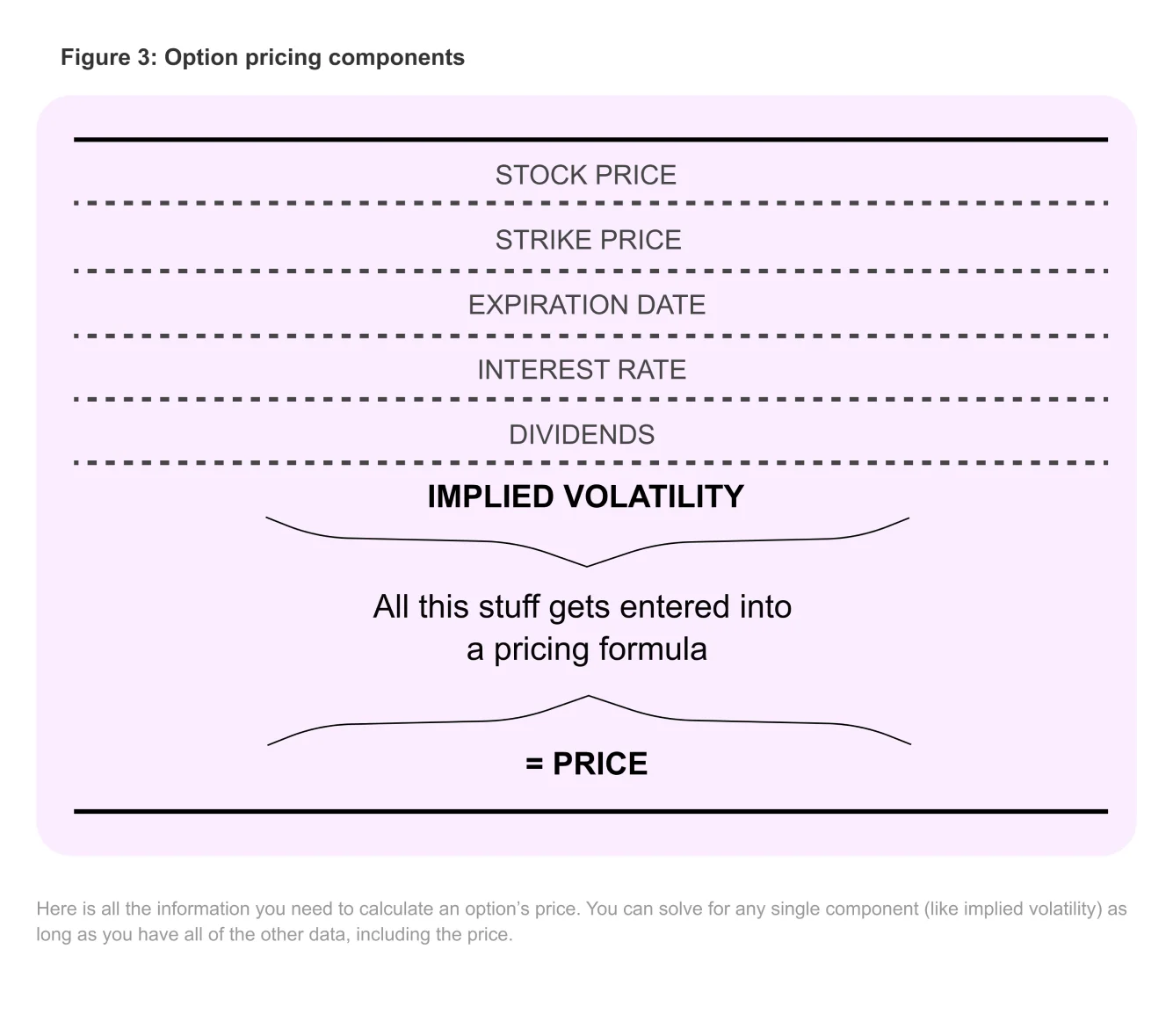

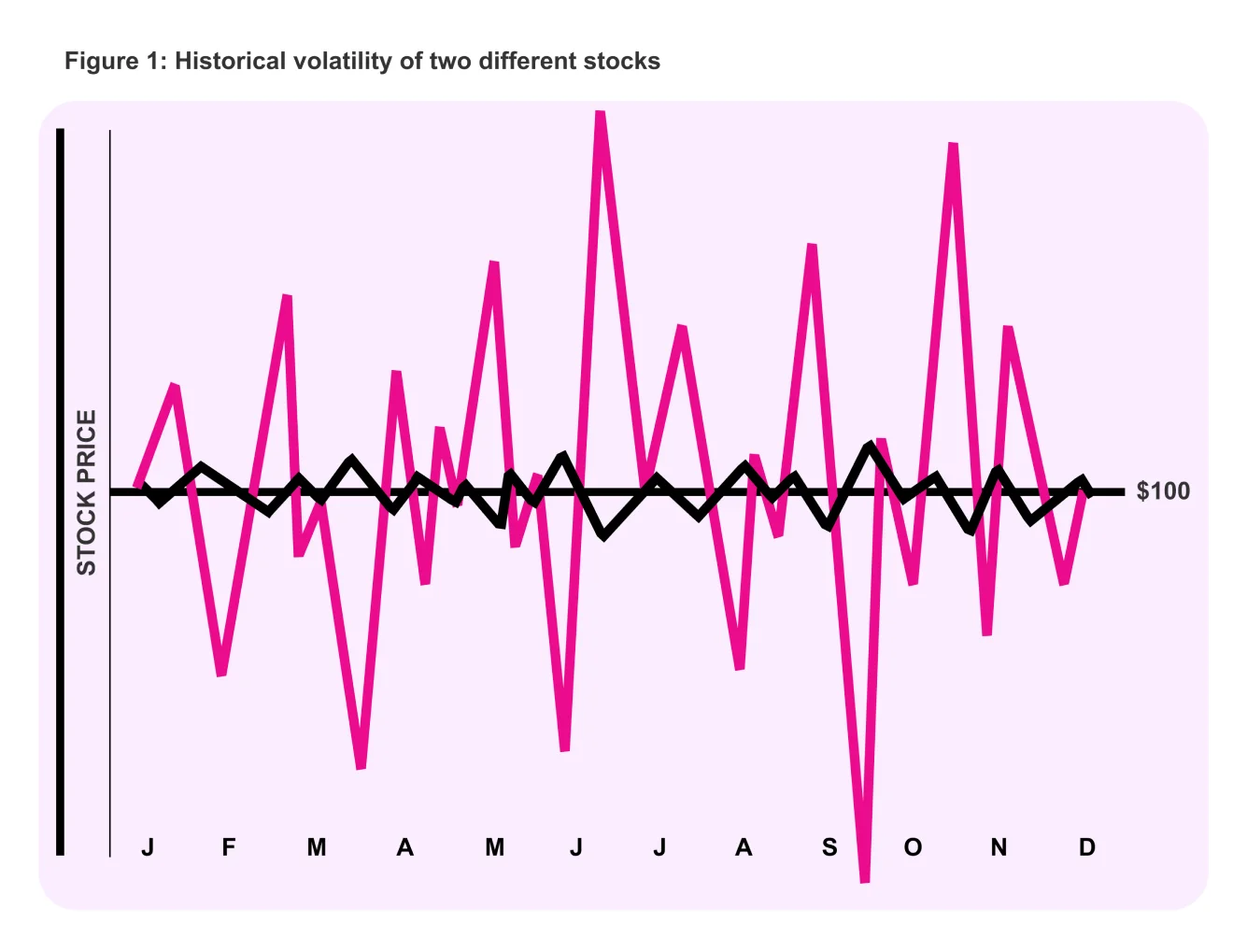

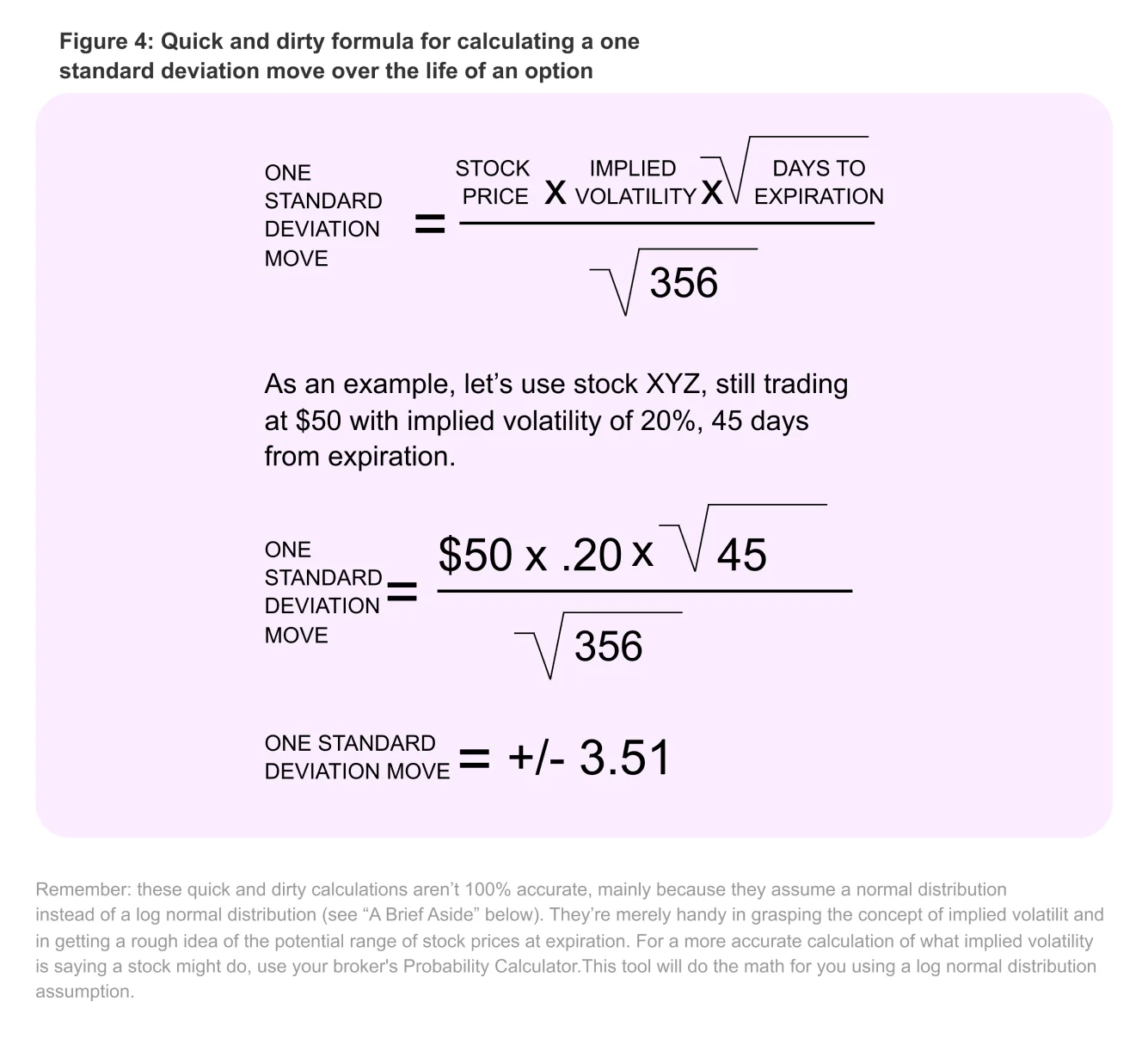

Options Volatility Implied Volatility In Options The Options Playbook Historical volatility (hv) is a statistical measure of the dispersion of returns for a given security or market index over a given period of time. generally, this measure is calculated by. Historical volatility is defined in textbooks as “the annualized standard deviation of past stock price movements.” but rather than bore you silly, let's just say it’s how much the stock price fluctuated on a day to day basis over a one year period. What exactly is hv, how is it calculated, and how does this impact your trade? in the following article, we will show what historical volatility is, how it’s calculated, and how to incorporate it into an option trade. welcome to option alerts, where we provide insight into making wiser trades. Methods for calculating stock volatility vary so the information presented by two sources might not match exactly. in some places throughout the site, we will refer to close to close historical volatility (c c vol).

Options Volatility Implied Volatility In Options The Options Playbook What exactly is hv, how is it calculated, and how does this impact your trade? in the following article, we will show what historical volatility is, how it’s calculated, and how to incorporate it into an option trade. welcome to option alerts, where we provide insight into making wiser trades. Methods for calculating stock volatility vary so the information presented by two sources might not match exactly. in some places throughout the site, we will refer to close to close historical volatility (c c vol). Incorporating historical volatility into investment strategies. Historical volatility (hv) why use volatility analysis? a comprehensive guide to understanding volatility in financial markets, including different calculation methods and practical applications. One of the most common ways to calculate historical volatility is by using the statistical concept of standard deviation. in this blog, i shall break down the process step by step, ensuring clarity even for those new to the subject. When calculating historical volatility in options, two common approaches are used: moving average and standard deviation methods. both techniques aim to quantify the degree of price variation over a specific period, providing traders with insight into market stability or turbulence.

Comments are closed.