Video Whats The Difference Between An Hsa And Fsa

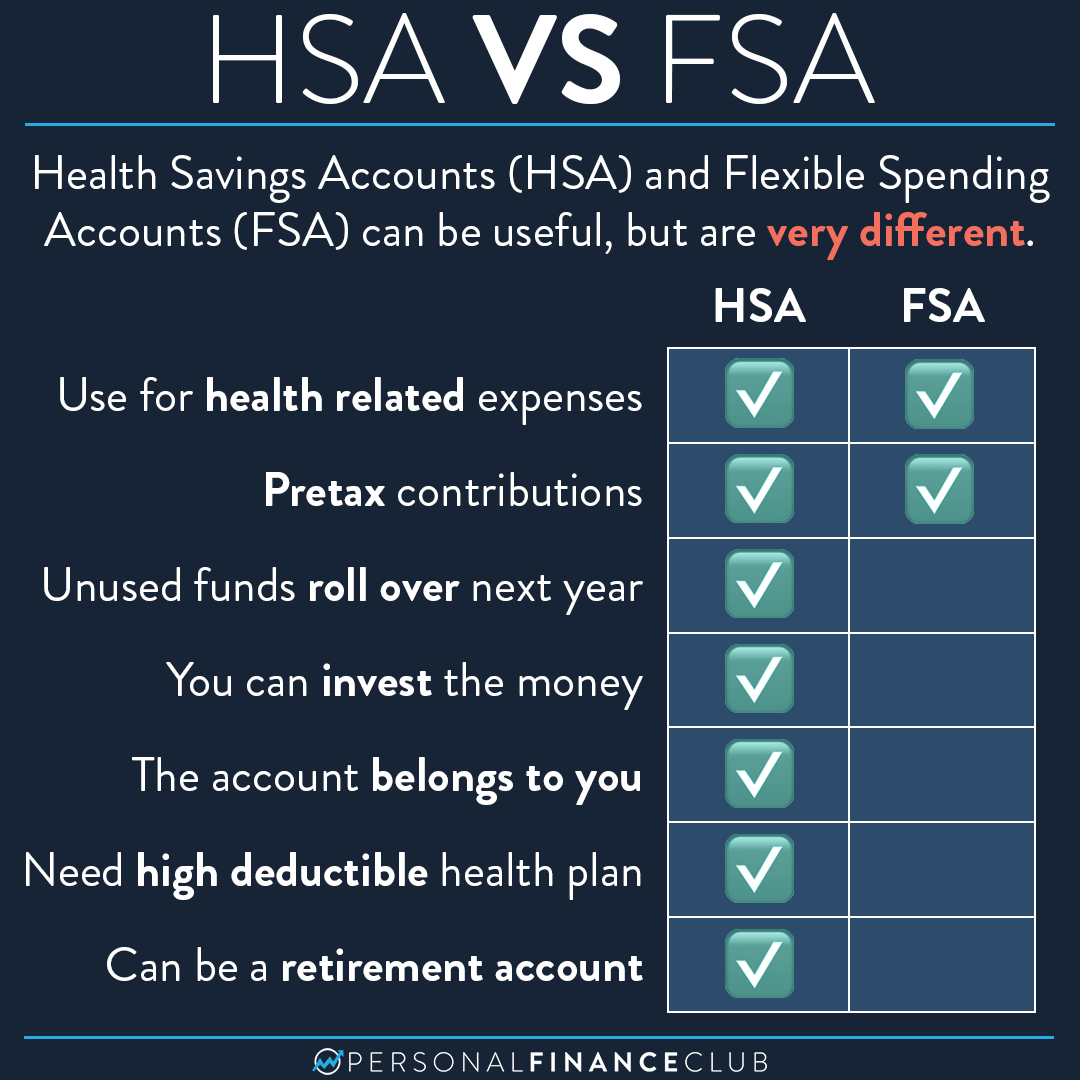

How Is An Hsa Different From An Fsa Personal Finance Club In this video, we break down everything you need to know about health savings accounts (hsas) compared to flexible spending accounts (fsas). If you're eligible for both an hsa and fsa, be sure to carefully weigh each option, considering the pros and cons we've outlined above. the choice of hsa vs. fsa (or hsa plus limited purpose fsa) comes down to your personal financial situation as well as your and your family's health.

Hsa Vs Fsa What S The Difference Health Myths Health Care Health What's the difference between an hsa and fsa account? here's which one best fits your needs. Health savings accounts (hsas) and flexible spending accounts (fsas) are two benefits offered by many employers that allocate pretax dollars towards medical expenses. hsas and fsas,. Compare and contrast hsas vs fsas. explore their differences, including pros and cons of each account and who should (and shouldn't) have each account type. Differences between hsas, hras, and fsas there are many differences between health savings accounts (hsas), health reimbursement accounts (hras) and flexible spending accounts (fsas) — and knowing these differences may help you know how to use these accounts to your advantage.

What S The Difference Between Hsa And Fsa Benefits Solutions Group Compare and contrast hsas vs fsas. explore their differences, including pros and cons of each account and who should (and shouldn't) have each account type. Differences between hsas, hras, and fsas there are many differences between health savings accounts (hsas), health reimbursement accounts (hras) and flexible spending accounts (fsas) — and knowing these differences may help you know how to use these accounts to your advantage. Fsa vs. hsa: what’s the difference? both fsas and hsas provide tax savings on health costs, but you have to buy a health insurance plan that pays few costs upfront to qualify for an. What is the difference between an hsa and an fsa? hsa and fsa contributions are tax deductible, and medical expense withdrawals are tax free. while funds in an hsa carry over from year to year, leftover fsa funds go back to the employer each year. Confused about fsa vs. hsa? this guide clarifies the key differences and similarities between these healthcare savings accounts for informed financial planning. Hsas and fsas are health savings accounts. hsas are an option if you have a high deductible health insurance plan. fsas go with traditional insurance plans.

Comments are closed.