Purpose Of Credit Risk Analysis Finance Tech Analytics Career

Credit Risk Analyst Pdf Financial Analyst Credit Risk Credit risk analysis can be understood as a measure to mitigate credit risk. the credit risk analysis process involves assessing the probability of loss due to default by the borrower. Credit risk analysts evaluate the likelihood of borrowers defaulting on loans, using financial data and risk models to manage exposure to credit risks and make informed lending decisions. over 2.8 million professionals use cfi to learn accounting, financial analysis, modeling and more.

Purpose Of Credit Risk Analysis Finance Tech Analytics Career Credit risk analysts generally produce reports and recommendations based on their analytical work. for instance, they may decide the terms, credit limit, and interest rate for a borrower. The goal of a credit risk analyst is to minimize the potential losses to the lender by identifying and mitigating any potential risks. in order to do this, credit risk analysts use a variety of tools and techniques, including statistical analysis, financial modeling, and industry specific knowledge. Keep reading to find detailed information about what credit risk analysts do, including the type of work they are tasked with on a daily basis, industries in which they work, and the specific skills needed for a successful career. In lending environments like banks, credit unions, and consumer finance institutions, credit risk analysts serve as the backbone of risk decision frameworks. they provide detailed assessments that guide loan underwriting and inform credit policy formulation.

Credit Analyst Overview Job Description Educational Requirements Keep reading to find detailed information about what credit risk analysts do, including the type of work they are tasked with on a daily basis, industries in which they work, and the specific skills needed for a successful career. In lending environments like banks, credit unions, and consumer finance institutions, credit risk analysts serve as the backbone of risk decision frameworks. they provide detailed assessments that guide loan underwriting and inform credit policy formulation. Credit risk analysts use statistics and data analysis to foresee defaults and estimate financial losses. by looking at data, they assess how much risk is in credit portfolios. The role of credit risk analyst is to scrutinise the data and financial statements of either individuals or firms to work out how much risk would be involved in lending them money. they prepare reports and conduct financial risk assessments for use in the decision making process. Credit risk analysts use statistical models and techniques to identify potential credit risks and develop strategies to mitigate them. their goal is to minimize losses for lenders and financial institutions by identifying and addressing potential credit risks early on. Credit risk analysts play a vital role in assessing loan applicants' creditworthiness, aiding lenders in making informed decisions. credit risk analyst analyze risk factors, monitors trends, and offers recommendations for granting credit.

Building A Career In Credit Analysis Credit risk analysts use statistics and data analysis to foresee defaults and estimate financial losses. by looking at data, they assess how much risk is in credit portfolios. The role of credit risk analyst is to scrutinise the data and financial statements of either individuals or firms to work out how much risk would be involved in lending them money. they prepare reports and conduct financial risk assessments for use in the decision making process. Credit risk analysts use statistical models and techniques to identify potential credit risks and develop strategies to mitigate them. their goal is to minimize losses for lenders and financial institutions by identifying and addressing potential credit risks early on. Credit risk analysts play a vital role in assessing loan applicants' creditworthiness, aiding lenders in making informed decisions. credit risk analyst analyze risk factors, monitors trends, and offers recommendations for granting credit.

Building A Career In Credit Analysis Credit risk analysts use statistical models and techniques to identify potential credit risks and develop strategies to mitigate them. their goal is to minimize losses for lenders and financial institutions by identifying and addressing potential credit risks early on. Credit risk analysts play a vital role in assessing loan applicants' creditworthiness, aiding lenders in making informed decisions. credit risk analyst analyze risk factors, monitors trends, and offers recommendations for granting credit.

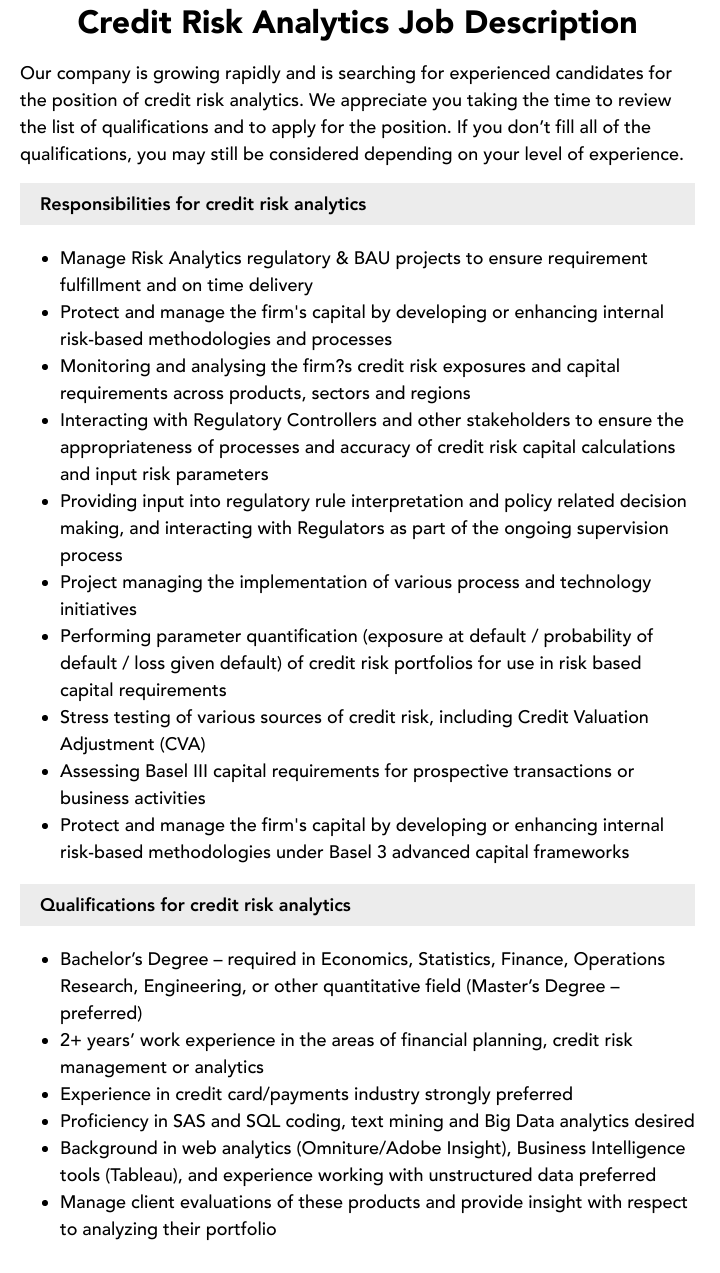

Credit Risk Analytics Job Description Velvet Jobs

Comments are closed.