Pension Plans Features Benefits Types Of Pension Plans Explained

Fillable Online Pension Plans Features Benefits Types Fax Email A pension plan is an employee benefit that makes regular payments to the employee in retirement. there are defined benefit and defined contribution pension plans. The two most widely known types of pension plans are defined benefit and defined contribution plans. however, government pensions also have distinct features that are worth discussing.

Pension Plans Features Benefits Types Pdf Pension Retirement Pension plans generally fall into two categories: defined benefit and defined contribution plans. understanding the differences between these types is crucial for making informed decisions about your retirement strategy. Understand how pension plans work, the different types available, and their role in securing financial stability in retirement. a pension is a type of retirement plan that provides monthly income in retirement. A guide to a what is a pension plan. here we discuss how it works, its types, and benefits, and compared it with a 401k plan. Various types of pension plans offer unique features and benefits, designed to cater to different financial circumstances and retirement goals. below, we’ll delve into the most common types of pension plans in the uk and explain their key features.

Types Of Pension Plans And Their Pros And Cons 1600x1000 W Words A guide to a what is a pension plan. here we discuss how it works, its types, and benefits, and compared it with a 401k plan. Various types of pension plans offer unique features and benefits, designed to cater to different financial circumstances and retirement goals. below, we’ll delve into the most common types of pension plans in the uk and explain their key features. In this section, we will dive into the different types of pension plans available and their unique features. from traditional defined benefit plans to modern cash balance plans, we’ll discuss the pros and cons of each and help you determine the best fit for your retirement goals. There are several types of pension plans, each with its own set of benefits. these include defined benefit plans, defined contribution plans, and hybrid plans. each type of plan offers different levels of security, flexibility, and tax advantages. A pension is an employer sponsored retirement savings plan that differs in key ways from alternatives such as 401 (k)s and 403 (b)s. pension enrollees often make little or no contributions to their plans, but they receive monthly benefits throughout their retirement years. compared to other options, pensions offer employees less responsibility—but also less flexibility—when it comes to. Through a pension plan, you will develop financial security in the future by receiving constant retirement income. the pension plan presents three major benefits: peace of mind, financial independence, and protection against increasing living expenses.

Pensions Basics Explained Pension Geeks Experts In Financial In this section, we will dive into the different types of pension plans available and their unique features. from traditional defined benefit plans to modern cash balance plans, we’ll discuss the pros and cons of each and help you determine the best fit for your retirement goals. There are several types of pension plans, each with its own set of benefits. these include defined benefit plans, defined contribution plans, and hybrid plans. each type of plan offers different levels of security, flexibility, and tax advantages. A pension is an employer sponsored retirement savings plan that differs in key ways from alternatives such as 401 (k)s and 403 (b)s. pension enrollees often make little or no contributions to their plans, but they receive monthly benefits throughout their retirement years. compared to other options, pensions offer employees less responsibility—but also less flexibility—when it comes to. Through a pension plan, you will develop financial security in the future by receiving constant retirement income. the pension plan presents three major benefits: peace of mind, financial independence, and protection against increasing living expenses.

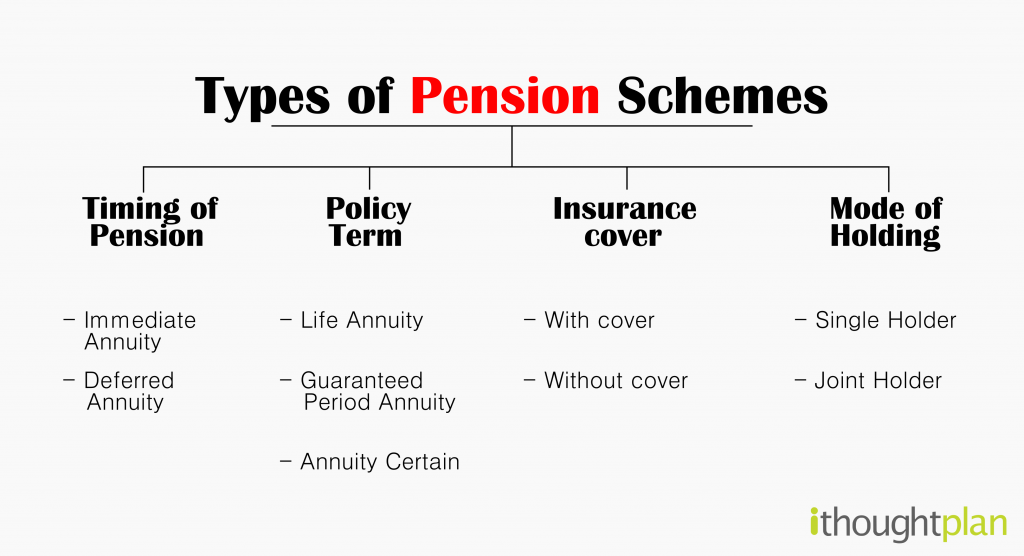

Types Of Pension Plans Ithought Plan S Blog On Pension Schemes A pension is an employer sponsored retirement savings plan that differs in key ways from alternatives such as 401 (k)s and 403 (b)s. pension enrollees often make little or no contributions to their plans, but they receive monthly benefits throughout their retirement years. compared to other options, pensions offer employees less responsibility—but also less flexibility—when it comes to. Through a pension plan, you will develop financial security in the future by receiving constant retirement income. the pension plan presents three major benefits: peace of mind, financial independence, and protection against increasing living expenses.

Comments are closed.