Hsas Vs Fsas What S The Difference Aeroflow Health

Health Care Choices Hsas Vs Fsas Wsj Fsas and hsas have multiple similarities, and it’s easy to confuse these two popular options for medical expenses. however, differences between them are important, and understanding what makes an fsa different from an hsa can help you decide which account is best for you and any eligible medical expenses. Hsa vs fsa: key differences outside of the similarities, hsas and fsas differ in a few important ways: you can carry over unused hsa funds hsas allow you to carry money forward indefinitely, so your funds are there for you year after year. this can make things easier if you happen to contribute more than you spend on qualified medical expenses in a year—you won't have to rush to buy band.

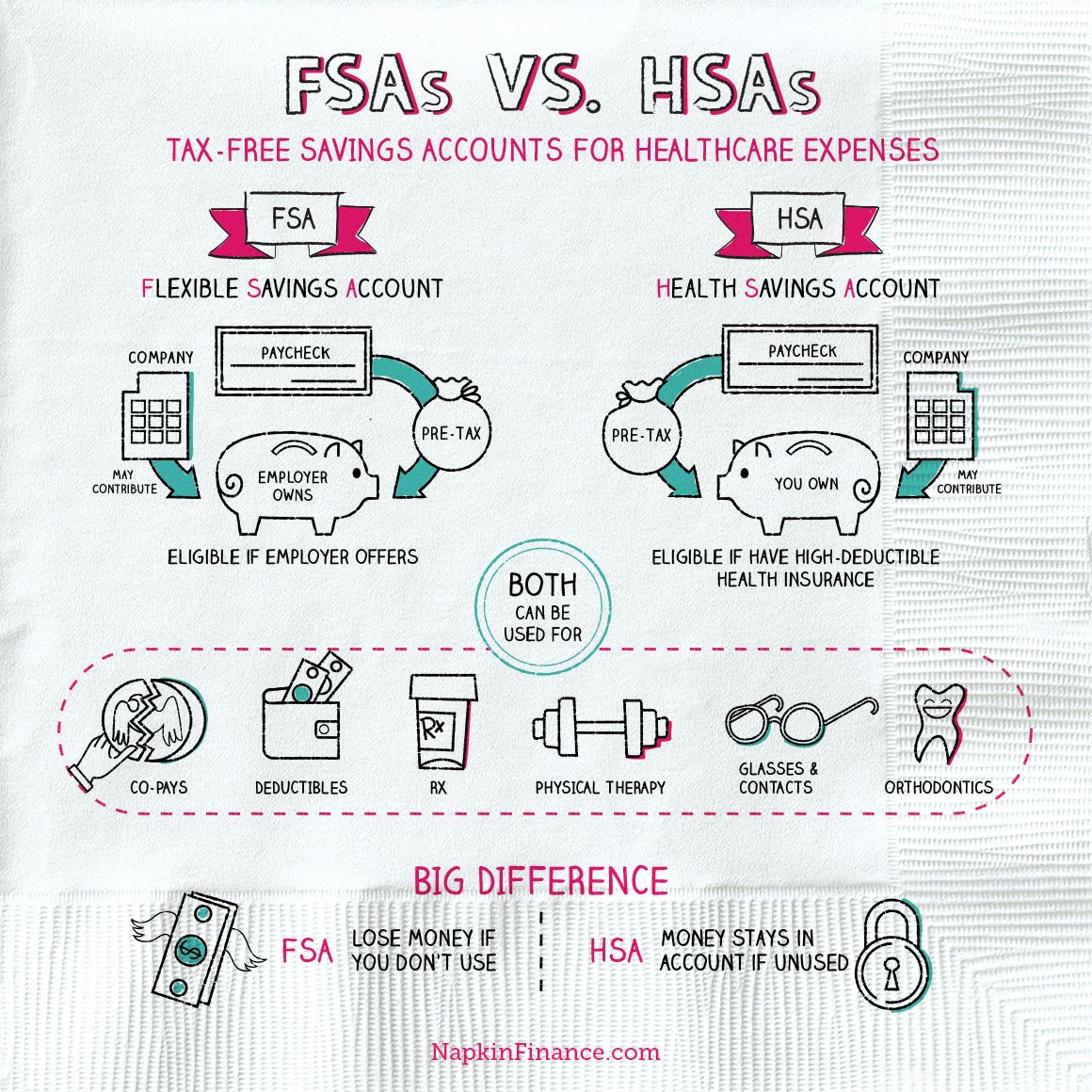

Fsas Vs Hsas Napkin Finance Understanding the difference between an hsa and an fsa is essential for anyone looking to take control of their out of pocket health expenses. these two types of accounts—health savings accounts (hsas) and flexible spending accounts (fsas)—both offer tax advantages that can make healthcare more affordable. but they differ in several important ways, especially when it comes to eligibility. Compare and contrast hsas vs fsas. explore their differences, including pros and cons of each account and who should (and shouldn't) have each account type. Both fsas and hsas provide tax savings on health costs, but you have to buy a health insurance plan that pays few costs upfront to qualify for an hsa, and not everybody should. Here's an overview of two popular tax advantaged medical accounts health savings plans (hsas) and flexible spending accounts (fsas) provide two useful options to save money towards your medical.

Hsas Vs Fsas Difference And Details Employer Flexible Both fsas and hsas provide tax savings on health costs, but you have to buy a health insurance plan that pays few costs upfront to qualify for an hsa, and not everybody should. Here's an overview of two popular tax advantaged medical accounts health savings plans (hsas) and flexible spending accounts (fsas) provide two useful options to save money towards your medical. Hsas and health fsas help pay for healthcare related costs you might expect (like copays, deductibles, and coinsurance) but also costs you might not (like menstrual care products, weight loss programs, and alcohol and drug treatment). Hsas and fsas both cover out of pocket medical expenses but they have key differences. here's how to decide which is right for you. Navigate healthcare savings with clarity. discover the distinctions between fsas and hsas and optimize your tax advantaged health funds. Both hsas and fsas offer tax savings for qualified medical expenses. however, there are several differences between these accounts. for example, hsas make a great long term option with more flexibility in contributing, the ability to keep your unused balance, and additional tax benefits. let's break this down in a side by side comparison.

The 5 Differences Between Hsas And Fsas Medzero Hsas and health fsas help pay for healthcare related costs you might expect (like copays, deductibles, and coinsurance) but also costs you might not (like menstrual care products, weight loss programs, and alcohol and drug treatment). Hsas and fsas both cover out of pocket medical expenses but they have key differences. here's how to decide which is right for you. Navigate healthcare savings with clarity. discover the distinctions between fsas and hsas and optimize your tax advantaged health funds. Both hsas and fsas offer tax savings for qualified medical expenses. however, there are several differences between these accounts. for example, hsas make a great long term option with more flexibility in contributing, the ability to keep your unused balance, and additional tax benefits. let's break this down in a side by side comparison.

Comments are closed.