How Principal Interest Actually Work In Loan Payments

How To Calculate Principal And Interest On A Mortgage Learn how to calculate principal and interest on loans, including simple interest and amortized loans, and understand the impact on your monthly payments and loan costs. Each monthly payment consists of principal (the amount you borrowed) and interest (the cost of borrowing). knowing how these elements work together can help you save thousands of dollars over time. with mortgage rates at 7.09% as of january 10, 2025, borrowing costs are rising.

How To Calculate Principal Interest Payments Sapling Interest is what you pay to borrow money, usually expressed as a percentage of the principal. your loan’s principal, interest rate, repayment term and fees decide how much you ultimately. As mentioned above, principal refers to the amount borrowed, while interest is the cost of borrowing that money. you’ll pay interest on the principal over the life of the loan. your interest rate is usually shown as a percentage of the principal balance. What is the principal of a loan? the principal is the original loan amount you borrow before any interest or fees are added. if you take out a $10,000 loan, your principal is $10,000. as you make payments, your principal decreases, reducing the amount of interest you pay over time. Interest accrues on the principal based on the account’s terms and its interest rate, which is the cost of borrowing money. monthly payments generally get split between the interest that accrued since previous payments and the principal balance.

Debt Payments Explained Learn All About The Different Between What is the principal of a loan? the principal is the original loan amount you borrow before any interest or fees are added. if you take out a $10,000 loan, your principal is $10,000. as you make payments, your principal decreases, reducing the amount of interest you pay over time. Interest accrues on the principal based on the account’s terms and its interest rate, which is the cost of borrowing money. monthly payments generally get split between the interest that accrued since previous payments and the principal balance. In the early months of a loan, much of your payment goes toward interest rather than reducing the principal. as time passes, the principal balance decreases, and more of your payment goes toward paying down the loan. using a loan payment calculator can help visualize how payments shift over time. The less the amount of the principal loan, the less interest it will accrue over time. you can learn how to calculate principal and interest amounts on mortgage payments. principal and interest calculations can help you understand monthly payments, the total cost of a loan, and the interest rate. Understanding how to calculate principal and interest is key so you know how much you could pay overall over the life of the loan. there are also costs to consider as well. what is a loan principal? a loan principal is the initial amount of your mortgage loan, not including any interest or fees. Of the almost $20,000 in mortgage payments you’ll make in the first year, over $15,000 goes toward interest. somewhere between year 15 and 20, your payments start going more toward the principal and less toward interest. the amount you’ll pay in interest alone ($292,331.31) exceeds the original loan amount ($280,000).

Understanding Principal Vs Interest Loan Repayment Basics Explained In the early months of a loan, much of your payment goes toward interest rather than reducing the principal. as time passes, the principal balance decreases, and more of your payment goes toward paying down the loan. using a loan payment calculator can help visualize how payments shift over time. The less the amount of the principal loan, the less interest it will accrue over time. you can learn how to calculate principal and interest amounts on mortgage payments. principal and interest calculations can help you understand monthly payments, the total cost of a loan, and the interest rate. Understanding how to calculate principal and interest is key so you know how much you could pay overall over the life of the loan. there are also costs to consider as well. what is a loan principal? a loan principal is the initial amount of your mortgage loan, not including any interest or fees. Of the almost $20,000 in mortgage payments you’ll make in the first year, over $15,000 goes toward interest. somewhere between year 15 and 20, your payments start going more toward the principal and less toward interest. the amount you’ll pay in interest alone ($292,331.31) exceeds the original loan amount ($280,000).

What Is A Loan Principal And How Does It Affect Your Finances Fundevity Understanding how to calculate principal and interest is key so you know how much you could pay overall over the life of the loan. there are also costs to consider as well. what is a loan principal? a loan principal is the initial amount of your mortgage loan, not including any interest or fees. Of the almost $20,000 in mortgage payments you’ll make in the first year, over $15,000 goes toward interest. somewhere between year 15 and 20, your payments start going more toward the principal and less toward interest. the amount you’ll pay in interest alone ($292,331.31) exceeds the original loan amount ($280,000).

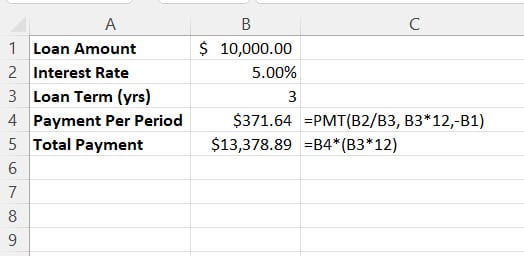

Calculating The Principal And Interest On A Loan Excelbuddy

Comments are closed.