How Many Shares Of Schd Do You Need To Make 100 Per Month

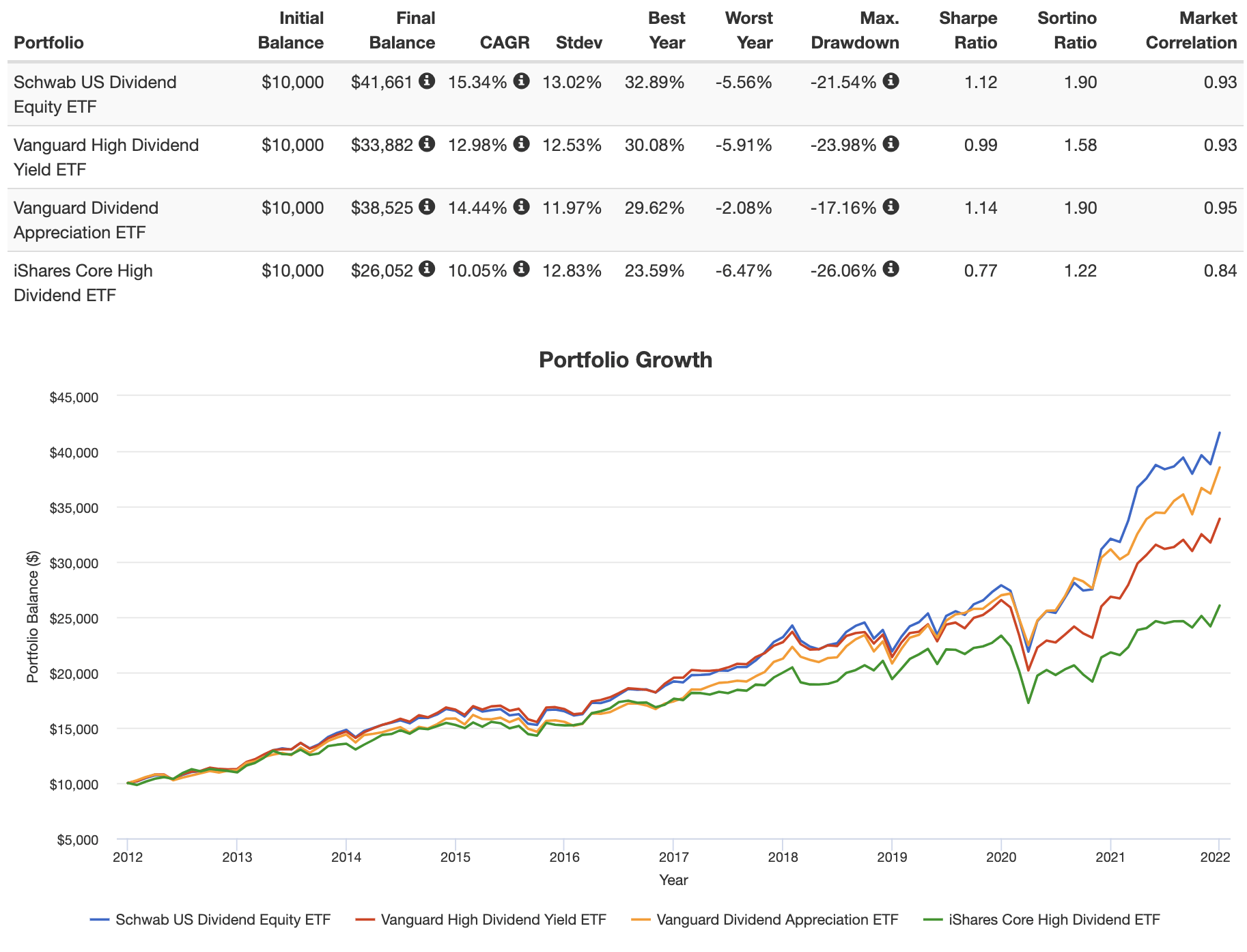

Schd Etf Review Is Schd A Good Investment Dividend Stocks If you invest $10,000 into schd (with additional $100 month investment), and assuming historic annual price increase of 7.67% and historic annual dividend increase of about 11.54%, without any extra investments, here is your what your portfolio would look like after 20 years, with and without drip:. Our schd dividend calculator is a simple tool to help you estimate the dividend income you’ll earn based on how much you invest. whether you’re investing a small or large amount, this calculator provides a breakdown of daily, monthly, quarterly, and yearly dividend payouts.

Thanks To This Sub I Ve Added 100 Shares Of Schd Today It S Harder The schd dividend payout calculator helps you estimate how much dividend income you could receive from investing in the schwab u.s. dividend equity etf (schd). this tool shows projected dividend payouts over time and allows you to compare income scenarios with and without dividend reinvestment. Free schd dividend calculator to track dividend history, calculate dividend yields, and estimate monthly income with real time data. If you’re wondering how much passive income you can earn from your schd investment, this article and calculator will help you estimate your potential earnings. In this guide, we’ll walk through everything you need to know about estimating your schd dividends, how compounding affects your returns, and how to use the best free tools available to optimize your investing decisions.

307 Best Schd Images On Pholder Dividends Schd And Et Fs If you’re wondering how much passive income you can earn from your schd investment, this article and calculator will help you estimate your potential earnings. In this guide, we’ll walk through everything you need to know about estimating your schd dividends, how compounding affects your returns, and how to use the best free tools available to optimize your investing decisions. Yes, you can use the calculator for multiple stocks. simply input the ticker of the stock along with your specific use case values or go for the default numbers to estimate the total monthly dividend income for your entire portfolio. how accurate is the schd dividend calculator?. Schd is an exchange traded fund that tracks the dow jones u.s. dividend 100 index, focusing on high quality u.s. companies with consistent dividend payments. with an expense ratio of just 0.06%, it's one of the most cost effective dividend etfs available. How many shares of schd would you need to make $100 per month in passive dividend income? i break down how many share you would need in today's price and today's dividend. 5,872 shares at average cost of $74.57. so it’s been rough lately but the dividends keep coming and it will recover soon enough. i love you man !!! i own a 125 shares. with a dps of 2.64, i bet that ~$1291 dividend income per month makes it a lot less rough. 🙂 true. it’s close to half my portfolio at this point.

Schd Dividend Snowball Calculator Dripcalc Yes, you can use the calculator for multiple stocks. simply input the ticker of the stock along with your specific use case values or go for the default numbers to estimate the total monthly dividend income for your entire portfolio. how accurate is the schd dividend calculator?. Schd is an exchange traded fund that tracks the dow jones u.s. dividend 100 index, focusing on high quality u.s. companies with consistent dividend payments. with an expense ratio of just 0.06%, it's one of the most cost effective dividend etfs available. How many shares of schd would you need to make $100 per month in passive dividend income? i break down how many share you would need in today's price and today's dividend. 5,872 shares at average cost of $74.57. so it’s been rough lately but the dividends keep coming and it will recover soon enough. i love you man !!! i own a 125 shares. with a dps of 2.64, i bet that ~$1291 dividend income per month makes it a lot less rough. 🙂 true. it’s close to half my portfolio at this point.

Comments are closed.