Fsa Vs Hsa What Is The Difference

Hsas Vs Fsas What S The Difference Aeroflow Health Hsa vs. fsa: which is better? if you're eligible for both an hsa and fsa, be sure to carefully weigh each option, considering the pros and cons we've outlined above. Compare and contrast hsas vs fsas. explore their differences, including pros and cons of each account and who should (and shouldn't) have each account type.

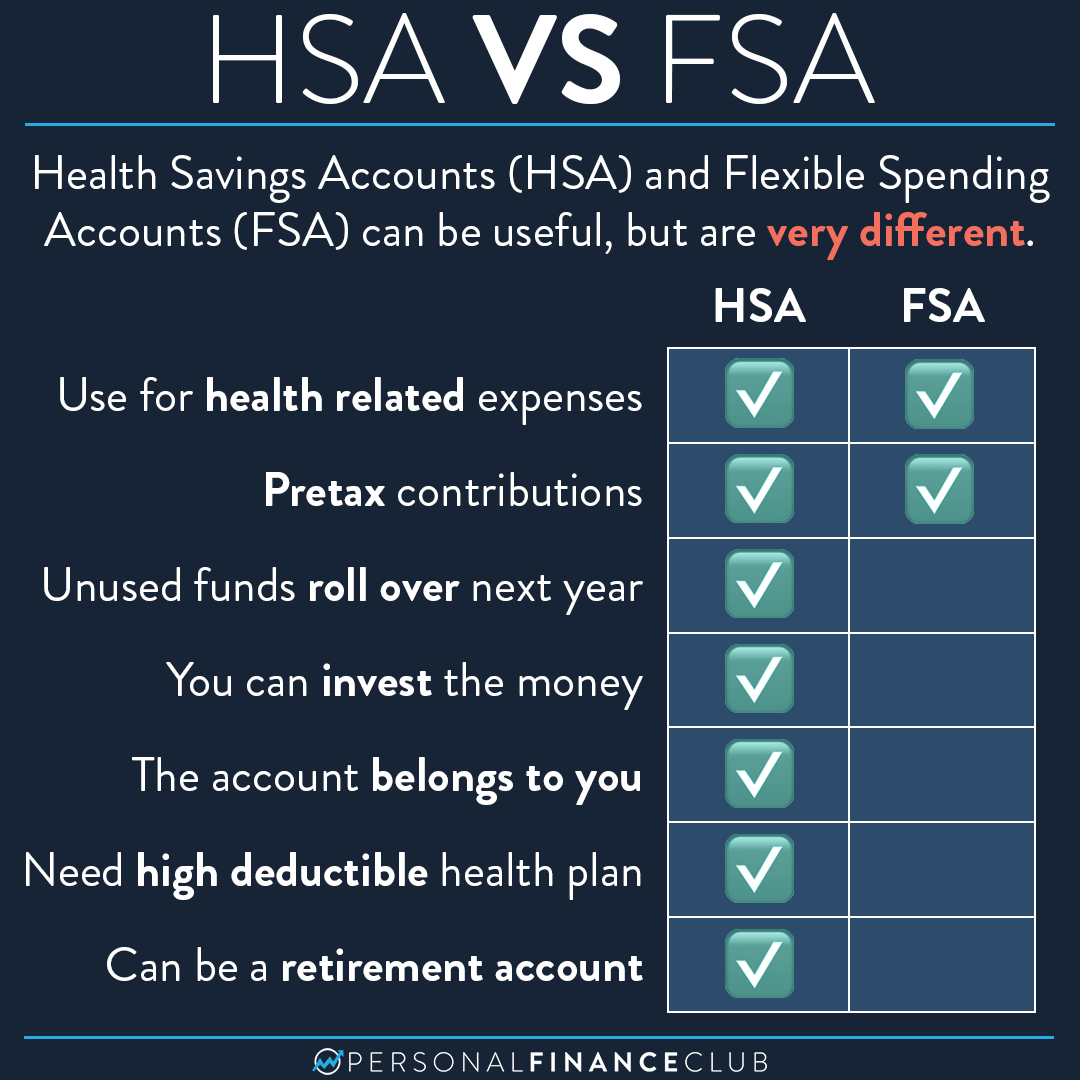

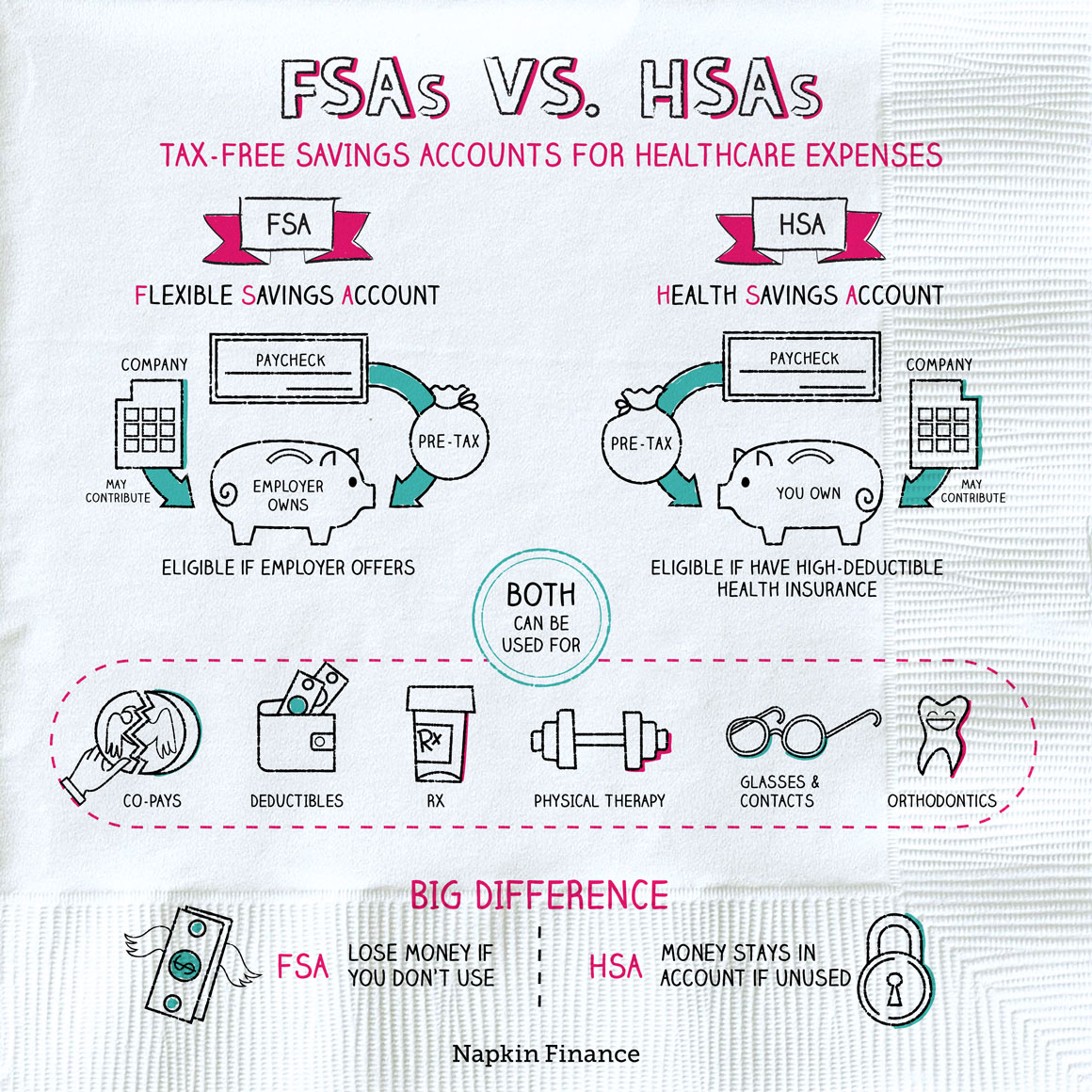

What Is Fsa Hsa Eligible At Thomas Reed Blog Health savings accounts (hsas) and flexible spending accounts (fsas) are financial tools designed to help individuals manage and pay for healthcare expenses. both offer tax advantages and aim to support healthcare needs, but they operate under different regulations and suit varied financial situations. this article defines each account type and outlines their primary differences, helping. Flexible spending accounts (fsa) and health savings accounts (hsa) let you save pretax money to spend later on medical and healthcare expenses that aren’t covered by your insurance plan. What is the difference between an hsa and an fsa? hsa and fsa contributions are tax deductible, and medical expense withdrawals are tax free. while funds in an hsa carry over from year to year, leftover fsa funds go back to the employer each year. Hsas and fsas have key differences in eligibility, portability and contribution limits. from time to time, you may run into medical expenses that your health insurance doesn't cover. it could.

Fsa Vs Hsa Use It Or Lose It Napkin Finance What is the difference between an hsa and an fsa? hsa and fsa contributions are tax deductible, and medical expense withdrawals are tax free. while funds in an hsa carry over from year to year, leftover fsa funds go back to the employer each year. Hsas and fsas have key differences in eligibility, portability and contribution limits. from time to time, you may run into medical expenses that your health insurance doesn't cover. it could. Hsas, health savings accounts, conversely, are potentially powerful savings vehicles that give you a tax preferred incentive to sock away money for big healthcare expenses today. or, you can. Hsas and fsas allow you to put pre tax dollars toward qualified medical expenses. an hsa and an fsa differ in eligibility requirements and requirements for when the money must be spent. there are limits to how much you’re able to contribute to an hsa or fsa. Although fsas and hsas both allow people to use pretax income for eligible medical expenses, there are considerable differences between the two account types. these include the qualifications, contributions limits, rules for rollovers and changing contribution amounts, and withdrawal penalties. Fsas are employer sponsored savings accounts that allow employees to set money aside each year to cover the cost of qualified medical expenses. the funny thing is that despite the name, they’re actually less flexible than hsas. but that doesn’t mean you can’t use them to flex on some medical costs. what are the differences between hsas and fsas?.

Comments are closed.