Fsa Vs Hsa Use It Or Lose It Napkin Finance

Fsa Vs Hsa Use It Or Lose It Napkin Finance If you’re eligible, saving in an fsa or hsa can be a great deal. but for fsas in particular, you typically only get one shot to adjust your contributions each year—and that’s during open enrollment. Both fsas and hsas provide tax savings on health costs, but you have to buy a health insurance plan that pays few costs upfront to qualify for an hsa, and not everybody should.

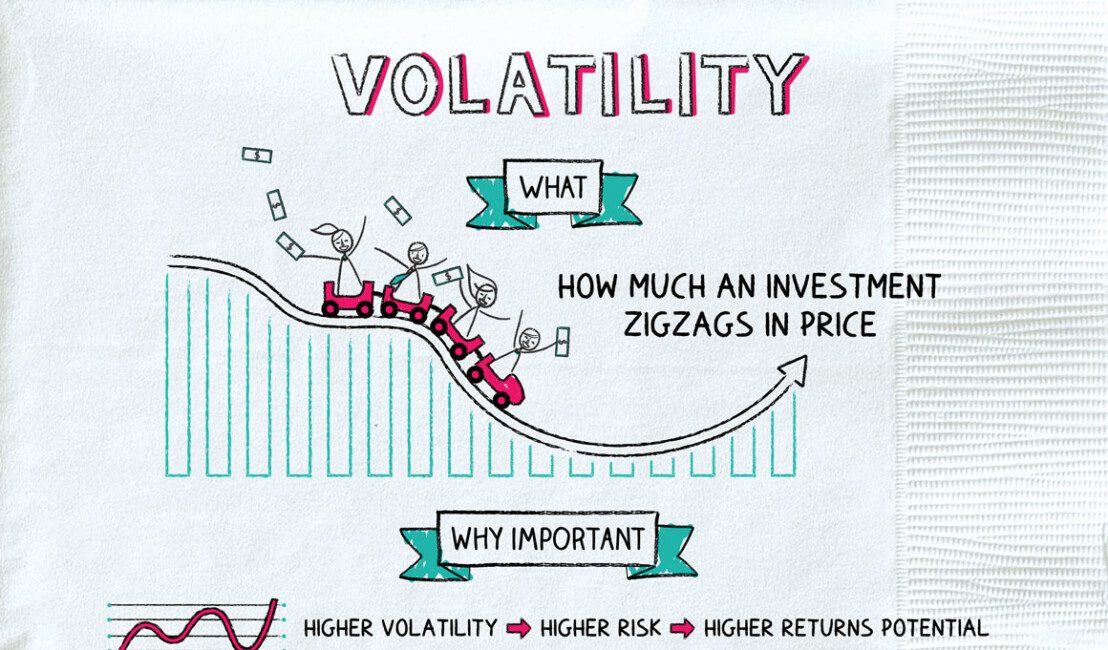

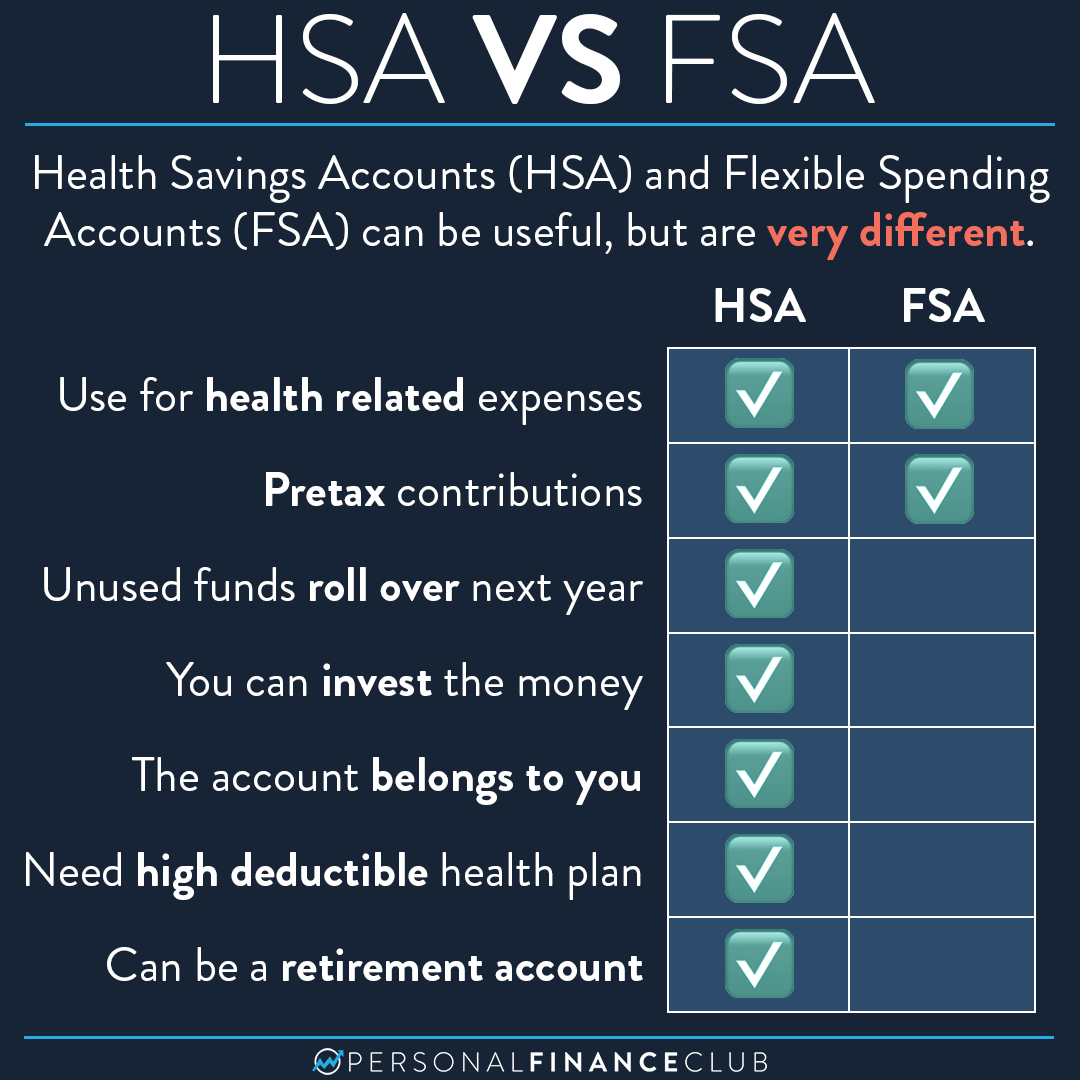

Fsa Vs Hsa Use It Or Lose It Napkin Finance An fsa (flexible spending account) is usually sponsored by an employer, and you fund it through pre tax payroll deductions. fsas are “use it or lose it” accounts. this means you generally need to spend the money within the plan year. however, some plans offer short grace periods or allow you to carry over a small portion. Health savings accounts (hsas) and flexible spending accounts (fsas) are two benefits offered by many employers that allocate pretax dollars towards medical expenses. hsas and fsas,. Two popular choices are flexible spending accounts (fsas) and health savings accounts (hsas). both are tax advantaged health spending accounts designed to help individuals and companies save on healthcare expenses. but which one is right for you and your employees?. Flexible spending accounts (fsa) and health savings accounts (hsa) let you save pretax money to spend later on medical and healthcare expenses that aren’t covered by your insurance plan .

How Is An Hsa Different From An Fsa Personal Finance Club Two popular choices are flexible spending accounts (fsas) and health savings accounts (hsas). both are tax advantaged health spending accounts designed to help individuals and companies save on healthcare expenses. but which one is right for you and your employees?. Flexible spending accounts (fsa) and health savings accounts (hsa) let you save pretax money to spend later on medical and healthcare expenses that aren’t covered by your insurance plan . Hsas, hras, and fsas are types of accounts that help pay for certain health care expenses. compare the details about each so you can choose what's right for you. Hsa vs. fsa: 2025 comparison guide & chart trying to choose between an hsa and an fsa? here’s the tl;dr: if you’ve got a high deductible health plan and want to build a safety net for future medical expenses—with room to save, invest, and snag tax perks—an hsa gives you more long term power and flexibility. but if your employer offers an fsa and you expect steady, predictable health. That's where a health savings account (hsa) or a flexible spending account (fsa) can make the difference: both of these accounts are meant to cover qualified medical expenses, but there are. There’s another drawback in addition to the low contribution limit: the use it or lose it provision. if you don’t spend all of the money in your fsa by year end, you may have to forfeit.

Hsa Vs Fsa Save Money On Healthcare Useful Guide Hsas, hras, and fsas are types of accounts that help pay for certain health care expenses. compare the details about each so you can choose what's right for you. Hsa vs. fsa: 2025 comparison guide & chart trying to choose between an hsa and an fsa? here’s the tl;dr: if you’ve got a high deductible health plan and want to build a safety net for future medical expenses—with room to save, invest, and snag tax perks—an hsa gives you more long term power and flexibility. but if your employer offers an fsa and you expect steady, predictable health. That's where a health savings account (hsa) or a flexible spending account (fsa) can make the difference: both of these accounts are meant to cover qualified medical expenses, but there are. There’s another drawback in addition to the low contribution limit: the use it or lose it provision. if you don’t spend all of the money in your fsa by year end, you may have to forfeit.

Hsa Vs Fsa Save Money On Healthcare Useful Guide That's where a health savings account (hsa) or a flexible spending account (fsa) can make the difference: both of these accounts are meant to cover qualified medical expenses, but there are. There’s another drawback in addition to the low contribution limit: the use it or lose it provision. if you don’t spend all of the money in your fsa by year end, you may have to forfeit.

Hsa Vs Fsa Understanding The Differences 7esl

Comments are closed.