Fsa Vs Hsa Difference And Comparison Diffen

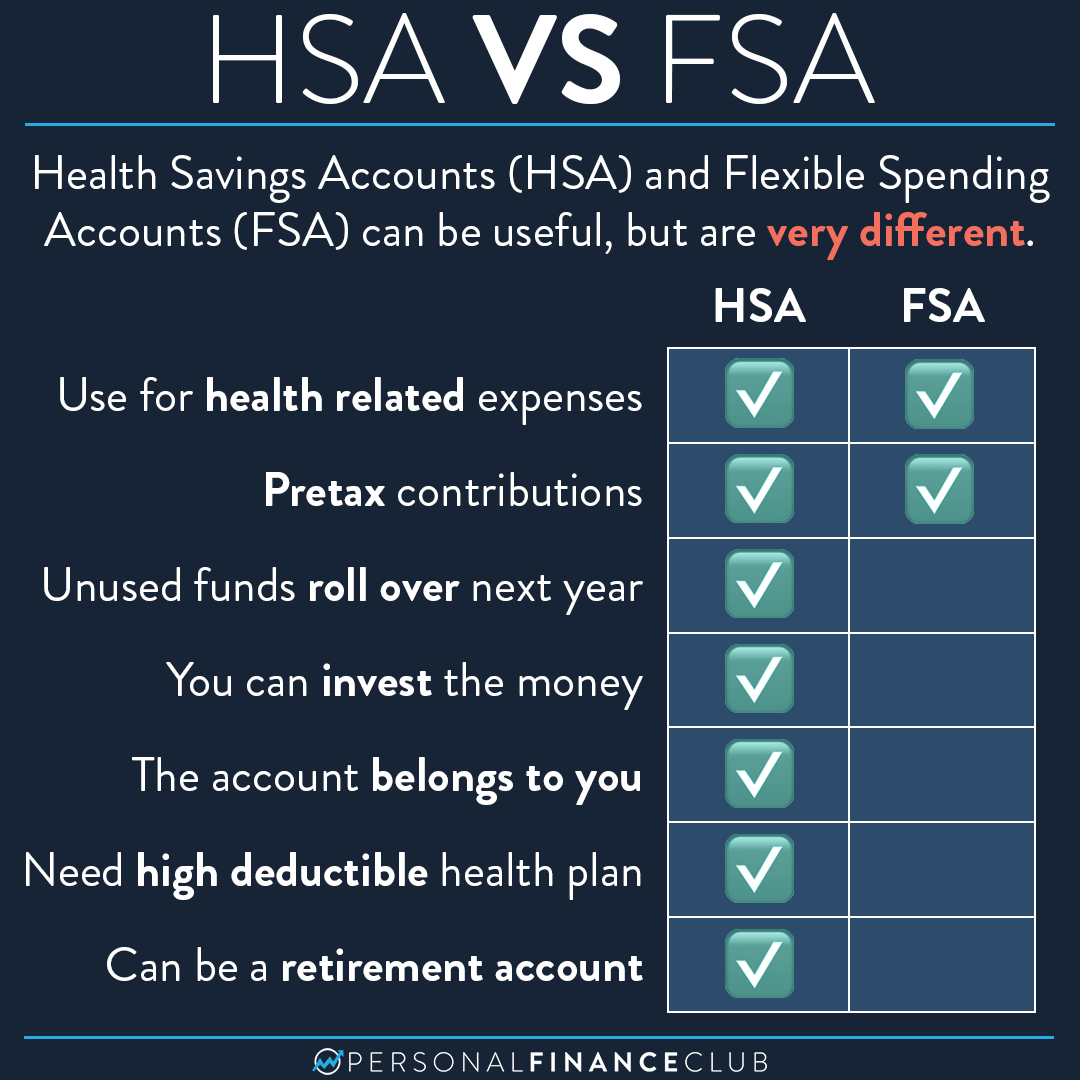

Fsa Vs Hsa Difference And Comparison Diffen What's the difference between fsa and hsa? fsa (flexible spending account) and hsa (health savings account) are tax advantaged accounts for healthcare expenses but they differ in terms of who is eligible, who owns the funds, whether funds are portable or roll over, contribution limits, and eligible. Hsa vs fsa: key differences outside of the similarities, hsas and fsas differ in a few important ways: you can carry over unused hsa funds hsas allow you to carry money forward indefinitely, so your funds are there for you year after year.

Fsa Vs Hsa Difference And Comparison Diffen Hsa vs. fsa: 2025 comparison guide & chart trying to choose between an hsa and an fsa? here’s the tl;dr: if you’ve got a high deductible health plan and want to build a safety net for future medical expenses—with room to save, invest, and snag tax perks—an hsa gives you more long term power and flexibility. but if your employer offers an fsa and you expect steady, predictable health. Compare and contrast hsas vs fsas. explore their differences, including pros and cons of each account and who should (and shouldn't) have each account type. Both fsas and hsas provide tax savings on health costs, but you have to buy a health insurance plan that pays few costs upfront to qualify for an hsa, and not everybody should. Flexible spending account (fsa) an fsa is similar to an hsa, but there are a few key differences. for one, the employer—not the employee—owns the fsa.

Fsa Vs Hsa Difference And Comparison Diffen Both fsas and hsas provide tax savings on health costs, but you have to buy a health insurance plan that pays few costs upfront to qualify for an hsa, and not everybody should. Flexible spending account (fsa) an fsa is similar to an hsa, but there are a few key differences. for one, the employer—not the employee—owns the fsa. Fsa vs. hsa: what’s the difference and which is right for you? flexible spending accounts (fsa) and health savings accounts (hsa) let you save pretax money to spend later on medical. Confused about fsa vs. hsa? this guide clarifies the key differences and similarities between these healthcare savings accounts for informed financial planning. Both hsas and fsas are tax free savings accounts meant to cover healthcare costs. hsas may provide a more flexible and portable option, but they’re only available with a high deductible health plan (hdhp). meanwhile, fsas have more restrictions and are typically offered as an employee benefit. What is the difference between an hsa and an fsa? hsa and fsa contributions are tax deductible, and medical expense withdrawals are tax free. while funds in an hsa carry over from year to year, leftover fsa funds go back to the employer each year.

How Is An Hsa Different From An Fsa Personal Finance Club Fsa vs. hsa: what’s the difference and which is right for you? flexible spending accounts (fsa) and health savings accounts (hsa) let you save pretax money to spend later on medical. Confused about fsa vs. hsa? this guide clarifies the key differences and similarities between these healthcare savings accounts for informed financial planning. Both hsas and fsas are tax free savings accounts meant to cover healthcare costs. hsas may provide a more flexible and portable option, but they’re only available with a high deductible health plan (hdhp). meanwhile, fsas have more restrictions and are typically offered as an employee benefit. What is the difference between an hsa and an fsa? hsa and fsa contributions are tax deductible, and medical expense withdrawals are tax free. while funds in an hsa carry over from year to year, leftover fsa funds go back to the employer each year.

Hsa Vs Fsa What S The Difference Health Myths Health Care Health Both hsas and fsas are tax free savings accounts meant to cover healthcare costs. hsas may provide a more flexible and portable option, but they’re only available with a high deductible health plan (hdhp). meanwhile, fsas have more restrictions and are typically offered as an employee benefit. What is the difference between an hsa and an fsa? hsa and fsa contributions are tax deductible, and medical expense withdrawals are tax free. while funds in an hsa carry over from year to year, leftover fsa funds go back to the employer each year.

Fsa Vs Hsa What S The Difference Taskforce Hr

Comments are closed.