A History Of Interest Rates Csinvesting

A History Of Interest And Debt Pdf Value Economics Interest An interest rate is the discount that individuals place on the value of future goods compared to present goods. this discount applies to money and everything else. Interest rates & inflation: 1900 2024 an inconsistent relationship before the liberating 1960s 20 year u.s. treasury bond vs. consumer price index (cpi) 20% 15% 10% 5% 0% 5%.

Eight Centuries Of Global Real Interest Rates Summary Pdf Interest rates have a long and complex history that dates back thousands of years, reflecting the evolution of economic systems and societal values. the practice of charging interest on loans can be traced back to ancient mesopotamia, where early forms of banking emerged. The full historical dataset is available for download here: fed funds rate | data | 1954 2025. shows the daily level of the federal funds rate back to 1954. The following chart summarizes the interest rate policies surrounding recessions since 1970. as the chart shows, the fed tends to lower interest rates during bouts of economic crisis and raise them as needed during more stable periods. key takeaways for businesses understanding this historical context provides valuable lessons for business leaders. Home › government › interest rate data › federal investments program rates and prices historical prices.

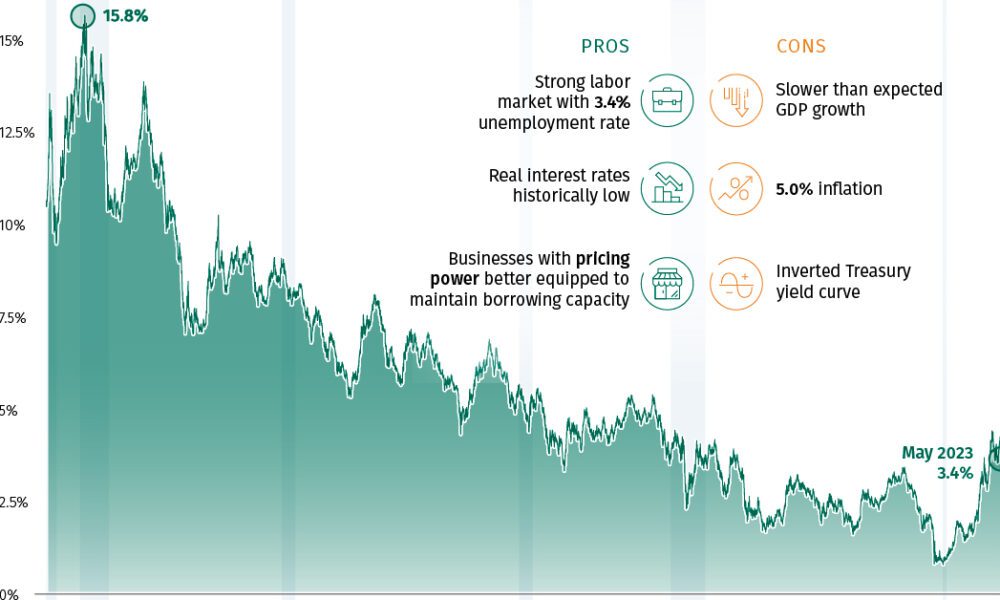

History Of Interest Rates Archives Visual Capitalist The following chart summarizes the interest rate policies surrounding recessions since 1970. as the chart shows, the fed tends to lower interest rates during bouts of economic crisis and raise them as needed during more stable periods. key takeaways for businesses understanding this historical context provides valuable lessons for business leaders. Home › government › interest rate data › federal investments program rates and prices historical prices. Update: i have replaced the end of the period t.bill rates that i used to report in this table, with the average t.bill rate during the year, since it better measures what you would have earned on that investment during the year. Delving into the annals of history, the saga of interest rates in the united states unfurls like a riveting thriller, casting light on the nation’s economic evolution. After maintaining historically low rates for nearly two years, the federal reserve began a series of rate hikes in early 2022, with the rate moving from 0.33 percent in april 2022 to 5.33. At the core of the federal reserve's interest rate decisions lies its dual mandate: maintaining price stability and maximizing employment. like a skilled conductor, the fed raises interest rates to cool an overheating economy and curb inflationary pressures.

History Lesson Duration Interest Rates Since 1931 Your Personal Update: i have replaced the end of the period t.bill rates that i used to report in this table, with the average t.bill rate during the year, since it better measures what you would have earned on that investment during the year. Delving into the annals of history, the saga of interest rates in the united states unfurls like a riveting thriller, casting light on the nation’s economic evolution. After maintaining historically low rates for nearly two years, the federal reserve began a series of rate hikes in early 2022, with the rate moving from 0.33 percent in april 2022 to 5.33. At the core of the federal reserve's interest rate decisions lies its dual mandate: maintaining price stability and maximizing employment. like a skilled conductor, the fed raises interest rates to cool an overheating economy and curb inflationary pressures.

The History Of Interest Rates After maintaining historically low rates for nearly two years, the federal reserve began a series of rate hikes in early 2022, with the rate moving from 0.33 percent in april 2022 to 5.33. At the core of the federal reserve's interest rate decisions lies its dual mandate: maintaining price stability and maximizing employment. like a skilled conductor, the fed raises interest rates to cool an overheating economy and curb inflationary pressures.

Comments are closed.