401k Contribution Limits For 2025

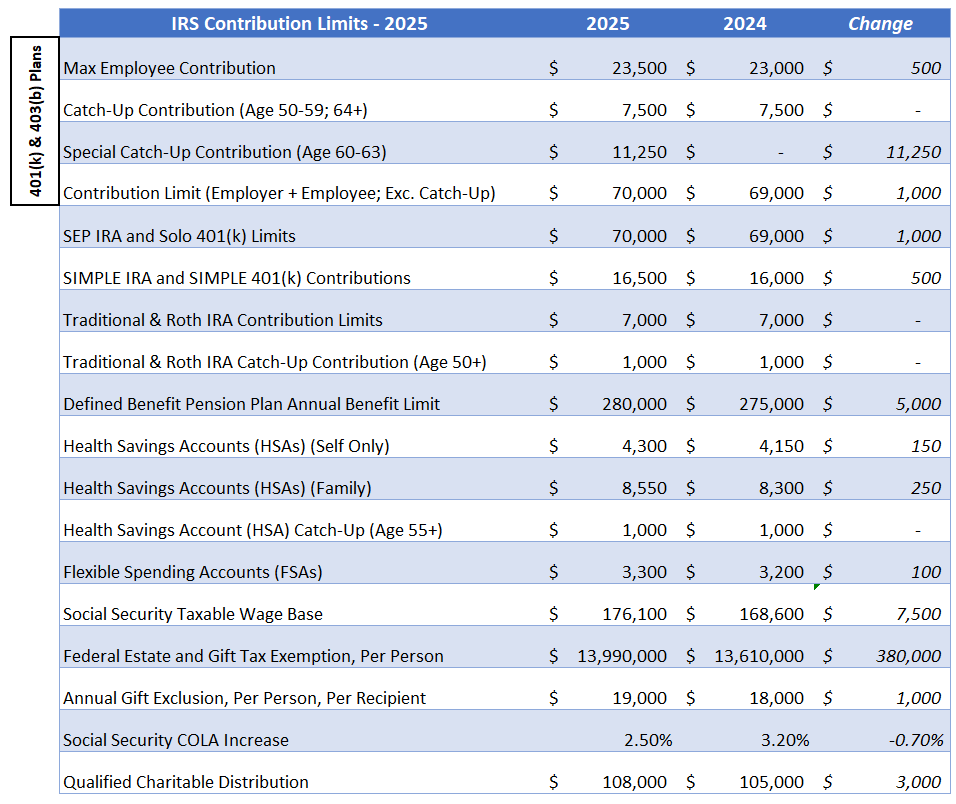

2025 401k Limits 2025 Contribution Limits Andy Amelina The what is the maximum 401k contribution for 2025 is now officially confirmed, giving workers and retirees clarity on how much they can save in tax advantaged retirement plans. for 2025, employees can contribute up to $23,500 to their 401 (k). this is a $500 increase from last year’s limit, reflecting adjustments for inflation. Learn how much you can save in your 401 (k) or ira in 2025, based on your age, income, and employer match. find out the new catch up contribution rules for savers aged 60 to 63 and the limits for highly compensated employees.

2025 Contribution Limits 401k Anna M Mathieson Learn about increased 401(k) contribution limits for 2025, along with catch up options and strategies to maximize retirement savings. Irs 401(k) limits increase to $23,500 in 2025. here’s how the big beautiful bill reshapes retirement, rmds, and roths. Retirement savers contributing to a 401 (k) plan can make larger contributions in 2025. the internal revenue service boosted the annual contribution limit for 401 (k)s, 403 (b)s, governmental 457. On november 1, 2024, the internal revenue service announced that the amount individuals can contribute to their 401k plans in 2025 has increased to $23,500, up from $23,000 for 2024.

401k Contribution Limits 2025 Angil Inesita Retirement savers contributing to a 401 (k) plan can make larger contributions in 2025. the internal revenue service boosted the annual contribution limit for 401 (k)s, 403 (b)s, governmental 457. On november 1, 2024, the internal revenue service announced that the amount individuals can contribute to their 401k plans in 2025 has increased to $23,500, up from $23,000 for 2024. The 2025 401 (k) annual contribution limit is $23,500, with a total contribution limit (including employer contributions) of $70,000. catch up contributions remain $7,500 for those 50 and older, but individuals 60 63 can contribute an additional $11,250. Employees using a workplace sponsored 401 (k) plan, a 403 (b) plan, or most 457 plans will be able to contribute an additional $500 per year in 2025. With the start of a new year comes new retirement plan contribution limits released by the irs. for 2025, you’ll see an increase in 401 (k) contributions, updates to cost of living adjustments, catch up contributions, and phase out ranges. this guide will break everything down so you’ll understand what you can expect this plan year. Most significantly, the amount individuals can contribute to their 401 (k) plans (as well as 403 (b), most 457 plans, and the thrift savings plan) in 2025 has increased to $23,500, up from $23,000 for 2024.

2025 Irs Contribution Limits For Iras 401 K S Tax Brackets The 2025 401 (k) annual contribution limit is $23,500, with a total contribution limit (including employer contributions) of $70,000. catch up contributions remain $7,500 for those 50 and older, but individuals 60 63 can contribute an additional $11,250. Employees using a workplace sponsored 401 (k) plan, a 403 (b) plan, or most 457 plans will be able to contribute an additional $500 per year in 2025. With the start of a new year comes new retirement plan contribution limits released by the irs. for 2025, you’ll see an increase in 401 (k) contributions, updates to cost of living adjustments, catch up contributions, and phase out ranges. this guide will break everything down so you’ll understand what you can expect this plan year. Most significantly, the amount individuals can contribute to their 401 (k) plans (as well as 403 (b), most 457 plans, and the thrift savings plan) in 2025 has increased to $23,500, up from $23,000 for 2024.

Comments are closed.