401k Contribution Limits 2025 Catch Up Lena Grace

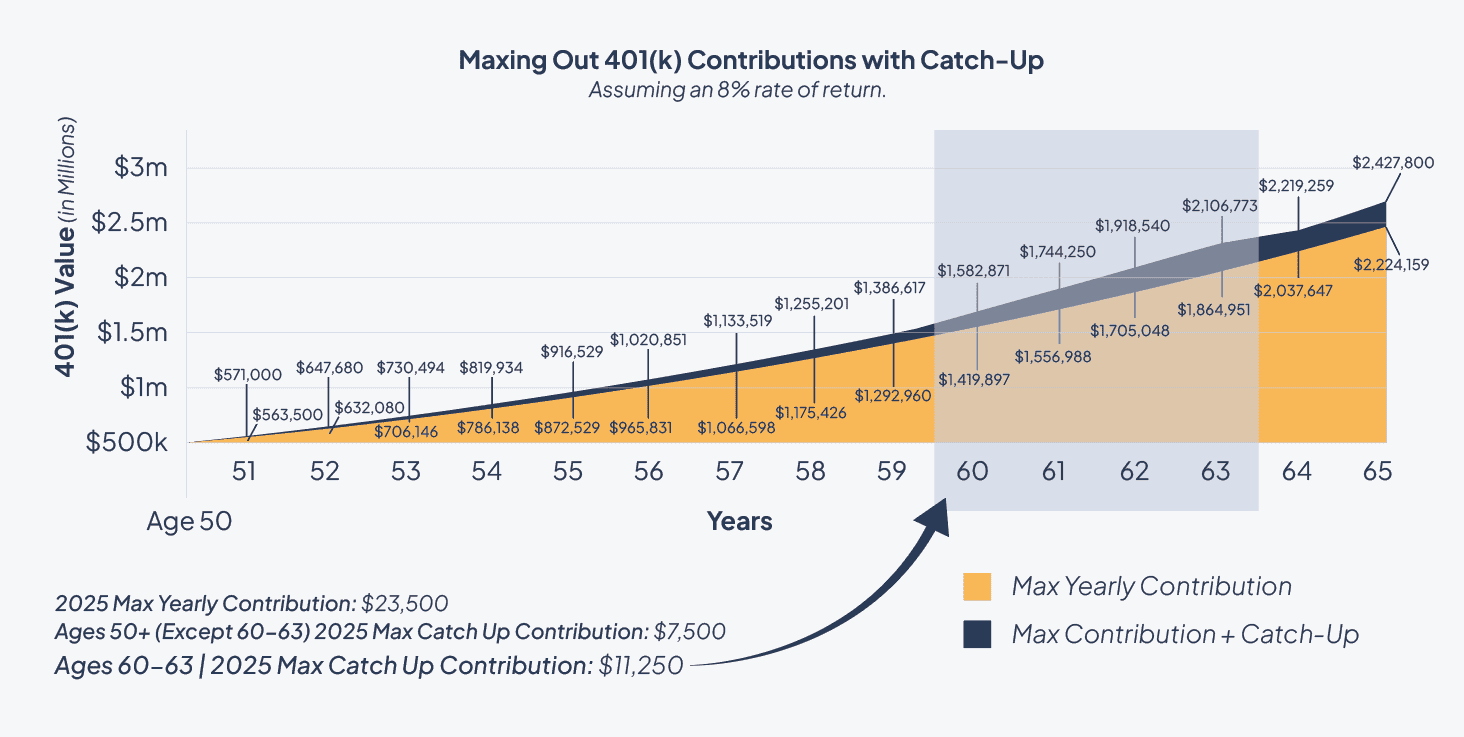

401k Contribution Limits 2025 Catch Up Lena Grace The catch up contribution limit that generally applies for employees aged 50 and over who participate in most 401 (k), 403 (b), governmental 457 plans, and the federal government’s thrift savings plan remains $7,500 for 2025. In 2025, the 401 (k) contribution limit for participants is increasing to $23,500, up from $23,000 in 2024. participants who are 50–59 and 64 can save an additional $7,500 in 2025 in catch up contributions. there’s a brand new extended catch up contribution provision for savers aged 60 63.

401k Contribution Limits 2025 Catch Up Lena Grace 401k employer contribution deadline 2025 lotta diannne, in 2022, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $20,500. Starting in 2025, individuals turning age 60 to 63 will be able to make catch up contributions totaling the higher of $10,000 or 150% of that year’s regular catch up amount annually to their <401(k); 403(b)> plan. The irs has announced the 2025 dollar limits and thresholds for retirement plans, which reflect the latest cost of living adjustments. The irs has increased 401(k) contribution limits for 2025, including raising the employee limit to $23,500 and adding a new catch up contribution of $11,250 for ages 60–63, per the secure 2.0 act. employers and plan administrators must update plans and inform employees to comply with new rules.

2025 Simple Ira Contribution Limits Catch Up Glynis Juliana The irs has announced the 2025 dollar limits and thresholds for retirement plans, which reflect the latest cost of living adjustments. The irs has increased 401(k) contribution limits for 2025, including raising the employee limit to $23,500 and adding a new catch up contribution of $11,250 for ages 60–63, per the secure 2.0 act. employers and plan administrators must update plans and inform employees to comply with new rules. Let’s break down the significant changes coming to 401 (k) contribution limits in 2025, including the recently announced base contribution increase and the new age based catch up provisions established by the secure act 2.0. In 2025, the standard 402 (g) limit is $23,500, while the catch up limit is $7,500. together, eligible individuals can contribute up to $31,000 annually ($23,500 402 (g) $7,500 catch up). catch up contributions are ignored when 415 (c) and adp testing. The age 50 catch up contribution limit for participants in 457 (b) plans remains at $7,500 for the 2025 tax year. secure 2.0 added an additional catch up contribution to those 60 to 63 of $3,750. For those age 50 and older, catch up contributions offer a powerful opportunity to contribute more to retirement accounts beyond the standard annual limits. below, i’ve addressed some of the most common questions i get from clients about catch up contributions, especially with the updated 2025 rules in play.

Comments are closed.