401k Contribution Limits 2025 Catch Up 2025 Nina C Johnson

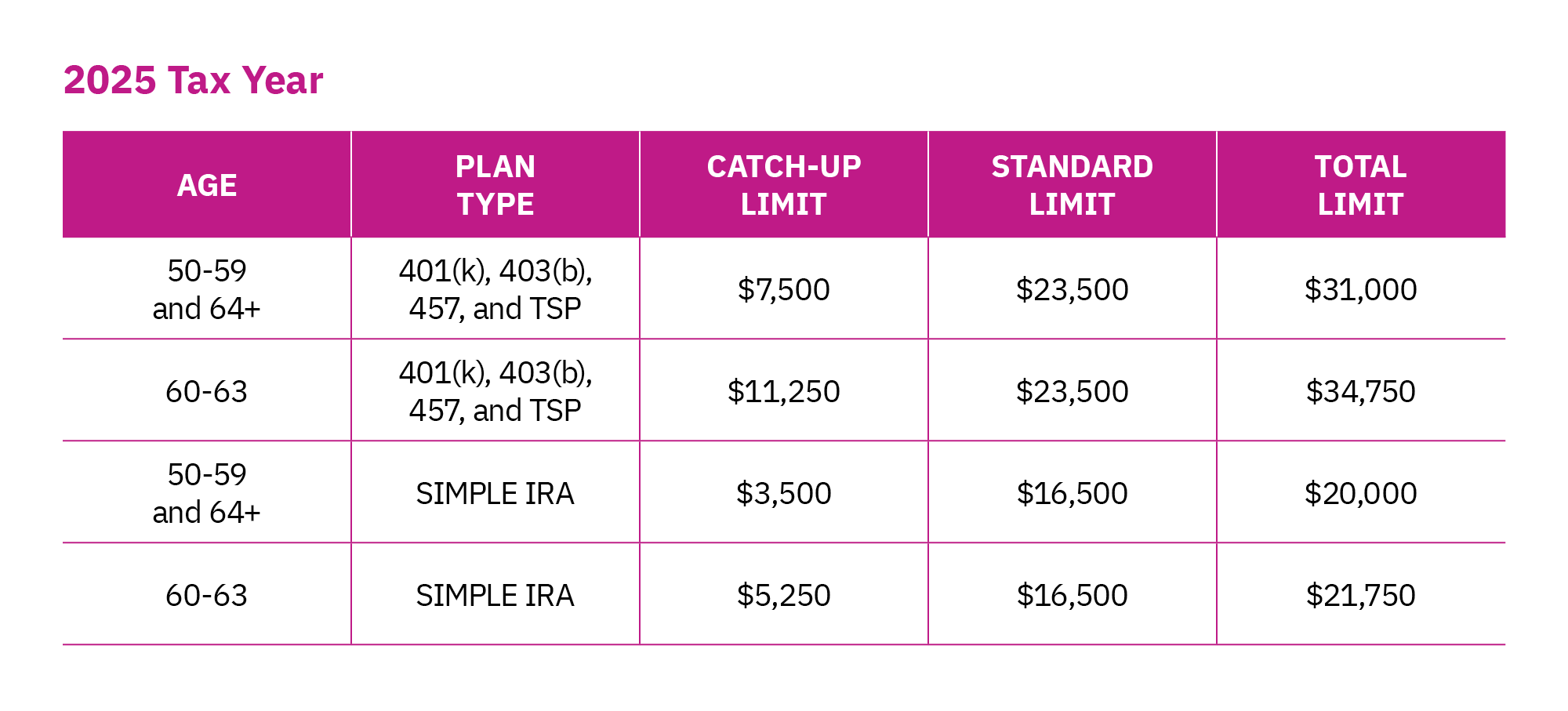

401k Contribution Limits 2025 Catch Up 2025 Nina C Johnson The catch up contribution limit that generally applies for employees aged 50 and over who participate in most 401 (k), 403 (b), governmental 457 plans, and the federal government’s thrift savings plan remains $7,500 for 2025. In 2025, the 401 (k) contribution limit for participants is increasing to $23,500, up from $23,000 in 2024. participants who are 50–59 and 64 can save an additional $7,500 in 2025 in catch up contributions. there’s a brand new extended catch up contribution provision for savers aged 60 63.

401k Contribution Limits 2025 Catch Up 2025 Nina C Johnson Let’s break down the significant changes coming to 401 (k) contribution limits in 2025, including the recently announced base contribution increase and the new age based catch up provisions established by the secure act 2.0. What is a higher catch up contribution? starting in 2025, individuals turning age 60 to 63 will be able to make catch up contributions totaling the higher of $10,000 or 150% of that year’s regular catch up amount annually to their <401(k); 403(b)> plan. this amount may be adjusted annually by the irs. what does this mean for me?. Turning 50? it’s time to boost your retirement savings. this article breaks down the updated 2025 401(k) catch up contribution limits, new rules for ages 60–63, and whether pre tax or roth contributions make the most sense for your situation. A new catch up rule allows employees age 60 to 63 to contribute up to $34,750 to their 401 (k) starting in 2025. automatic enrollment now will be required for most new 401 (k) and 403 (b) plans starting in 2025. part time workers are now eligible to join retirement plans after two consecutive years with 500 hours. automatic portability allows small account balances ($7,000 or less) to move.

401k Contribution Limits 2025 Catch Up 2025 Nina C Johnson Turning 50? it’s time to boost your retirement savings. this article breaks down the updated 2025 401(k) catch up contribution limits, new rules for ages 60–63, and whether pre tax or roth contributions make the most sense for your situation. A new catch up rule allows employees age 60 to 63 to contribute up to $34,750 to their 401 (k) starting in 2025. automatic enrollment now will be required for most new 401 (k) and 403 (b) plans starting in 2025. part time workers are now eligible to join retirement plans after two consecutive years with 500 hours. automatic portability allows small account balances ($7,000 or less) to move. On january 10, 2025, the internal revenue service (“irs”) issued proposed regulations providing long awaited guidance on the updates to 401 (k) catch up contributions introduced by the secure 2.0 act of 2022 (secure 2.0). these updates affect individuals nearing retirement age and high earners. if you’re a small business owner, you’ll want to prepare now to ensure a smooth transition. The catch up contribution limit that generally applies for employees aged 50 and over who participate in most 401k, 403b, governmental 457 plans, and the federal government's thrift savings plan remains $7,500 for 2025. Conclusion the 2025 401 (k) contribution limit changes present significant opportunities for retirement savers, particularly those aged 60 63 who can take advantage of the new supersize catch up provisions. For 2025, the standard contribution limit for 401 (k) plans rises to $23,000, up from $22,500 in 2024. workers aged 50 or older can continue making an additional catch up contribution of $7,500, unchanged from the prior year.

2025 401k Contribution Limits 2025 Catch Up Rick L Sanchez On january 10, 2025, the internal revenue service (“irs”) issued proposed regulations providing long awaited guidance on the updates to 401 (k) catch up contributions introduced by the secure 2.0 act of 2022 (secure 2.0). these updates affect individuals nearing retirement age and high earners. if you’re a small business owner, you’ll want to prepare now to ensure a smooth transition. The catch up contribution limit that generally applies for employees aged 50 and over who participate in most 401k, 403b, governmental 457 plans, and the federal government's thrift savings plan remains $7,500 for 2025. Conclusion the 2025 401 (k) contribution limit changes present significant opportunities for retirement savers, particularly those aged 60 63 who can take advantage of the new supersize catch up provisions. For 2025, the standard contribution limit for 401 (k) plans rises to $23,000, up from $22,500 in 2024. workers aged 50 or older can continue making an additional catch up contribution of $7,500, unchanged from the prior year.

401k Contribution Limits 2025 Catch Up 2025 Beverly E Stanford Conclusion the 2025 401 (k) contribution limit changes present significant opportunities for retirement savers, particularly those aged 60 63 who can take advantage of the new supersize catch up provisions. For 2025, the standard contribution limit for 401 (k) plans rises to $23,000, up from $22,500 in 2024. workers aged 50 or older can continue making an additional catch up contribution of $7,500, unchanged from the prior year.

Comments are closed.