2025 Irs Standard Mileage Rate Companymileage

Irs Standard Mileage Rate 2025 Vs 2025 Eudora Alfreda For 2025, the irs mileage rate for business use is 70 cents, a three cent increase from 2024's mileage rate of 67 cents per mile. learn more. Beginning jan. 1, 2025, the standard mileage rates for the use of a car, van, pickup or panel truck will be: 70 cents per mile driven for business use, up 3 cents from 2024.

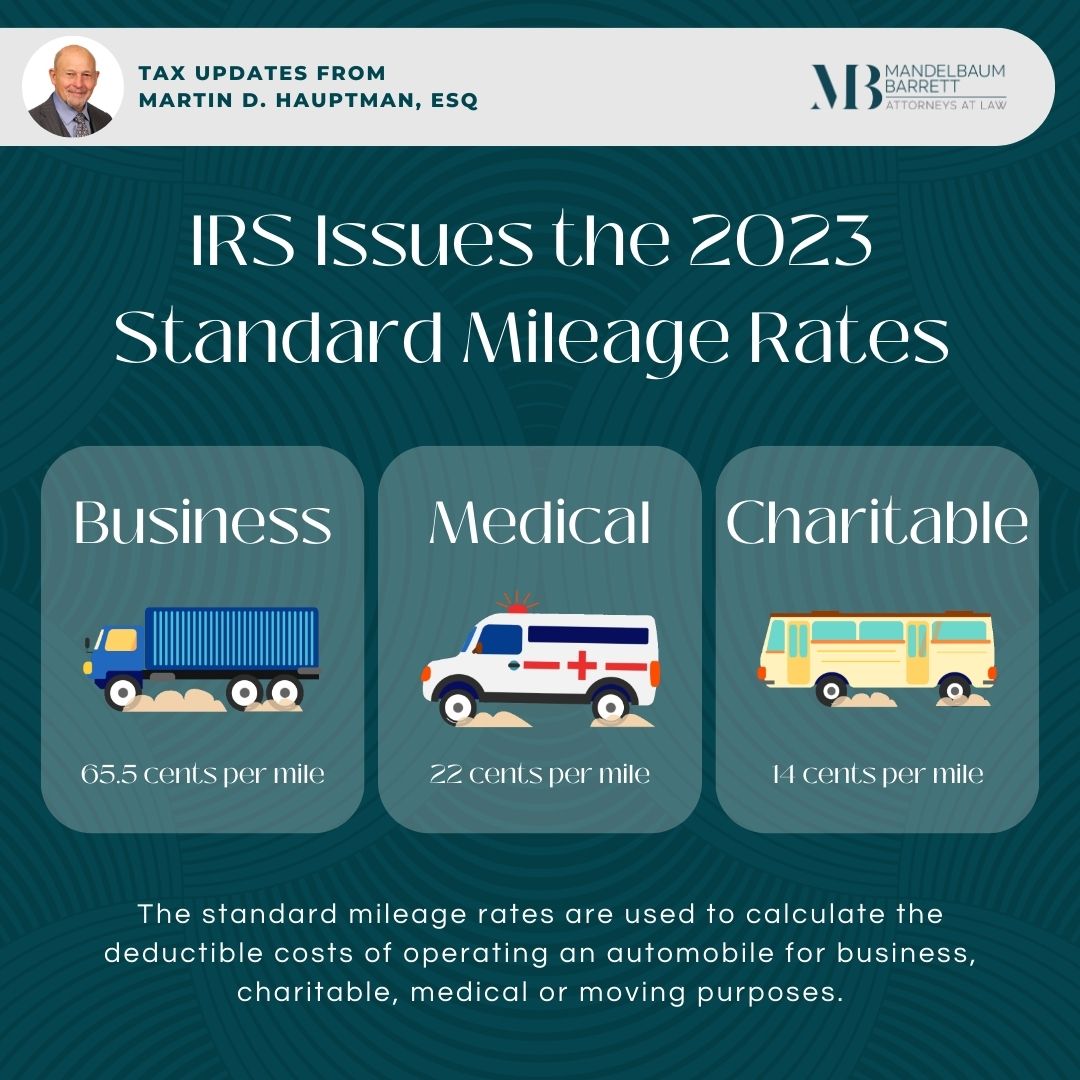

Standard Mileage Rate 2025 Irs Anna L Garcia The irs today released notice 2025 5 providing the standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business, charitable, medical, or moving purposes in 2025. On that note, the irs recently released notice 2025 5, announcing adjustments to the standard mileage rates that are relevant for businesses and individuals alike. 2025 irs standard mileage rates effective january 1, 2025, the new standard mileage rates for the use of a car, van, pickup, or panel truck are:. For a leased vehicle, taxpayers using the standard mileage rate must employ that method for the entire lease period, including renewals. notice 2025 5 contains the optional 2025 standard mileage rates, as well as the maximum automobile cost used to calculate mileage reimbursement allowances under a fixed and variable rate (favr) plan. The internal revenue service (irs) has announced an increase in the standard mileage rate for business use of a personal vehicle for the 2025 tax year. the rate has been raised by 3 cents per mile, reflecting adjustments for inflation and rising transportation costs. this change directly impacts millions of taxpayers who use their personal vehicles for business related travel and seek.

Irs Standard Mileage Rate 2025 Deduction Noah Waller A For a leased vehicle, taxpayers using the standard mileage rate must employ that method for the entire lease period, including renewals. notice 2025 5 contains the optional 2025 standard mileage rates, as well as the maximum automobile cost used to calculate mileage reimbursement allowances under a fixed and variable rate (favr) plan. The internal revenue service (irs) has announced an increase in the standard mileage rate for business use of a personal vehicle for the 2025 tax year. the rate has been raised by 3 cents per mile, reflecting adjustments for inflation and rising transportation costs. this change directly impacts millions of taxpayers who use their personal vehicles for business related travel and seek. Blog irs mileage rates 2025 explained: maximize your tax deduction with confidence for 2025, the irs has updated the standard mileage rate for business use of a personal vehicle to 70 cents per mile — up from 67 cents in 2024. The internal revenue service (irs) has announced an increase in the optional standard mileage rate for business use starting january 1, 2025. this change provides taxpayers with updated rates to calculate deductible costs for vehicle use in business, charitable, medical, and certain moving purposes. Get the latest irs mileage rate for business, charity, medical, and moving. learn how to track and deduct mileage for tax savings. The standard mileage rates for 2025 are: find out when you can deduct vehicle mileage. find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.

Irs Announces 2025 Standard Mileage Rates Marshfield Insurance Blog irs mileage rates 2025 explained: maximize your tax deduction with confidence for 2025, the irs has updated the standard mileage rate for business use of a personal vehicle to 70 cents per mile — up from 67 cents in 2024. The internal revenue service (irs) has announced an increase in the optional standard mileage rate for business use starting january 1, 2025. this change provides taxpayers with updated rates to calculate deductible costs for vehicle use in business, charitable, medical, and certain moving purposes. Get the latest irs mileage rate for business, charity, medical, and moving. learn how to track and deduct mileage for tax savings. The standard mileage rates for 2025 are: find out when you can deduct vehicle mileage. find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.

2025 Irs Standard Mileage Rate Companymileage Get the latest irs mileage rate for business, charity, medical, and moving. learn how to track and deduct mileage for tax savings. The standard mileage rates for 2025 are: find out when you can deduct vehicle mileage. find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.

2025 Irs Standard Mileage Rate Companymileage

Comments are closed.