2025 401k Limits And Catch Up Limits Madison Fletcher

2025 401k Limits And Catch Up Limits Madison Fletcher Washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,500, up from $23,000 for 2024. Learn about increased 401(k) contribution limits for 2025, along with catch up options and strategies to maximize retirement savings.

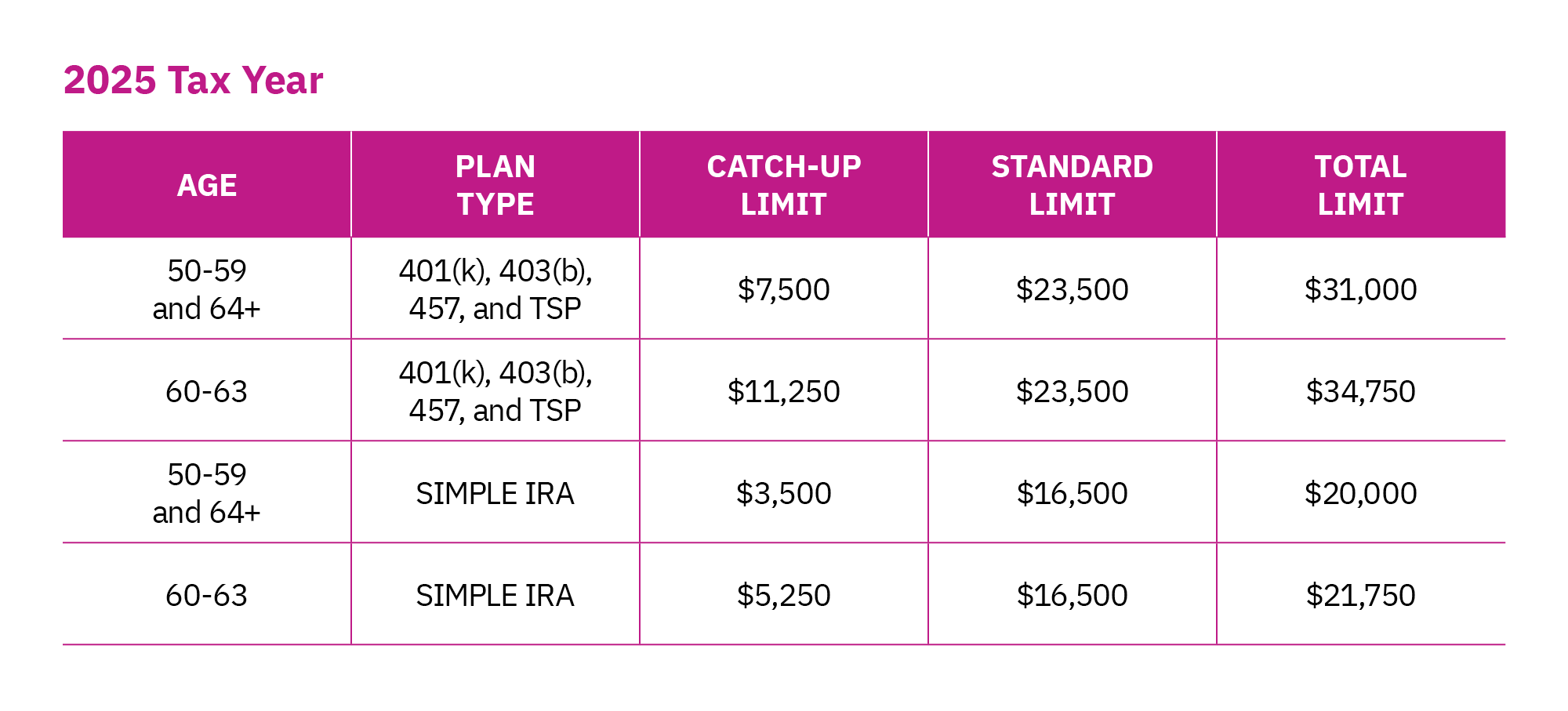

2025 401k Catch Up Contribution Limits 2025 Sawyer Fletcher The below example uses numbers from the 2025 tax year to show how workplace savings contributions work. each year the limits may be adjusted for cost of living by the irs. Age 50 ? maximize your retirement savings in 2025. get catch up limits, deadlines, and learn about the new 60 63 "super catch up. Contribution limits for 401 (k) and other workplace retirement plans rise for 2025. sixty to 63 year olds get a super contribution for the first time. The 401k catch up contribution limits 2025 have become a major topic of interest for retirement savers, especially those aged 50 and older looking to maximize their retirement security. with new irs guidelines released for next year, workers approaching retirement have a clearer picture of how much more they can set aside on top of standard contribution limits.

401k Limits 2025 Catch Up 2025 Thomas L Britt Contribution limits for 401 (k) and other workplace retirement plans rise for 2025. sixty to 63 year olds get a super contribution for the first time. The 401k catch up contribution limits 2025 have become a major topic of interest for retirement savers, especially those aged 50 and older looking to maximize their retirement security. with new irs guidelines released for next year, workers approaching retirement have a clearer picture of how much more they can set aside on top of standard contribution limits. Learn about the recently announced 2025 plan contribution limits for employees participating in employer sponsored retirement plans. Irs 401(k) limits increase to $23,500 in 2025. here’s how the big beautiful bill reshapes retirement, rmds, and roths. For employees aged 50 or older, the catch up contribution limit for most simple accounts remains at $3,500. the secure act 2.0 also allows participants aged 60, 61,62, and 63 to have a higher catch up contribution limit of $5,250 for simple accounts. Let’s break down the significant changes coming to 401 (k) contribution limits in 2025, including the recently announced base contribution increase and the new age based catch up provisions established by the secure act 2.0.

2025 401k Contribution Limits 2025 Catch Up Rick L Sanchez Learn about the recently announced 2025 plan contribution limits for employees participating in employer sponsored retirement plans. Irs 401(k) limits increase to $23,500 in 2025. here’s how the big beautiful bill reshapes retirement, rmds, and roths. For employees aged 50 or older, the catch up contribution limit for most simple accounts remains at $3,500. the secure act 2.0 also allows participants aged 60, 61,62, and 63 to have a higher catch up contribution limit of $5,250 for simple accounts. Let’s break down the significant changes coming to 401 (k) contribution limits in 2025, including the recently announced base contribution increase and the new age based catch up provisions established by the secure act 2.0.

401k Contribution Limits 2025 Catch Up 2025 Beverly E Stanford For employees aged 50 or older, the catch up contribution limit for most simple accounts remains at $3,500. the secure act 2.0 also allows participants aged 60, 61,62, and 63 to have a higher catch up contribution limit of $5,250 for simple accounts. Let’s break down the significant changes coming to 401 (k) contribution limits in 2025, including the recently announced base contribution increase and the new age based catch up provisions established by the secure act 2.0.

401k Limits 2025 Catch Up Rebecca Terry

Comments are closed.