Using The Double Declining Balance Depreciation Chegg

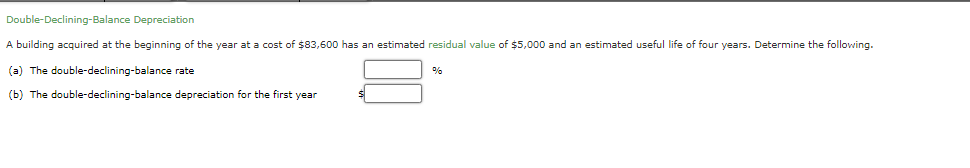

Solved Double Declining Balance Depreciation A ï The Chegg Question: using the double declining balance method calculate the annual depreciation that will be recorded each year for an asset that cost $18,000, has a useful life of four years and has an estimated salvage value of $3,200. Among the various methods of calculating depreciation, the double declining balance (ddb) method stands out for its unique approach. this article is a must read for anyone looking to understand and effectively apply the ddb method.

Using The Double Declining Balance Depreciation Chegg Calculate depreciation of an asset using the double declining balance method and create and print depreciation schedules. calculator for depreciation at a declining balance factor of 2 (200% of straight line). includes formulas, example, depreciation schedule and partial year calculations. A double declining balance depreciation method is an accelerated depreciation method that can be used to depreciate the asset's value over the useful life. it is a bit more complex than the straight line method of depreciation but is useful for deferring tax payments and maintaining low profitability in the early years. Using the double declining balance depreciation method, compute the machine's first year depreciation expense. on june 1, harding co. purchased a machine for $14,000 and estimates it will use the machine for five years with a $2,000 salvage value. The double declining balance (ddb) method is an accelerated depreciation technique that allows faster write off of assets in their initial, more productive years.

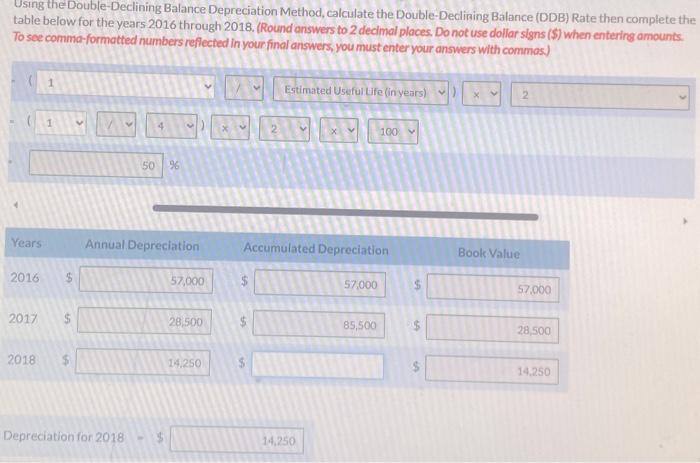

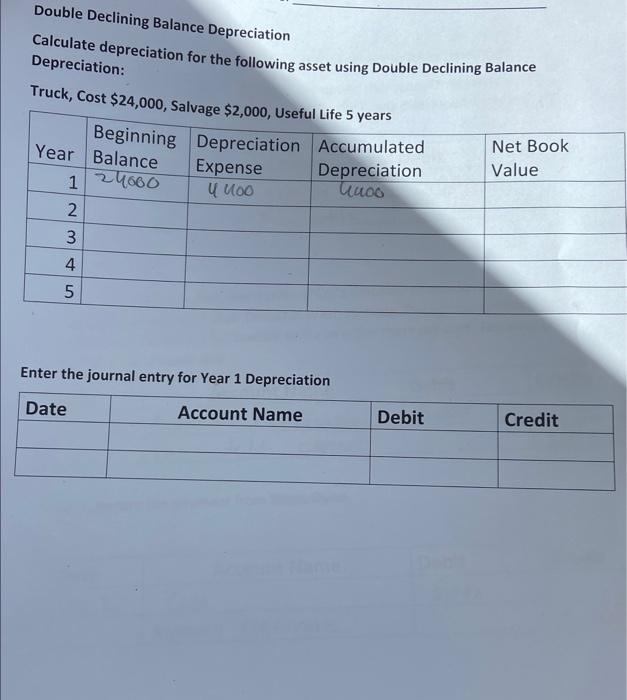

Solved Double Declining Balance Depreciation Calculate Chegg Using the double declining balance depreciation method, compute the machine's first year depreciation expense. on june 1, harding co. purchased a machine for $14,000 and estimates it will use the machine for five years with a $2,000 salvage value. The double declining balance (ddb) method is an accelerated depreciation technique that allows faster write off of assets in their initial, more productive years. In this article, we will break down the double declining balance depreciation method. this approach helps businesses calculate how much value their assets lose over time. it’s important to understand how this method works, especially if you’re studying accounting or managing finances. Prepare a schedule of depreciation expense, accumulated depreciation, and book value per year for the equipment under the three depreciation methods: straight line, units of production, and double declining balance. The double declining balance method calculates depreciation by applying a constant rate to an asset’s declining book value. first, the straight line depreciation rate is determined by dividing 100% by the asset’s useful life. In double declining balance depreciation, the asset depreciates at twice the rate of straight line depreciation. in this method, the depreciation expense is higher in the early years as compared to a straight line, which has a uniform depreciation expense.

Solved Using Double Declining Balance Depreciation Annual Chegg In this article, we will break down the double declining balance depreciation method. this approach helps businesses calculate how much value their assets lose over time. it’s important to understand how this method works, especially if you’re studying accounting or managing finances. Prepare a schedule of depreciation expense, accumulated depreciation, and book value per year for the equipment under the three depreciation methods: straight line, units of production, and double declining balance. The double declining balance method calculates depreciation by applying a constant rate to an asset’s declining book value. first, the straight line depreciation rate is determined by dividing 100% by the asset’s useful life. In double declining balance depreciation, the asset depreciates at twice the rate of straight line depreciation. in this method, the depreciation expense is higher in the early years as compared to a straight line, which has a uniform depreciation expense.

Comments are closed.