The Double Declining Balance Depreciation Method

A Simple Guide To Double Declining Balance Method The Formula for Double-Declining Balance As the name implies, double-declining depreciation writes down assets at twice the rate of standard depreciation based on the cost of the asset The formula The double-declining-balance method causes lower profit in the earlier years of an asset's life than in the later years due to the greater depreciation expense in the earlier years

Double Declining Balance Method Of Depreciation Accounting Corner When choosing a depreciation method for your business, you have to consider the tax implications If you would rather have a bigger tax deduction in the near-term, using a double-declining balance Declining balance method The declining balance method is used to recognize the majority of an asset's depreciation early in its lifespan There are two variations of this: the double-declining Double-declining value: Similar to the declining value method, the double-declining value method allows you to fully depreciate the item at double the rate, as the name implies Declining Balance Depreciation With this accelerated form of depreciation, you deduct a greater portion of the asset’s value at the beginning of its life This typically at a rate of double or 150%

Double Declining Balance Method Of Depreciation Accounting Corner Double-declining value: Similar to the declining value method, the double-declining value method allows you to fully depreciate the item at double the rate, as the name implies Declining Balance Depreciation With this accelerated form of depreciation, you deduct a greater portion of the asset’s value at the beginning of its life This typically at a rate of double or 150% A $100,000 machine with a 10-year double-declining balance depreciation schedule would see a write-down of $20,000 in year one, $16,000 in year two, $12,800 in year three, No matter the The declining-balance method applies the depreciation rate against the non-depreciated balance For tax purposes, the MACRS is the primary method of depreciation and uses either the declining An Optimum Switch from Double-Declining Balance to Sum-Of-The-Years Digits Depreciation, The Accounting Review, Vol 46, No 3 (Jul, 1971), pp 574-582 Free online reading for over 10 million Accelerated depreciation allows businesses to write off the cost of an asset more quickly than the traditional straight-line method This can provide asset owners with potentially valuable tax

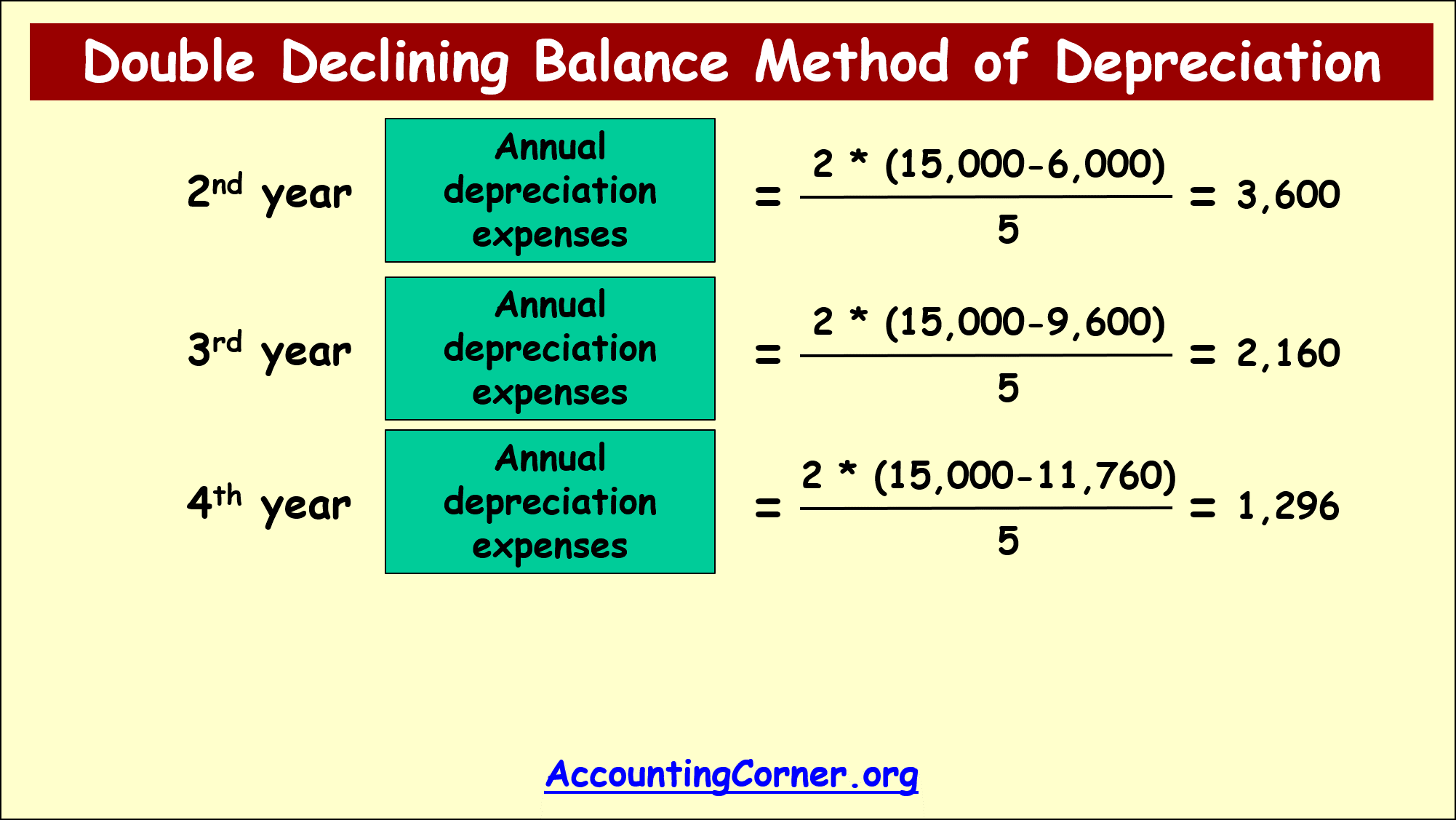

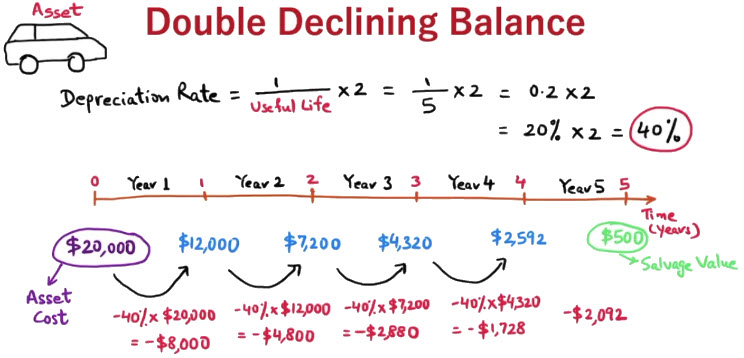

Double Declining Balance Method Of Depreciation Accounting Corner A $100,000 machine with a 10-year double-declining balance depreciation schedule would see a write-down of $20,000 in year one, $16,000 in year two, $12,800 in year three, No matter the The declining-balance method applies the depreciation rate against the non-depreciated balance For tax purposes, the MACRS is the primary method of depreciation and uses either the declining An Optimum Switch from Double-Declining Balance to Sum-Of-The-Years Digits Depreciation, The Accounting Review, Vol 46, No 3 (Jul, 1971), pp 574-582 Free online reading for over 10 million Accelerated depreciation allows businesses to write off the cost of an asset more quickly than the traditional straight-line method This can provide asset owners with potentially valuable tax Double declining balance depreciation seeks to reflect the accelerated depreciation of some assets To calculate one takes the starting book value divided by the years of useful life, times two There are four allowable methods for calculating depreciation under generally accepted accounting principles (GAAP): straight-line, declining balance, sum-of-the-years' digits, and units of

Mastering The Double Declining Balance Depreciation Method Ddb An Optimum Switch from Double-Declining Balance to Sum-Of-The-Years Digits Depreciation, The Accounting Review, Vol 46, No 3 (Jul, 1971), pp 574-582 Free online reading for over 10 million Accelerated depreciation allows businesses to write off the cost of an asset more quickly than the traditional straight-line method This can provide asset owners with potentially valuable tax Double declining balance depreciation seeks to reflect the accelerated depreciation of some assets To calculate one takes the starting book value divided by the years of useful life, times two There are four allowable methods for calculating depreciation under generally accepted accounting principles (GAAP): straight-line, declining balance, sum-of-the-years' digits, and units of

The Double Declining Balance Depreciation Method Double declining balance depreciation seeks to reflect the accelerated depreciation of some assets To calculate one takes the starting book value divided by the years of useful life, times two There are four allowable methods for calculating depreciation under generally accepted accounting principles (GAAP): straight-line, declining balance, sum-of-the-years' digits, and units of

Comments are closed.