Solved Find The Present Value Using The Future Value Chegg

Solved Find The Present Value Using The Future Value Chegg Therefore, the future value of your annuity due with $1,000 annual payments at a 5 percent interest rate for five years would be about $5,80191 In the case of a T-bill, we know our purchase price, or present value, its face value or future value, and how long until it matures For short-term Treasuries, this duration could be 30 to 182

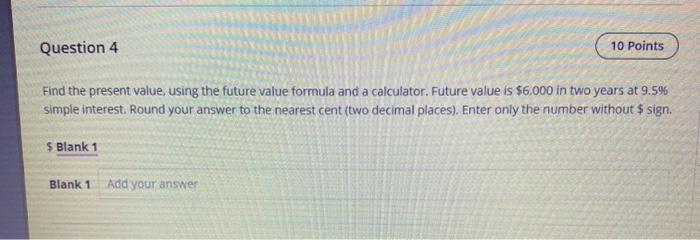

Solved Find The Present Value Using The Future Value Formula Chegg present value vs future value Present value calculations can be helpful if you’re considering cashing out or selling your annuity To find the present value of an annuity, you’ll need to know The present value is the money required now to produce those future payments Types of Annuities Annuities as ongoing payments can be defined as ordinary annuities or annuities due When planning for retirement, you need to account for the value of any annuities that you own Trouble is, there’s not just one value of an annuity—there are two: present value and future In the case of a T-bill, we know our purchase price, or present value; its face value, or future value; and how long until it matures For short-term Treasuries, this duration could be 30 days to

Solved Find The Present Value Using The Future Value Chegg When planning for retirement, you need to account for the value of any annuities that you own Trouble is, there’s not just one value of an annuity—there are two: present value and future In the case of a T-bill, we know our purchase price, or present value; its face value, or future value; and how long until it matures For short-term Treasuries, this duration could be 30 days to The future value should be worth more than the present value since it’s earning interest and growing over time Ordinary annuity vs annuity due: What’s the difference? When using the general The present value of an annuity is the sum that must be invested now to guarantee a desired payment in the future, or if the annuity is already owned, it’s the amount you would get if you cashed In the case of a T-bill, we know our purchase price, or present value, its face value or future value, and how long until it matures For short-term Treasuries, this duration could be 30 to 182

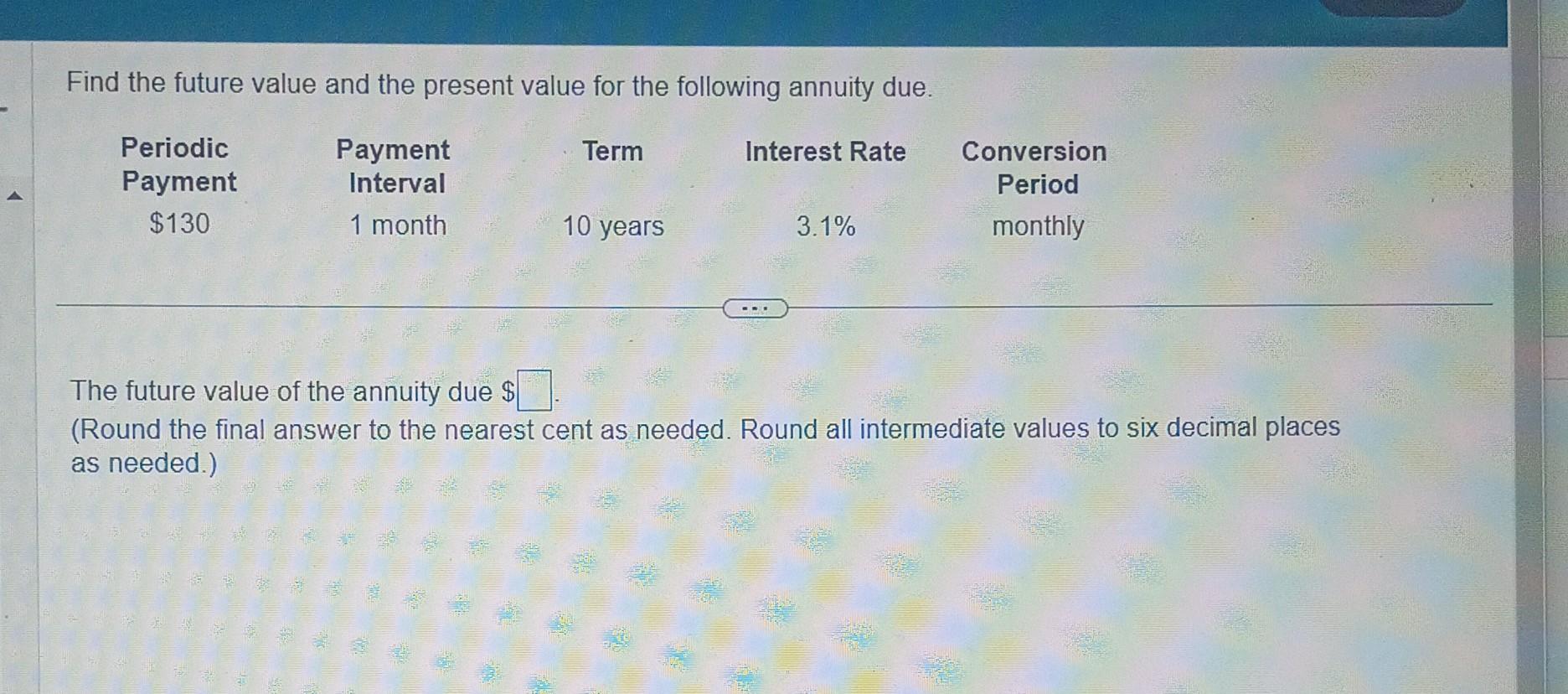

Solved Find The Future Value And The Present Value For The Chegg The future value should be worth more than the present value since it’s earning interest and growing over time Ordinary annuity vs annuity due: What’s the difference? When using the general The present value of an annuity is the sum that must be invested now to guarantee a desired payment in the future, or if the annuity is already owned, it’s the amount you would get if you cashed In the case of a T-bill, we know our purchase price, or present value, its face value or future value, and how long until it matures For short-term Treasuries, this duration could be 30 to 182

Comments are closed.