Solved Double Declining Balance Depreciation Calculate Chegg

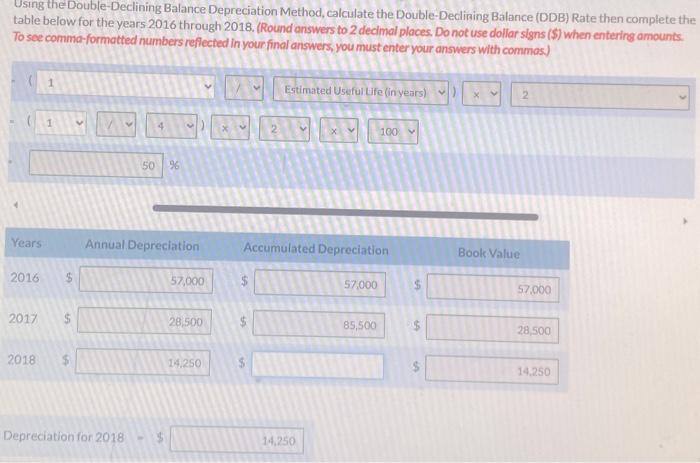

Using The Double Declining Balance Depreciation Chegg 6:576% Is there a way to leverage the DDB formulas to achieve the correct formulas for tax purposes? A You can view the original article this reader is referring to hereYou can use a built-in Understanding DDB Depreciation Depreciation rates used in the declining balance method could be 150%, 200% (double), or 250% of the straight-line rate

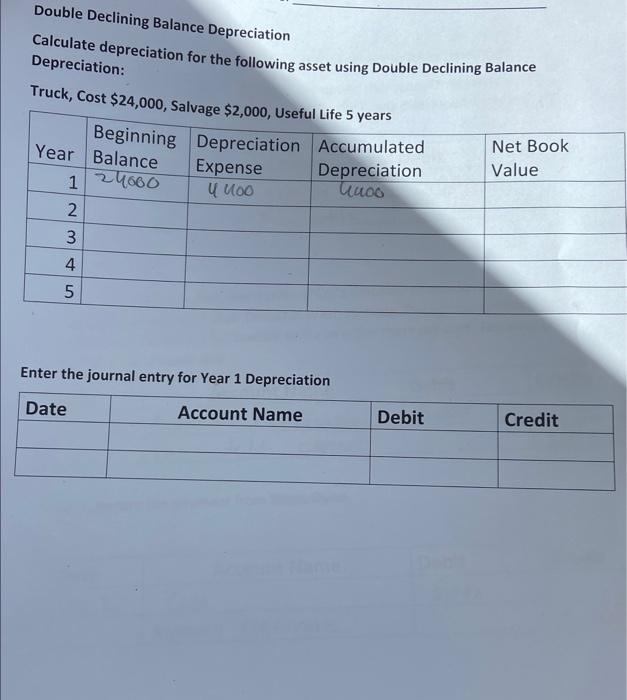

Solved Double Declining Balance Depreciation Calculate Chegg The Formula for Double-Declining Balance As the name implies, double-declining depreciation writes down assets at twice the rate of standard depreciation based on the cost of the asset The formula For the double declining balance method, the following formula is used to calculate each year's depreciation amount: A few notes First, if the 150% declining balance method is used, Of the depreciation methods described above, the accelerated methods of depreciation are declining balance and double-declining balance You can manually adjust the depreciation expense taken to equal The double declining balance method is often used for equipment when the units of production method is not used Formula: 2 x (1/Life of asset) x Book value = Depreciation expense

Solved How Do They Calculate The Double Declining Balance Chegg Of the depreciation methods described above, the accelerated methods of depreciation are declining balance and double-declining balance You can manually adjust the depreciation expense taken to equal The double declining balance method is often used for equipment when the units of production method is not used Formula: 2 x (1/Life of asset) x Book value = Depreciation expense Double declining balance depreciation is a method of depreciating large business assets quickly Learn how and when to use it Written by: Dock Treece, Senior Writer Updated Apr 19, 2024 A company reports larger depreciation expenses during the earlier years of an asset’s useful life when it uses the declining balance method It's an accelerated system

Comments are closed.