How To Calculate The Declining Balance Method For Depreciation Explained Double Declining Method

Double Declining Balance Method Of Depreciation Accounting Corner Double declining balance depreciation is a method of depreciating large business assets quickly Learn how and when to use it Written by: Dock Treece, Senior Writer Updated Apr 19, 2024 6:576% Is there a way to leverage the DDB formulas to achieve the correct formulas for tax purposes? A You can view the original article this reader is referring to hereYou can use a built-in

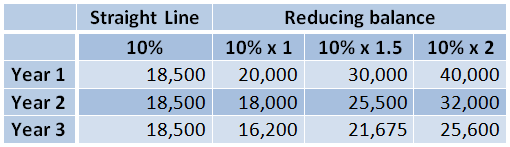

Double Declining Balance Depreciation Calculator Double Entry Bookkeeping When depreciating an asset, companies need to consider either a straight-line or accelerated schedule When choosing the latter, the double-declining balance mode of depreciation is among the most For the double declining balance method, the following formula is used to calculate each year's depreciation amount: A few notes First, if the 150% declining balance method is used, the factor of Two common methods of depreciation are straight-line and declining balance The method used to calculate depreciation depends on the expected life of the asset and the goals of using a A company buys equipment for $100,000 to manufacture its product It deducts the full $100,000 as a business expense in the same year That year, the company generated $500,000 in sales

How To Calculate Double Declining Depreciation 8 Steps Two common methods of depreciation are straight-line and declining balance The method used to calculate depreciation depends on the expected life of the asset and the goals of using a A company buys equipment for $100,000 to manufacture its product It deducts the full $100,000 as a business expense in the same year That year, the company generated $500,000 in sales Depreciation is a concept and a method that recognizes that some business assets become less valuable over time and provides a way to calculate and record the effects of this Depreciation impacts Typically, companies calculate depreciation for their own purposes using a method called straight-line depreciation 150 percent declining balance method and the straight-line method The double-declining balance (DDB) depreciation method, also known as the reducing balance method, is one of two common methods a business uses to account for the expense of a long-lived asset A company reports larger depreciation expenses during the earlier years of an asset’s useful life when it uses the declining balance method It's an accelerated system

How To Calculate Double Declining Depreciation 8 Steps Depreciation is a concept and a method that recognizes that some business assets become less valuable over time and provides a way to calculate and record the effects of this Depreciation impacts Typically, companies calculate depreciation for their own purposes using a method called straight-line depreciation 150 percent declining balance method and the straight-line method The double-declining balance (DDB) depreciation method, also known as the reducing balance method, is one of two common methods a business uses to account for the expense of a long-lived asset A company reports larger depreciation expenses during the earlier years of an asset’s useful life when it uses the declining balance method It's an accelerated system 150% Declining Balance Method: Similar to the Double Declining Balance method, this method uses a lower rate of 150% of the straight-line rate This method is less aggressive than DDB but still

What Is Double Declining Balance Method Of Depreciation The double-declining balance (DDB) depreciation method, also known as the reducing balance method, is one of two common methods a business uses to account for the expense of a long-lived asset A company reports larger depreciation expenses during the earlier years of an asset’s useful life when it uses the declining balance method It's an accelerated system 150% Declining Balance Method: Similar to the Double Declining Balance method, this method uses a lower rate of 150% of the straight-line rate This method is less aggressive than DDB but still

Comments are closed.