How To Calculate The Declining Balance Method For Depreciation Explained Double Declining

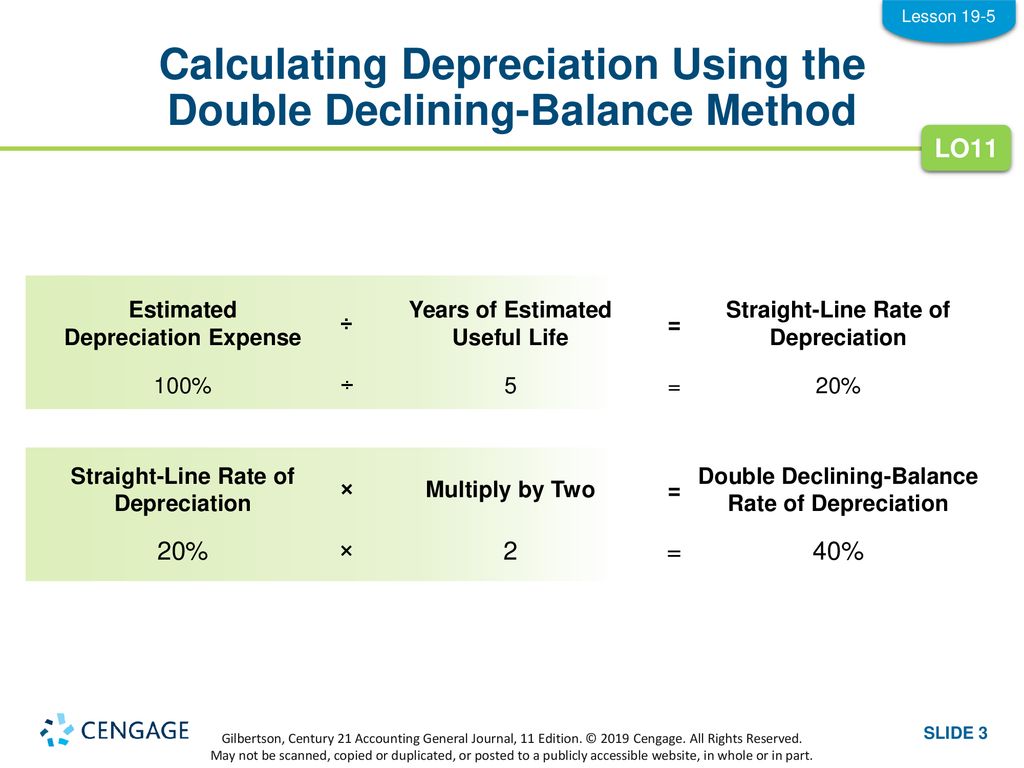

Calculate Double Declining Balance Depreciation Accountinginside Double declining balance depreciation is a method of quickly depreciating large business assets Learn how and when to use it Variable-declining balance uses the double-declining factor but also initiates the automatic switch to straight-line depreciation once that is greater than double-declining

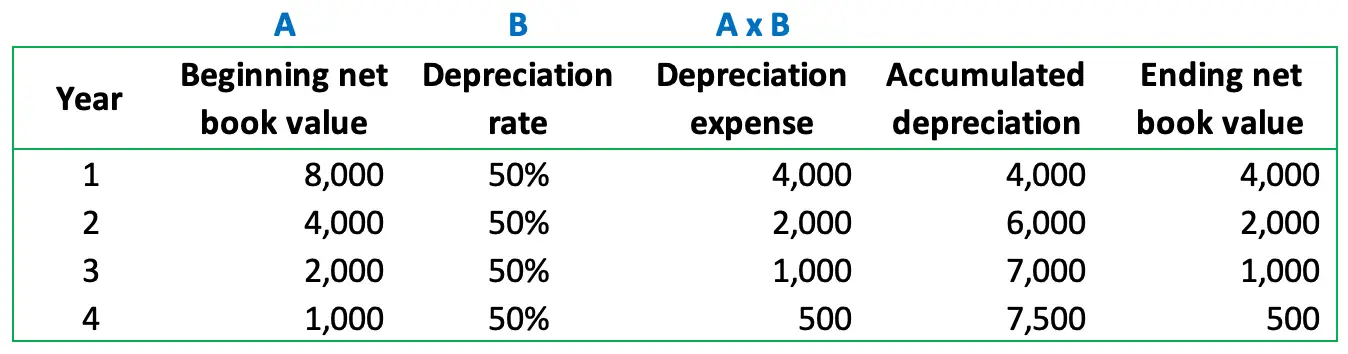

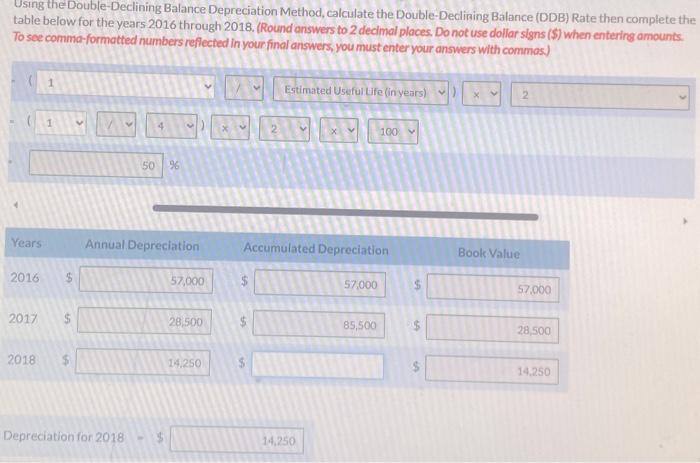

Using The Double Declining Balance Depreciation Chegg GAAP Declining Balance Method Companies that comply with generally accounting principles, called GAAP, may opt to use the declining balance method to calculate depreciation on a particular asset For the double declining balance method, the following formula is used to calculate each year's depreciation amount: A few notes Declining Balance With this accelerated depreciation, you deduct a greater portion of the asset’s value at the beginning of its life — typically at a rate of double or 150% When depreciating an asset, companies need to consider either a straight-line or accelerated schedule When choosing the latter, the double-declining balance mode of depreciation is among the most

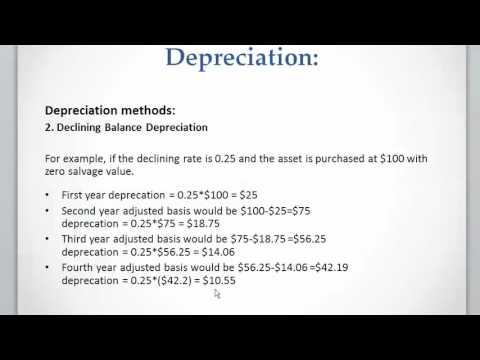

Double Declining Balance Method Of Depreciation Accounting Corner Declining Balance With this accelerated depreciation, you deduct a greater portion of the asset’s value at the beginning of its life — typically at a rate of double or 150% When depreciating an asset, companies need to consider either a straight-line or accelerated schedule When choosing the latter, the double-declining balance mode of depreciation is among the most Depreciation is a concept and a method that recognizes that some business assets become less valuable over time and provides a way to calculate and record the effects of this Depreciation impacts 150% Declining Balance Method: Similar to the Double Declining Balance method, this method uses a lower rate of 150% of the straight-line rate This method is less aggressive than DDB but still The double-declining balance (DDB) depreciation method is an accelerated method that multiplies an asset's value by a depreciation rate A company reports larger depreciation expenses during the earlier years of an asset’s useful life when it uses the declining balance method It's an accelerated system

Double Declining Balance Depreciation Method Accounting Services Depreciation is a concept and a method that recognizes that some business assets become less valuable over time and provides a way to calculate and record the effects of this Depreciation impacts 150% Declining Balance Method: Similar to the Double Declining Balance method, this method uses a lower rate of 150% of the straight-line rate This method is less aggressive than DDB but still The double-declining balance (DDB) depreciation method is an accelerated method that multiplies an asset's value by a depreciation rate A company reports larger depreciation expenses during the earlier years of an asset’s useful life when it uses the declining balance method It's an accelerated system

Mecacit The Double Declining Balance Depreciation Method The double-declining balance (DDB) depreciation method is an accelerated method that multiplies an asset's value by a depreciation rate A company reports larger depreciation expenses during the earlier years of an asset’s useful life when it uses the declining balance method It's an accelerated system

Double Declining Balance Method Formula Free Template 53 Off

Comments are closed.