How To Calculate Double Declining Depreciation 8 Steps

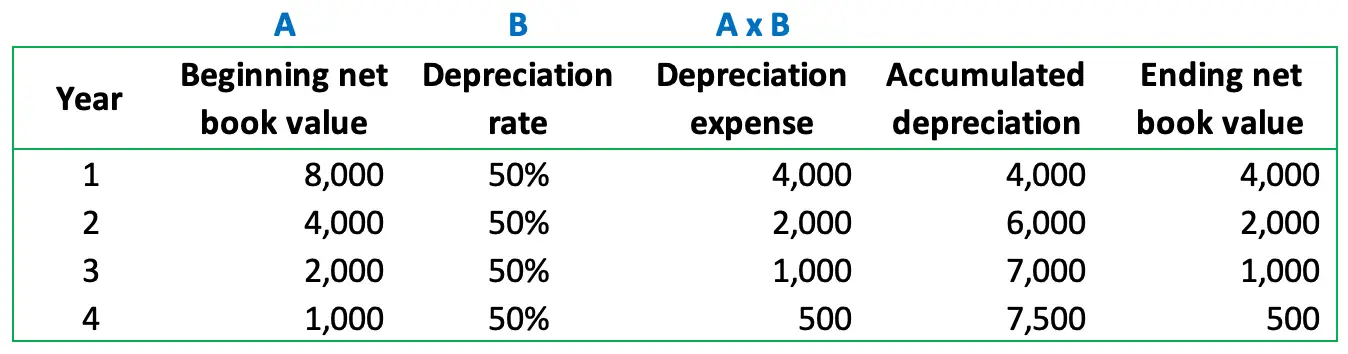

How To Calculate Double Declining Depreciation 8 Steps For the double declining balance method, the following formula is used to calculate each year's depreciation amount: A few notes First, if the 150% declining balance method is used, the factor of The VDB function calculates double-declining-balance depreciation (or some other factor of declining-balance depreciation) for any period, including partial periods This function contains seven

How To Calculate Double Declining Depreciation 8 Steps As the name implies, double-declining depreciation writes down assets at twice the rate of standard depreciation based on the cost of the asset the company would observe the following steps The four depreciation methods include straight-line, declining balance, sum-of-the-years' digits, and units of production Most companies use a single depreciation methodology for all of their assets Double declining balance depreciation is a method of depreciating large business assets quickly Learn how and when to use it Written by: Dock Treece, Senior Writer Updated Apr 19, 2024 How to calculate depreciation for fixed assets with the straight-line method, the sum of the years’ digits method, and others, using Microsoft Excel

How To Calculate Double Declining Depreciation 8 Steps Double declining balance depreciation is a method of depreciating large business assets quickly Learn how and when to use it Written by: Dock Treece, Senior Writer Updated Apr 19, 2024 How to calculate depreciation for fixed assets with the straight-line method, the sum of the years’ digits method, and others, using Microsoft Excel Two common ways of calculating depreciation are the straight-line and double declining balance methods Excel can accomplish both using the SLN function to calculate the straight line -- a To calculate this capital expenditure depreciation expense, the company's accounting team must use the asset's purchase price, its useful life, and its residual value Here's how Image source Depreciation is a concept and a method that recognizes that some business assets become less valuable over time and provides a way to calculate and record the effects of this Depreciation impacts

How To Calculate Double Declining Depreciation 8 Steps Two common ways of calculating depreciation are the straight-line and double declining balance methods Excel can accomplish both using the SLN function to calculate the straight line -- a To calculate this capital expenditure depreciation expense, the company's accounting team must use the asset's purchase price, its useful life, and its residual value Here's how Image source Depreciation is a concept and a method that recognizes that some business assets become less valuable over time and provides a way to calculate and record the effects of this Depreciation impacts

How To Calculate Double Declining Depreciation 8 Steps Depreciation is a concept and a method that recognizes that some business assets become less valuable over time and provides a way to calculate and record the effects of this Depreciation impacts

Calculate Double Declining Balance Depreciation Accountinginside

Comments are closed.