Double Declining Balance Method Of Depreciation In 3 Steps

Double Declining Balance Method Pdf Depreciation Lease In this guide, we’ll explain how the double declining balance method works in simple terms, compare it with other depreciation methods, and provide step by step examples. In this video, i will teach you how to use the double declining balance method to calculate the depreciation expense for your assets.

A Simple Guide To Double Declining Balance Method Double declining balance depreciation isn’t a tongue twister invented by bored irs employees—it’s a smart way to save money up front on business expenses. with the double declining balance method, you depreciate less and less of an asset’s value over time. The double declining balance method (ddb) describes an approach to accounting for the depreciation of fixed assets where the depreciation expense is greater in the initial years of the asset’s assumed useful life. The double declining balance (ddb) depreciation method, also known as the reducing balance method, is one of two common methods a business uses to account for the expense of a long lived. The steps involved in calculating depreciation expense using a double declining balance method are as follows: initial cost: begin by noting the asset's initial cost at the time of purchase.

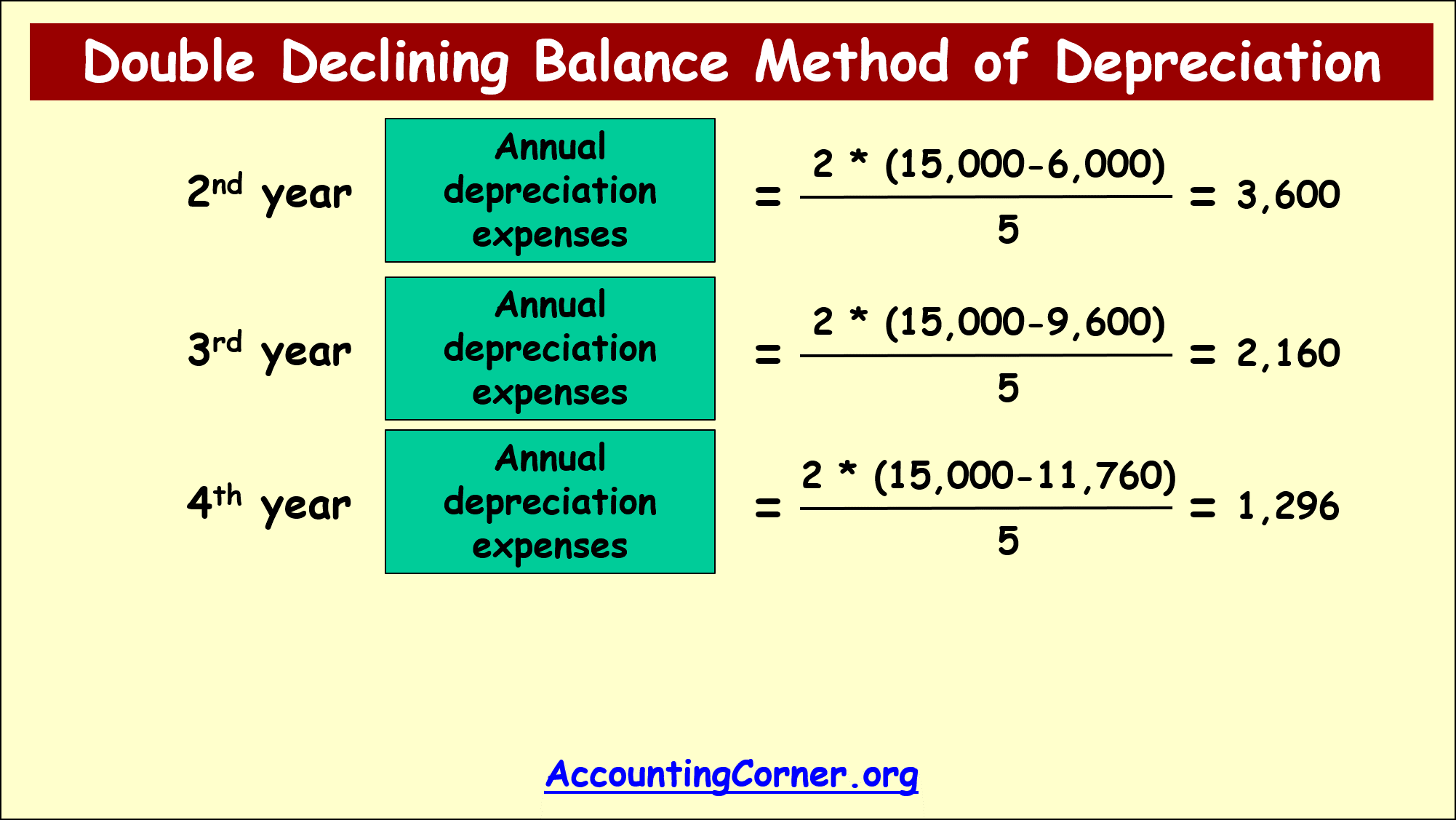

Double Declining Balance Method Of Depreciation Accounting Corner The double declining balance (ddb) depreciation method, also known as the reducing balance method, is one of two common methods a business uses to account for the expense of a long lived. The steps involved in calculating depreciation expense using a double declining balance method are as follows: initial cost: begin by noting the asset's initial cost at the time of purchase. Among the various methods of calculating depreciation, the double declining balance (ddb) method stands out for its unique approach. this article is a must read for anyone looking to understand and effectively apply the ddb method. Start by computing the ddb rate, which remains constant throughout the useful life of the fixed asset. however, depreciation expense in the succeeding years declines because we multiply the ddb rate by the undepreciated basis, or book value, of the asset. read on for our step by step guide. Learn how to calculate depreciation using the double declining balance method with examples, formulas, and automation tips using wafeq accounting software. In this comprehensive guide, we will explore the double declining balance method, its formula, examples, applications, and its comparison with other depreciation methods. what is the double declining balance method?.

Double Declining Balance Method Of Depreciation Accounting Corner Among the various methods of calculating depreciation, the double declining balance (ddb) method stands out for its unique approach. this article is a must read for anyone looking to understand and effectively apply the ddb method. Start by computing the ddb rate, which remains constant throughout the useful life of the fixed asset. however, depreciation expense in the succeeding years declines because we multiply the ddb rate by the undepreciated basis, or book value, of the asset. read on for our step by step guide. Learn how to calculate depreciation using the double declining balance method with examples, formulas, and automation tips using wafeq accounting software. In this comprehensive guide, we will explore the double declining balance method, its formula, examples, applications, and its comparison with other depreciation methods. what is the double declining balance method?.

Comments are closed.