Double Declining Balance Method Of Depreciation Accounting Corner

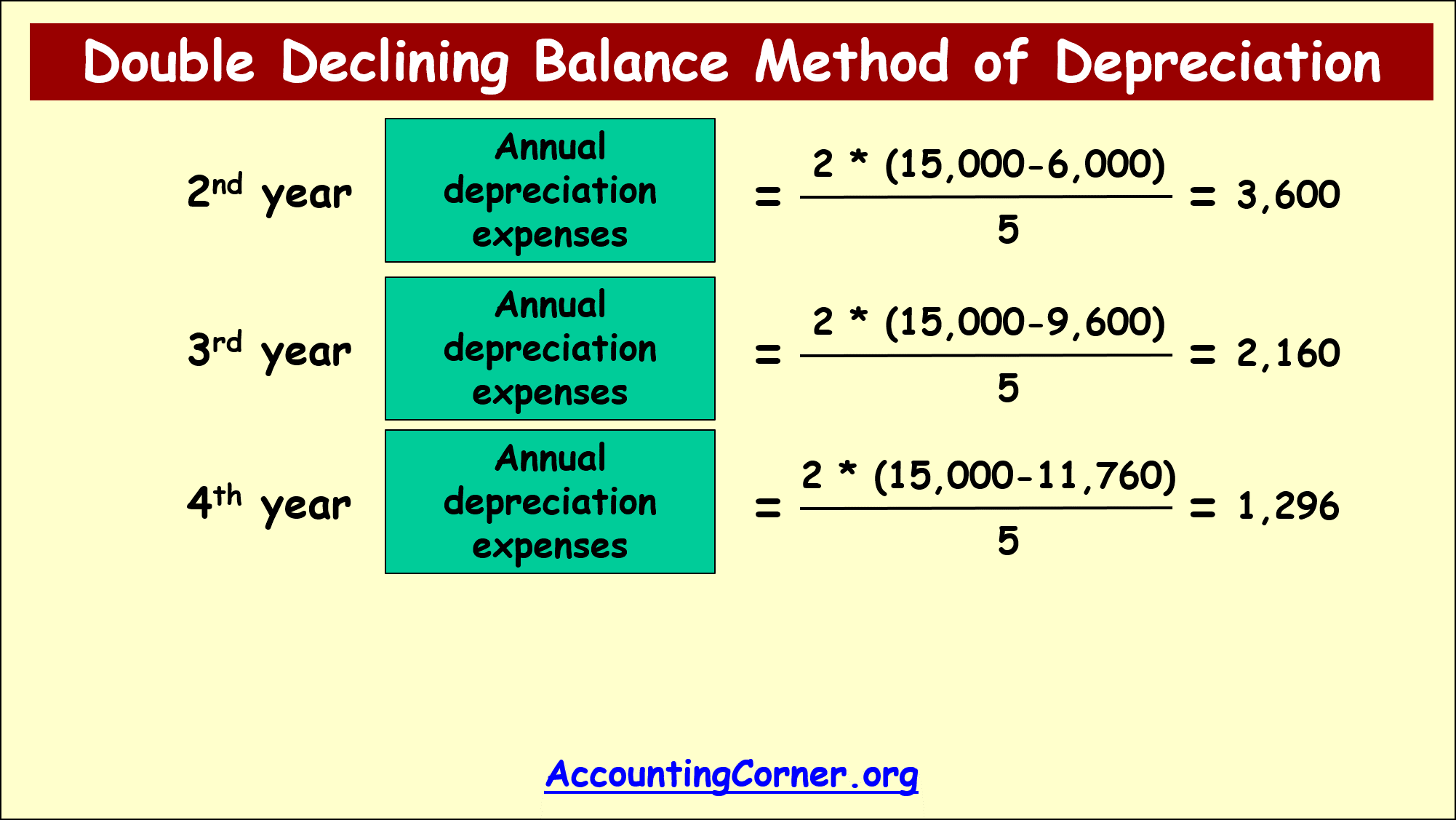

Double Declining Balance Method Of Depreciation Accounting Corner Here is double declining balance formula: annual depreciation = 2* (cost accumulated depreciation at the beginning of the year) useful life in years. in order to demonstrate application of double declining balance method of depreciation explore the below example: 1st year annual depreciation=2* (15,000 0) 5=6,000. The double declining balance method calculates depreciation by applying a constant rate to an asset’s declining book value. first, the straight line depreciation rate is determined by dividing 100% by the asset’s useful life.

Double Declining Balance Method Of Depreciation Accounting Corner Double declining balance (ddb) depreciation is a method of accelerated depreciation that allows for greater depreciation expenses in the initial years of an asset's life. In this guide, we’ll explain how the double declining balance method works in simple terms, compare it with other depreciation methods, and provide step by step examples. What is the double declining balance method? the double declining balance method (ddb) is a form of accelerated depreciation in which the annual depreciation expense is greater during the earlier stages of the fixed asset’s useful life. To record depreciation using the double declining balance method in your financial statements, you need to calculate the depreciation expense for each period, subtract it from the asset’s book value, and record it as an expense on the income statement.

Double Declining Balance Method Of Depreciation Accounting Corner What is the double declining balance method? the double declining balance method (ddb) is a form of accelerated depreciation in which the annual depreciation expense is greater during the earlier stages of the fixed asset’s useful life. To record depreciation using the double declining balance method in your financial statements, you need to calculate the depreciation expense for each period, subtract it from the asset’s book value, and record it as an expense on the income statement. Learn how to calculate depreciation using the double declining balance method with examples, formulas, and automation tips using wafeq accounting software. The double declining balance method is an accelerated depreciation technique, allowing for larger depreciation expenses in the early years of an asset’s life, reflecting its faster loss of value and allowing for deferred tax liabilities. What is the double declining balance depreciation method? double declining balance depreciation is a method of depreciating large business assets quickly. learn how and when to use it . What is double declining balance depreciation? the double declining balance method is a form of accelerated depreciation. in this approach, the asset is depreciated at double the rate as compared to straight line depreciation. hence, it’s called double declining balance depreciation.

Double Declining Balance Method Of Depreciation Accounting Corner Learn how to calculate depreciation using the double declining balance method with examples, formulas, and automation tips using wafeq accounting software. The double declining balance method is an accelerated depreciation technique, allowing for larger depreciation expenses in the early years of an asset’s life, reflecting its faster loss of value and allowing for deferred tax liabilities. What is the double declining balance depreciation method? double declining balance depreciation is a method of depreciating large business assets quickly. learn how and when to use it . What is double declining balance depreciation? the double declining balance method is a form of accelerated depreciation. in this approach, the asset is depreciated at double the rate as compared to straight line depreciation. hence, it’s called double declining balance depreciation.

Comments are closed.