Double Declining Balance Method Formula How To Calculate

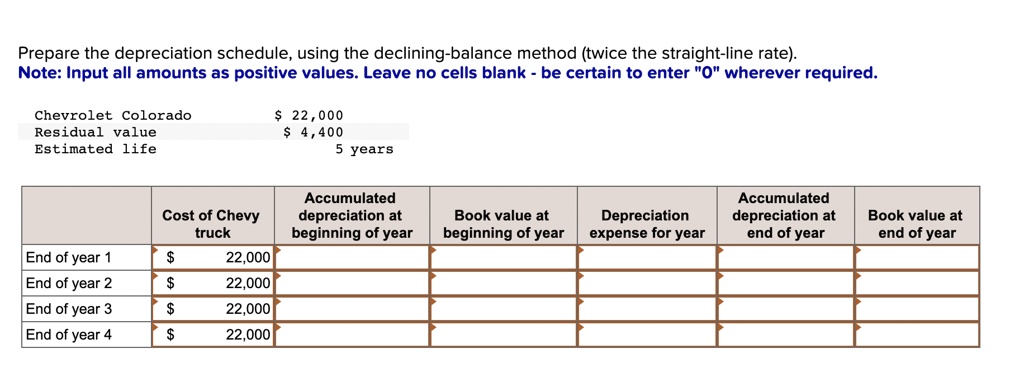

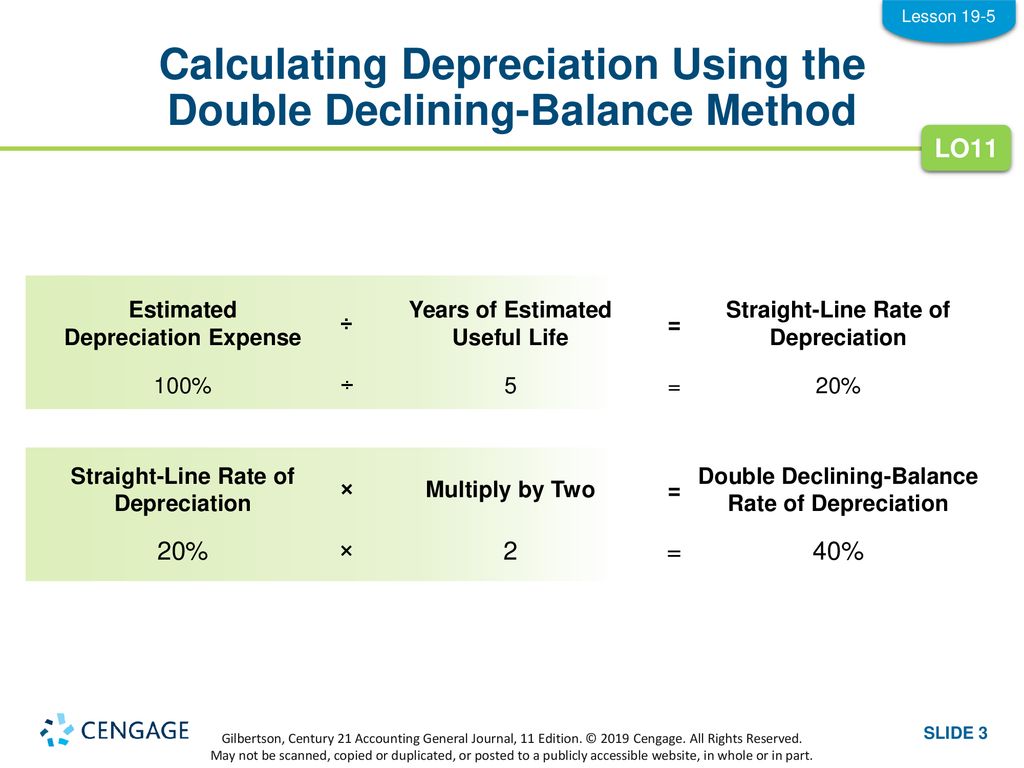

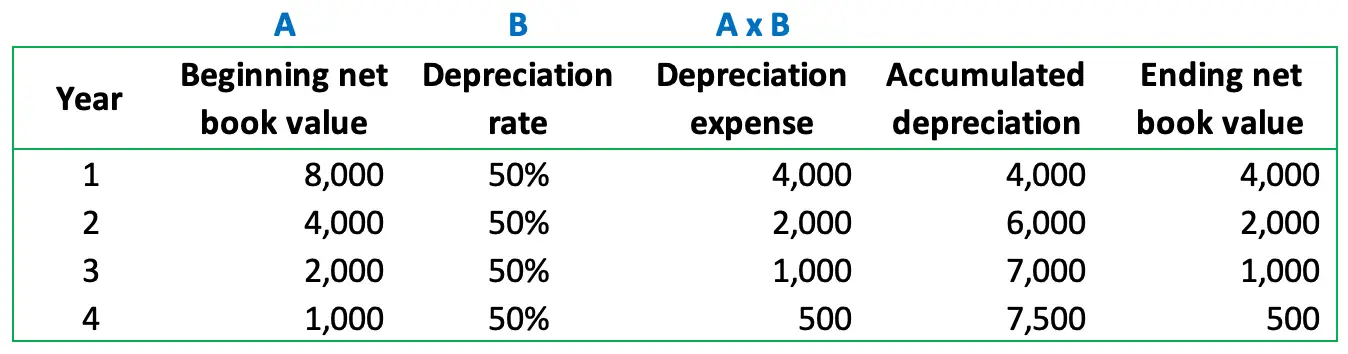

Double Declining Balance Method Formula Free Template 53 Off The depreciation expense recorded under the double declining method is calculated by multiplying the accelerated rate, 36.0% by the beginning pp&e balance in each period. Calculate depreciation of an asset using the double declining balance method and create and print depreciation schedules. calculator for depreciation at a declining balance factor of 2 (200% of straight line). includes formulas, example, depreciation schedule and partial year calculations.

Double Declining Balance Method Formula Free Template 53 Off The formula to calculate double declining balance depreciation is: 2 x straight line rate (for 150% declining balance, the amount is 1.5 x straight line rate) the straight line rate for a 5 year asset is 1 5 or 20%. when we double the straight line rate, we get 2 x 20% = 40%. 40% is the percentage we will apply each year of the assets life. Learn how to use the double declining balance method, using the ddb balance depreciation formula and calculator for accelerated depreciation. depreciate fixed assets using ddb or straight line method. Using the double declining balance method, the company would first calculate the straight line depreciation (sldp) as 1 10 years of useful life = 10% per year. The double declining balance method is a method used to depreciate the value of an asset over time. it is a form of accelerated depreciation, which means that the asset depreciates at a faster rate than it would under a straight line depreciation method.

Calculate Double Declining Balance Depreciation Accountinginside Using the double declining balance method, the company would first calculate the straight line depreciation (sldp) as 1 10 years of useful life = 10% per year. The double declining balance method is a method used to depreciate the value of an asset over time. it is a form of accelerated depreciation, which means that the asset depreciates at a faster rate than it would under a straight line depreciation method. Double declining balance method formula using the double declining balance method, the depreciation will be: double declining balance method formula = 2 x cost of the asset x depreciation rate or double declining balance formula = 2 x cost of the asset useful life. First, determine the annual depreciation expense using the straight line method. this is done by subtracting the salvage value from the purchase cost of the asset, then dividing it by the useful life of the asset. straight line depreciation expense = purchase cost−salvage value useful life. Start by computing the ddb rate, which remains constant throughout the useful life of the fixed asset. however, depreciation expense in the succeeding years declines because we multiply the ddb rate by the undepreciated basis, or book value, of the asset. read on for our step by step guide. In this comprehensive guide, we will explore the double declining balance method, its formula, examples, applications, and its comparison with other depreciation methods. what is the double declining balance method?.

Comments are closed.