Double Declining Balance Method Formula Free Template

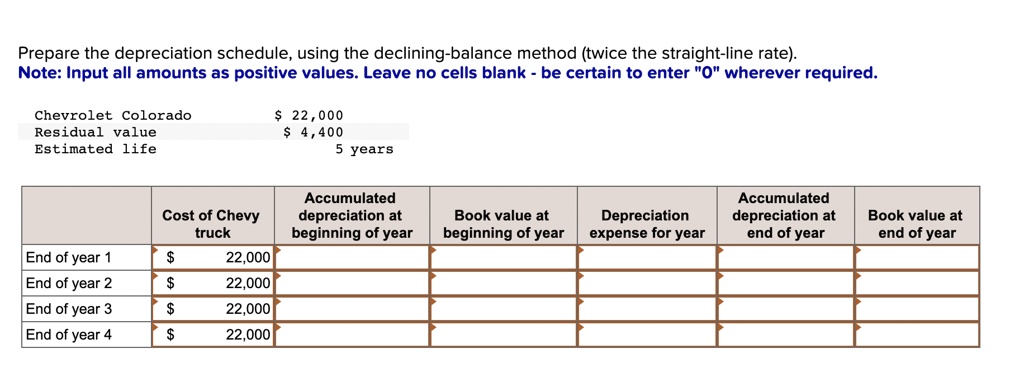

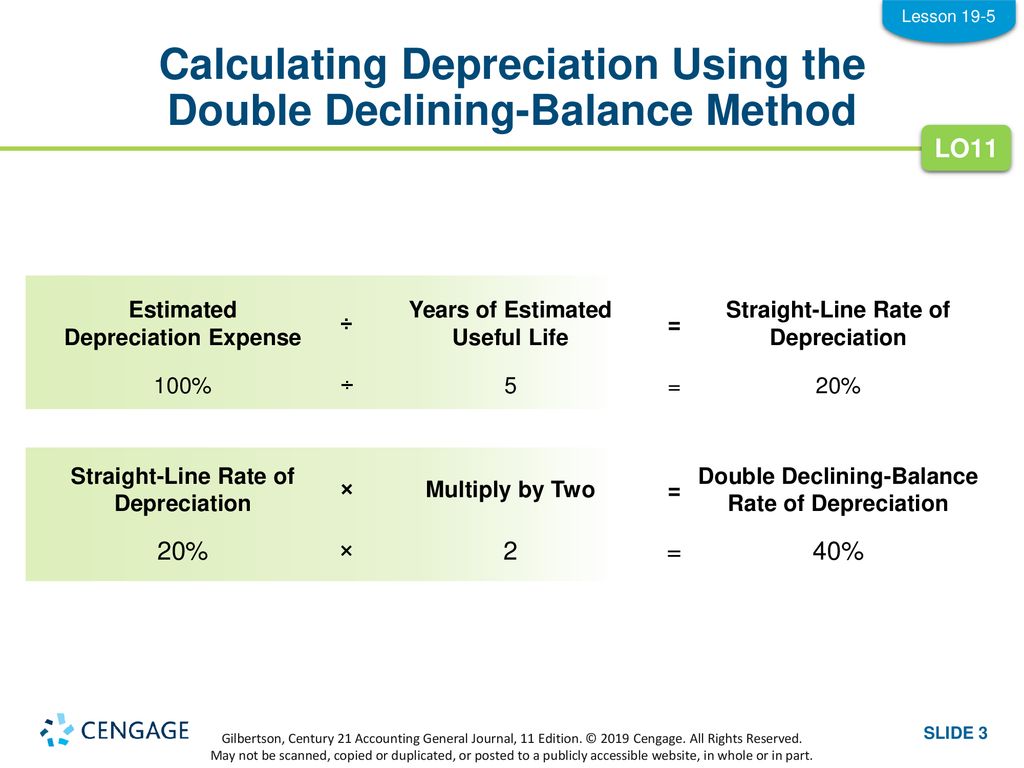

Double Declining Balance Depreciation Template Pdf Understanding DDB Depreciation Depreciation rates used in the declining balance method could be 150%, 200% (double), or 250% of the straight-line rate The Formula for Double-Declining Balance As the name implies, double-declining depreciation writes down assets at twice the rate of standard depreciation based on the cost of the asset The formula

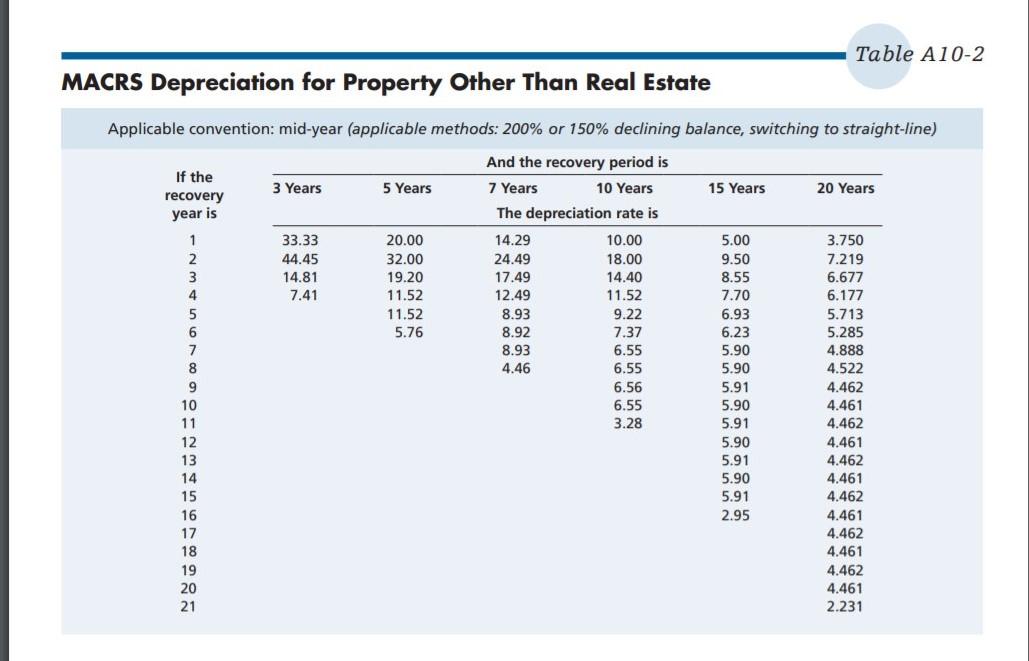

Double Declining Balance Method Formula Free Template 53 Off A company reports larger depreciation expenses during the earlier years of an asset’s useful life when it uses the declining balance method It's an accelerated system 6:576% Is there a way to leverage the DDB formulas to achieve the correct formulas for tax purposes? A You can view the original article this reader is referring to hereYou can use a built-in Double declining balance depreciation is a method of depreciating large business assets quickly Learn how and when to use it Written by: Dock Treece, Senior Writer Updated Apr 19, 2024

Double Declining Balance Method Formula Free Template 53 Off Double declining balance depreciation is a method of depreciating large business assets quickly Learn how and when to use it Written by: Dock Treece, Senior Writer Updated Apr 19, 2024

Double Declining Balance Method Formula Free Template 53 Off

Comments are closed.