Double Declining Balance Depreciation Method Accounting Services

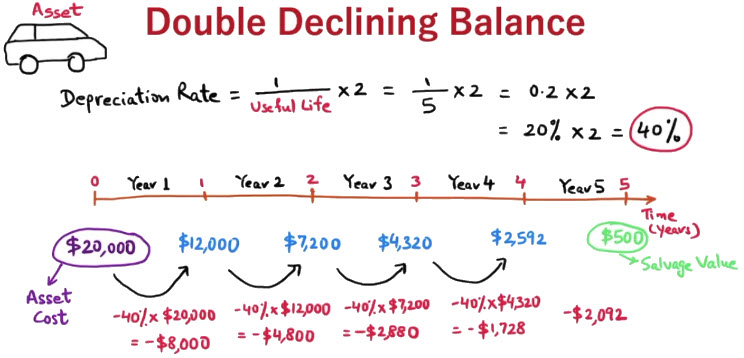

Double Declining Balance Depreciation Method тлж Accounting Services Understanding DDB Depreciation Depreciation rates used in the declining balance method could be 150%, 200% (double), or 250% of the straight-line rate To change the depreciation method and alter the schedule, companies need to file IRS Form 3115, Application for Change in Accounting Method This form needs to include an explanation (justification)

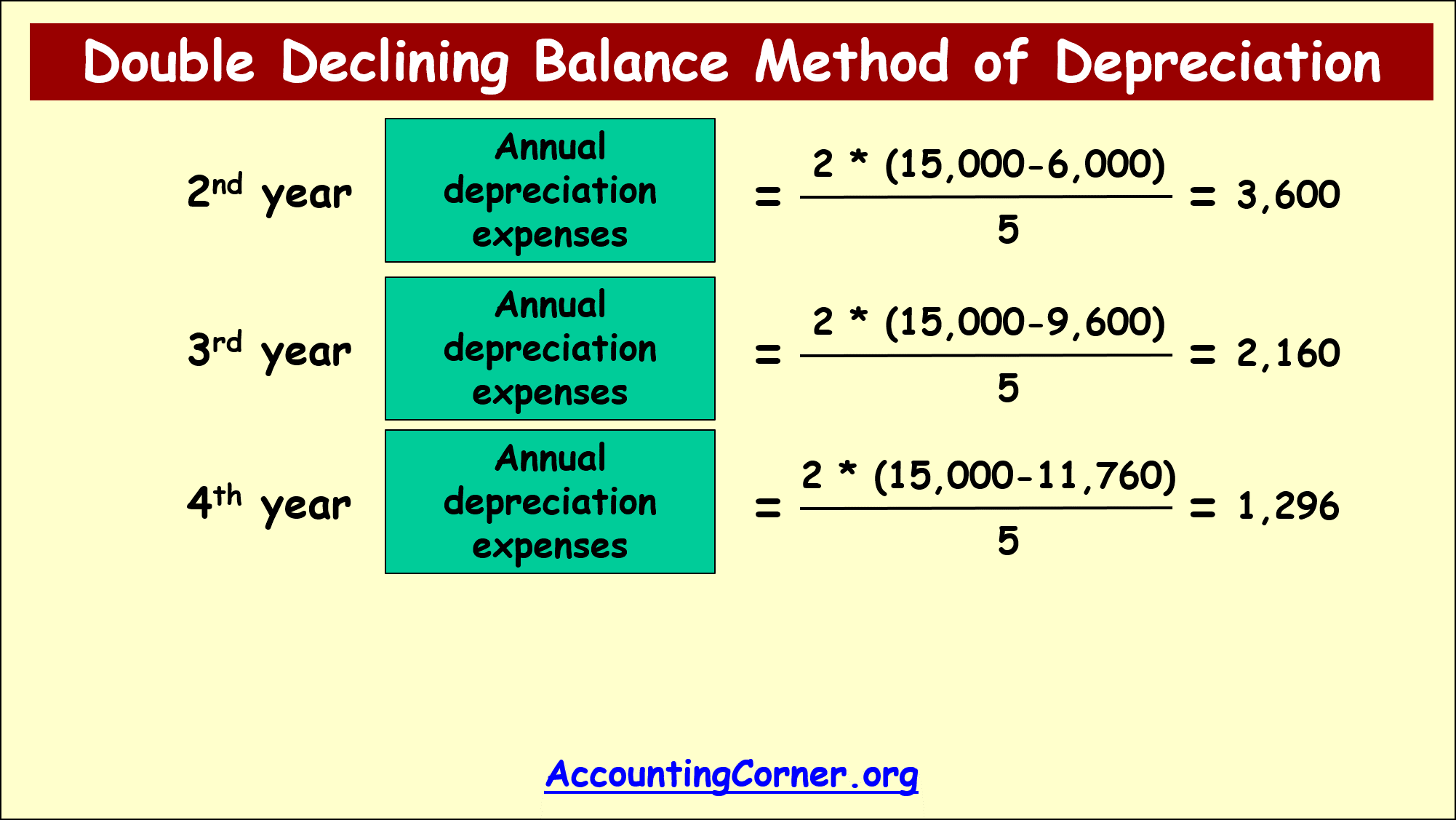

Double Declining Balance Depreciation Method тлж Accounting Services A company reports larger depreciation expenses during the earlier years of an asset’s useful life when it uses the declining balance method It's an accelerated system For the double declining balance method, the following formula is used to calculate each year's depreciation amount: A few notes First, if the 150% declining balance method is used, the factor of When choosing a depreciation method for your business, you have to consider the tax implications If you would rather have a bigger tax deduction in the near-term, using a double-declining balance Declining Balance Depreciation With this accelerated form of depreciation, you deduct a greater portion of the asset’s value at the beginning of its life This typically at a rate of double or 150%

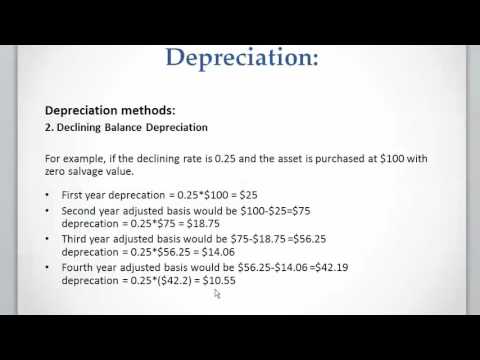

Double Declining Balance Method Of Depreciation Accounting Corner When choosing a depreciation method for your business, you have to consider the tax implications If you would rather have a bigger tax deduction in the near-term, using a double-declining balance Declining Balance Depreciation With this accelerated form of depreciation, you deduct a greater portion of the asset’s value at the beginning of its life This typically at a rate of double or 150% Because this accounting methodology is based on based on the depreciation rate Double-declining value: Similar to the declining value method, the double-declining value method allows you to Two common ways of calculating depreciation are the straight-line and double declining balance methods Excel can accomplish both using the SLN function to calculate the straight line -- a There are two main methods of calculating depreciation, the straight-line method and the declining balance method Here's the difference between the two, and when each method might be useful Declining Balance Depreciation With this accelerated form of depreciation, you deduct a greater portion of the asset’s value at the beginning of its life This typically at a rate of double or 150%

Double Declining Balance Method Of Depreciation Accounting Corner Because this accounting methodology is based on based on the depreciation rate Double-declining value: Similar to the declining value method, the double-declining value method allows you to Two common ways of calculating depreciation are the straight-line and double declining balance methods Excel can accomplish both using the SLN function to calculate the straight line -- a There are two main methods of calculating depreciation, the straight-line method and the declining balance method Here's the difference between the two, and when each method might be useful Declining Balance Depreciation With this accelerated form of depreciation, you deduct a greater portion of the asset’s value at the beginning of its life This typically at a rate of double or 150%

Double Declining Balance Method Of Depreciation Accounting Corner There are two main methods of calculating depreciation, the straight-line method and the declining balance method Here's the difference between the two, and when each method might be useful Declining Balance Depreciation With this accelerated form of depreciation, you deduct a greater portion of the asset’s value at the beginning of its life This typically at a rate of double or 150%

The Double Declining Balance Depreciation Method

Comments are closed.